- Japan

- /

- Electronic Equipment and Components

- /

- TSE:5885

GDEP ADVANCEInc (TSE:5885) Margin Decline Challenges Bullish Growth Narrative

Reviewed by Simply Wall St

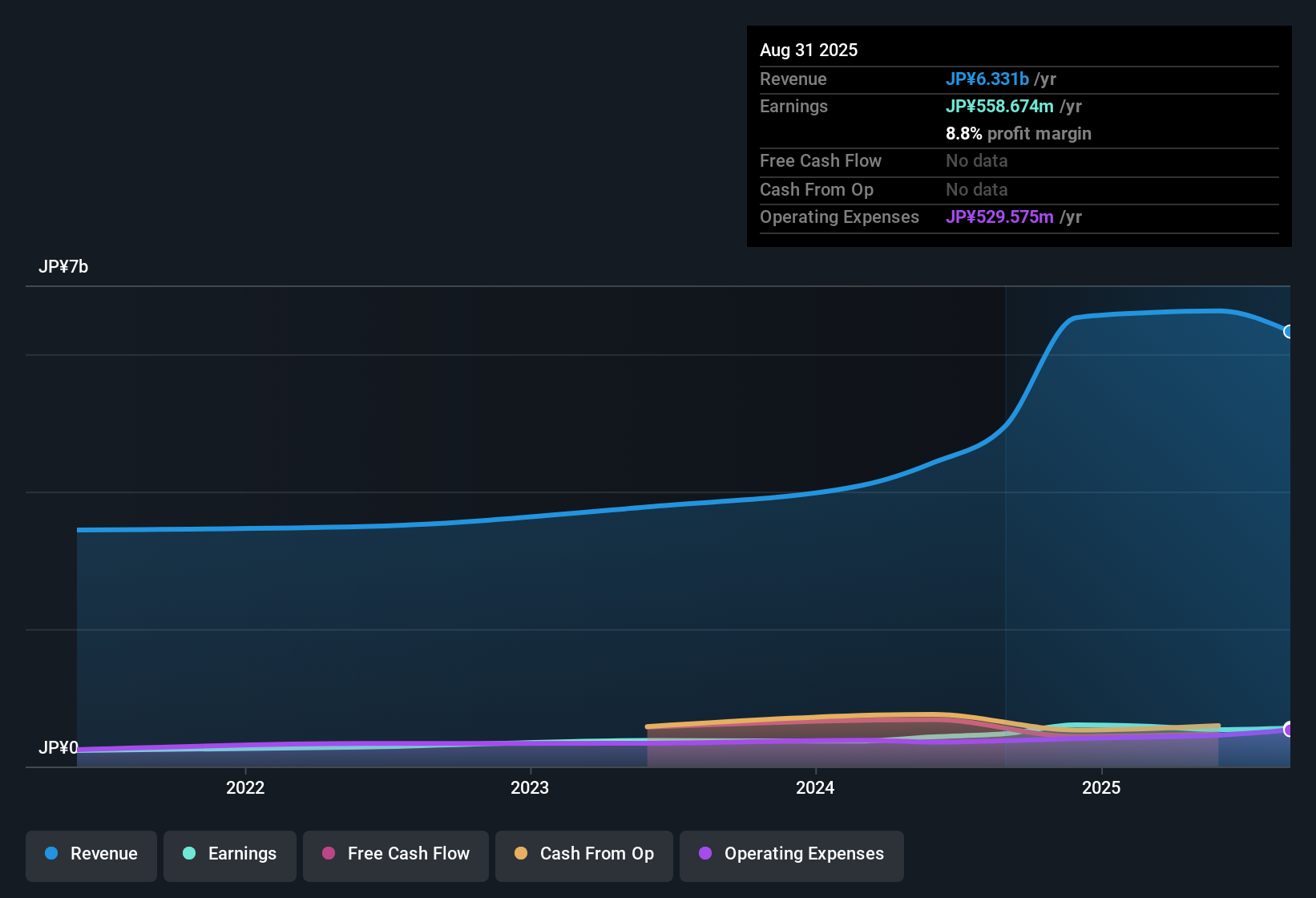

GDEP ADVANCEInc (TSE:5885) reported a net profit margin of 8.8%, down from 9.7% previously, as annual earnings growth reached 16.7% for the year. While that pace is a step down from the company’s 5-year annualized growth of 19.6%, profits have advanced at a brisk multi-year clip and are classified as high quality by headline metrics. Investors will note the consistent track record of earnings expansion, set against some recent margin compression, and a share price that currently stands at ¥3015.

See our full analysis for GDEP ADVANCEInc.Next, we will compare these results against the main community narratives to see where market expectations match reality and where they could diverge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Compression Outpaces Long-Term Growth

- Net profit margin slid to 8.8%, declining from 9.7% last year, even while multi-year annualized earnings have trended upward at 19.6% per year.

- While ongoing profit growth might make bulls optimistic, the recent margin slide introduces tension:

- Despite high-quality earnings, the pace of profit expansion is starting to trail the company's longer-term trend.

- Consistent profit growth is encouraging, but tightening margins suggest underlying pressures that could narrow future upside.

Premium Valuation Widens Versus Peers

- The company trades at a Price-to-Earnings Ratio of 29.2x, far above both peer average of 8.4x and Japan's electronics industry at 14.1x.

- Some investors will point out the sustained earnings momentum as justification for a higher multiple, but the current ratio more than doubles the sector's standard:

- Strong past growth may not fully justify the premium valuation, especially if margins remain under pressure.

- This rich valuation makes the stock particularly vulnerable to any disappointment in future profit growth or sector sentiment shifts.

DCF Valuation Shows Large Market Premium

- At a share price of ¥3015, GDEP ADVANCEInc currently sits 62% above its DCF fair value estimate of ¥1863.57.

- The significant gap above DCF fair value is a clear red flag for value-focused investors:

- This level of market premium requires robust future performance just to justify today's price, leaving little room for error.

- Any signs of slowing growth or further margin compression could quickly re-rate the stock closer to fair value.

To see how different investors are weighing the risks and rewards now, read the Structured Market Sentiment and Investment Narrative for GDEP ADVANCEInc. Curious how numbers become stories that shape markets? Explore Community Narratives

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on GDEP ADVANCEInc's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

GDEP ADVANCEInc's high valuation and narrowing profit margins raise questions about whether strong past growth can continue to support its premium price.

If you're searching for stocks with more attractive price tags and robust fundamentals, check out these 878 undervalued stocks based on cash flows and find opportunities the market may have overlooked.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5885

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives