- Japan

- /

- Electronic Equipment and Components

- /

- TSE:3107

Undiscovered Gems in Asia to Explore This August 2025

Reviewed by Simply Wall St

Amidst global economic uncertainties and trade tensions, Asian markets have shown resilience, with some regions like Japan experiencing robust industrial production and retail sales. As investors navigate these turbulent times, identifying stocks with strong fundamentals and growth potential becomes crucial in uncovering the hidden opportunities within Asia's dynamic landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wuxi Xinan Technology | NA | 11.99% | 4.45% | ★★★★★★ |

| Nanfang Black Sesame GroupLtd | 45.53% | -12.49% | 10.72% | ★★★★★★ |

| Sinotherapeutics | NA | 25.52% | -7.66% | ★★★★★★ |

| CTCI Advanced Systems | 33.93% | 20.38% | 21.25% | ★★★★★☆ |

| Hefei Gocom Information TechnologyLtd | 1.34% | 9.11% | -12.23% | ★★★★★☆ |

| DorightLtd | 5.31% | 15.47% | 9.44% | ★★★★★☆ |

| Jinlihua Electric | 48.71% | 7.36% | 31.30% | ★★★★★☆ |

| WuHu Foresight TechnologyLtd | 4.74% | 44.50% | 6.61% | ★★★★★☆ |

| BioDlink International | 54.00% | 61.14% | 50.47% | ★★★★★☆ |

| Synic SolutionLtd | 70.76% | 6.08% | 55.66% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Vobile Group (SEHK:3738)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vobile Group Limited is an investment holding company that offers software as a service for digital content asset protection and transactions across the United States, Mainland China, and internationally, with a market cap of approximately HK$10.25 billion.

Operations: Vobile Group generates revenue primarily from its SaaS offerings, amounting to HK$2.40 billion.

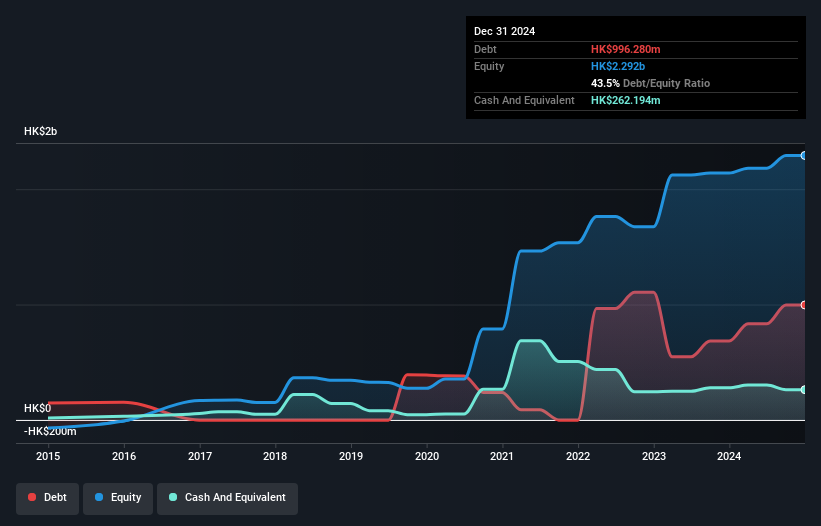

Vobile Group has made significant strides, reducing its debt to equity ratio from 142.5% to 43.5% over five years and achieving profitability this year, with interest payments well-covered by EBIT at a 3.1x ratio. Despite not being free cash flow positive, the company shows promise with earnings projected to grow annually by 28.55%. Recent strategic moves include a collaboration with Shanghai Film Group and raising HKD 521.64 million through a follow-on equity offering at HKD 3.78 per share, indicating strong market confidence in its digital content ventures and financial health improvements.

- Unlock comprehensive insights into our analysis of Vobile Group stock in this health report.

Explore historical data to track Vobile Group's performance over time in our Past section.

Shenzhen Chengtian Weiye Technology (SZSE:300689)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Chengtian Weiye Technology Co., Ltd. is a company engaged in the smart card manufacturing industry with a market cap of CN¥6.92 billion.

Operations: The company's primary revenue stream is from the smart card manufacturing industry, generating CN¥383.25 million.

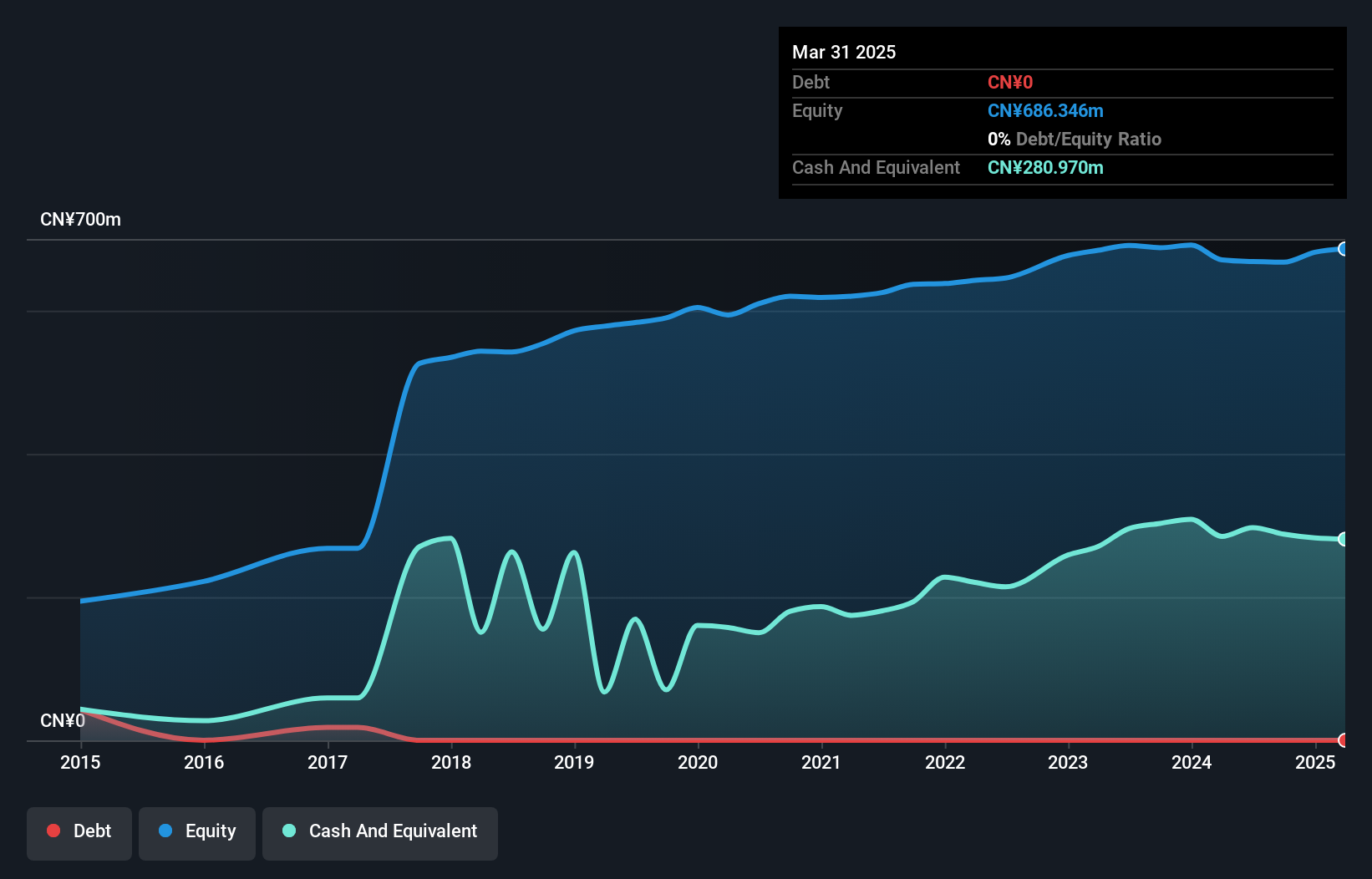

Shenzhen Chengtian Weiye Technology, a tech entity with no debt over the past five years, has experienced significant earnings growth of 978% in the last year, outpacing industry averages. However, its earnings have decreased annually by 23% over the past five years. The company's recent financial results include a notable one-off gain of CN¥9.2M as of March 2025. Despite its volatile share price recently, it remains profitable with positive free cash flow and an approved Employee Stock Ownership Plan for 2025 following shareholder votes on May 14th.

- Click here and access our complete health analysis report to understand the dynamics of Shenzhen Chengtian Weiye Technology.

Understand Shenzhen Chengtian Weiye Technology's track record by examining our Past report.

Daiwabo Holdings (TSE:3107)

Simply Wall St Value Rating: ★★★★★★

Overview: Daiwabo Holdings Co., Ltd. operates as an IT infrastructure distributor in Japan and has a market capitalization of approximately ¥279.11 billion.

Operations: Daiwabo generates revenue primarily from its IT Infrastructure Distribution Business, which accounts for ¥1.12 trillion, while the Industrial Machinery Business contributes ¥12.90 billion. The company's net profit margin is a crucial metric to consider when evaluating its financial performance.

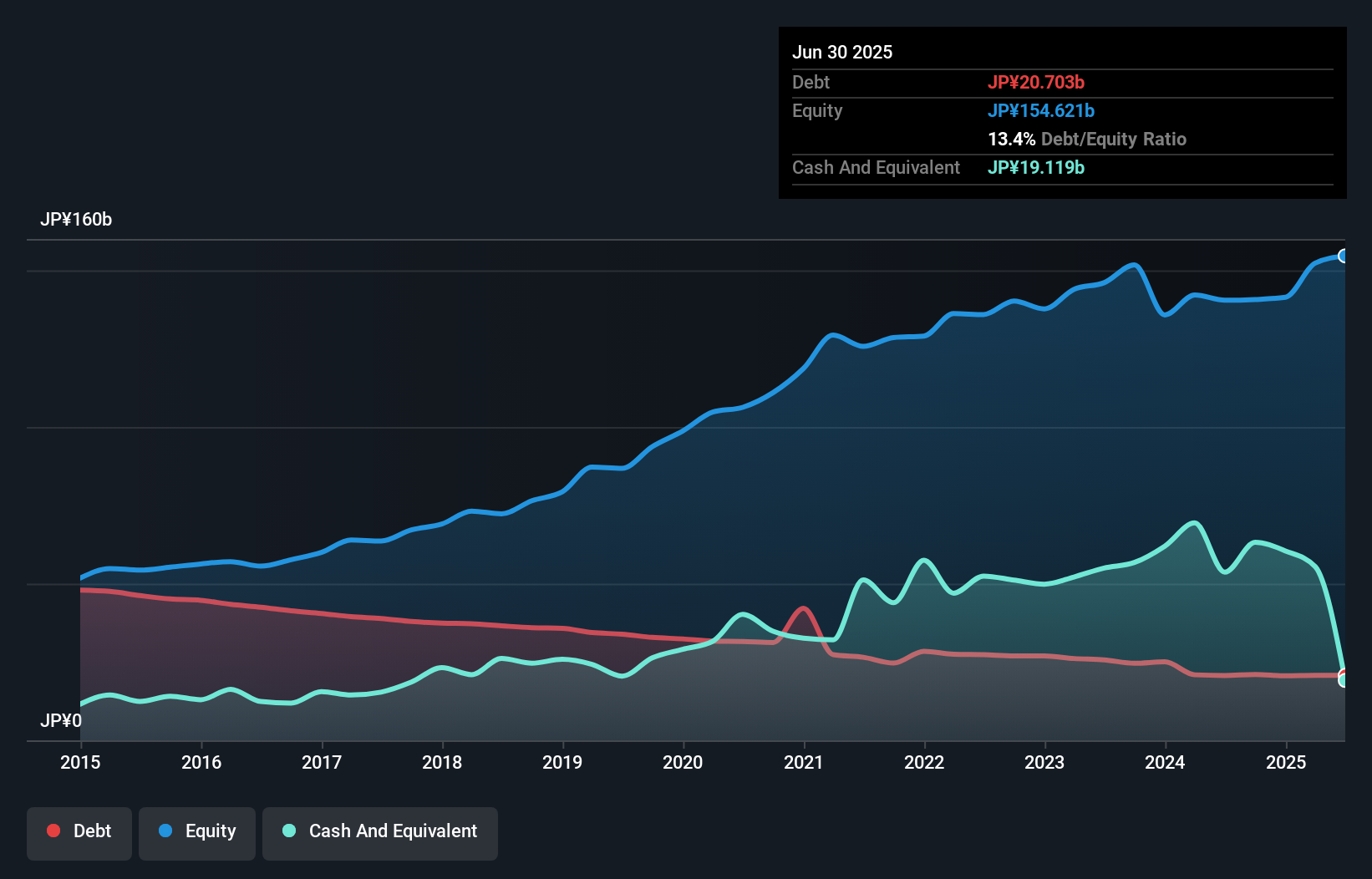

Daiwabo Holdings, a promising player in the Asian market, has shown impressive financial health with its cash exceeding total debt and a reduced debt-to-equity ratio from 30.2% to 13.6% over five years. Its earnings growth of 477.9% outpaced the electronics industry's 5.1%, highlighting robust performance and high-quality non-cash earnings. The company is trading at a significant discount of 26.7% below estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. A recent share repurchase program aims to enhance shareholder value by buying back up to ¥8 billion worth of shares, further boosting investor confidence.

- Delve into the full analysis health report here for a deeper understanding of Daiwabo Holdings.

Review our historical performance report to gain insights into Daiwabo Holdings''s past performance.

Next Steps

- Click here to access our complete index of 2567 Asian Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3107

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives