- Japan

- /

- Electronic Equipment and Components

- /

- TSE:3107

Here's Why We Think Daiwabo Holdings (TSE:3107) Is Well Worth Watching

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Daiwabo Holdings (TSE:3107). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Daiwabo Holdings with the means to add long-term value to shareholders.

Daiwabo Holdings' Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Daiwabo Holdings has managed to grow EPS by 22% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

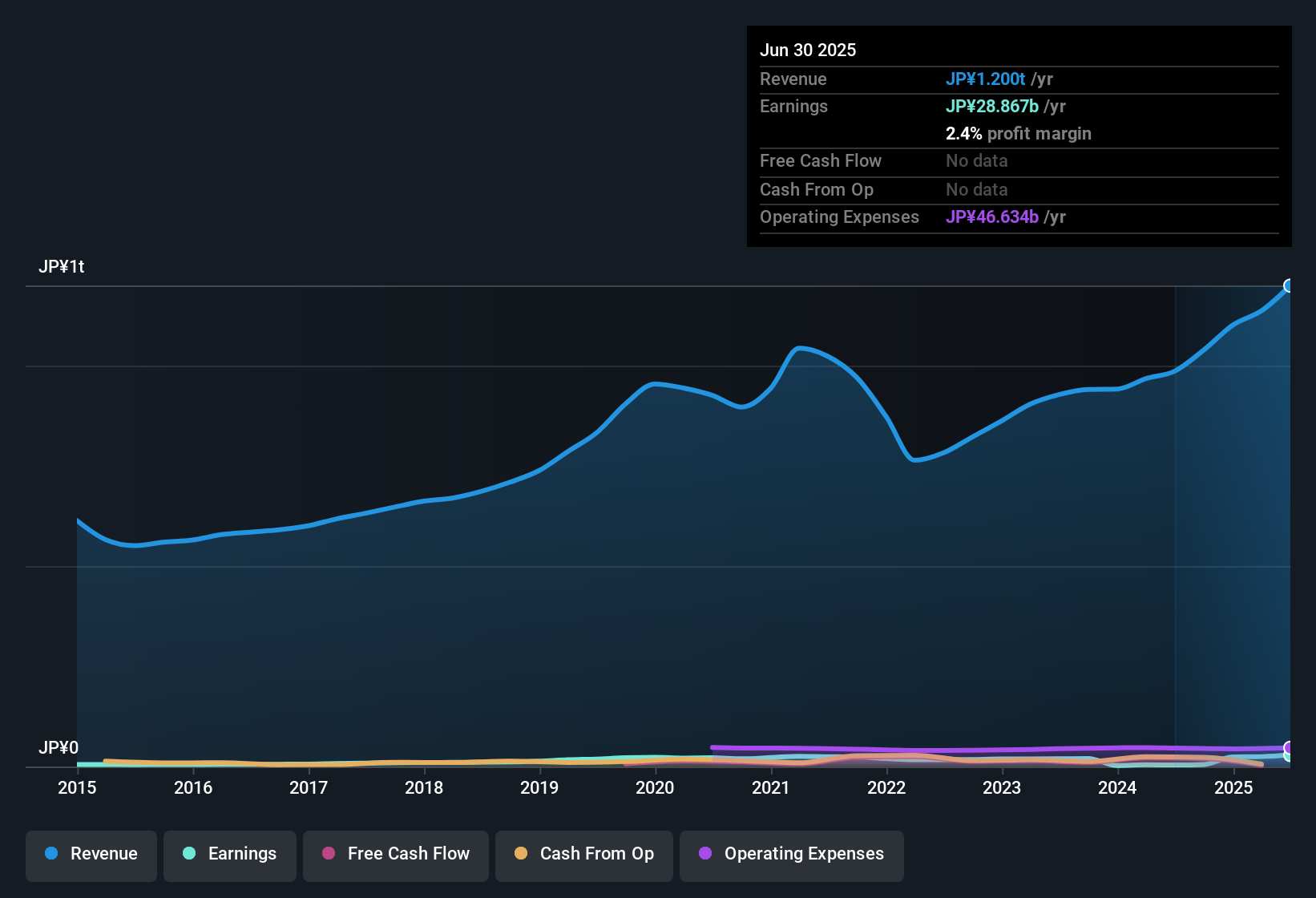

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. EBIT margins for Daiwabo Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 22% to JP¥1.2t. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Check out our latest analysis for Daiwabo Holdings

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Daiwabo Holdings' future EPS 100% free.

Are Daiwabo Holdings Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. The median total compensation for CEOs of companies similar in size to Daiwabo Holdings, with market caps between JP¥152b and JP¥487b, is around JP¥135m.

Daiwabo Holdings offered total compensation worth JP¥102m to its CEO in the year to March 2025. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Daiwabo Holdings Deserve A Spot On Your Watchlist?

You can't deny that Daiwabo Holdings has grown its earnings per share at a very impressive rate. That's attractive. With swiftly growing earnings, the best days may still be to come, and the modest CEO pay suggests the company is careful with cash. So this stock is well worth an addition to your watchlist as it has the potential to provide great value to shareholders. It is worth noting though that we have found 2 warning signs for Daiwabo Holdings (1 is significant!) that you need to take into consideration.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in JP with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3107

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026