Undiscovered Gems And 2 Other Promising Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the challenges of rising U.S. Treasury yields and tepid economic growth, small-cap stocks have faced increased pressure compared to their large-cap counterparts. In this environment, identifying promising stocks requires a keen eye for companies that can thrive amid macroeconomic fluctuations and offer potential resilience against broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| United Wire Factories | NA | 4.86% | 0.19% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Bumitama Agri (SGX:P8Z)

Simply Wall St Value Rating: ★★★★★★

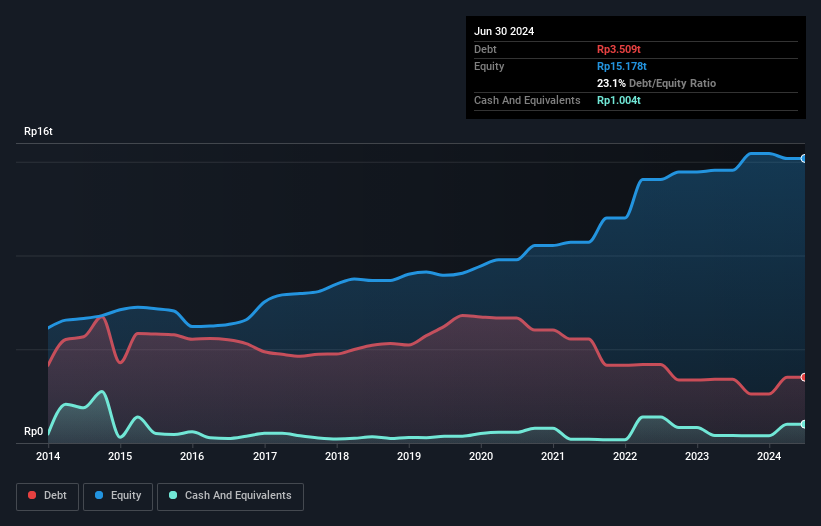

Overview: Bumitama Agri Ltd. is an investment holding company involved in the production and trade of crude palm oil, palm kernel, and related products for refineries in Indonesia, with a market cap of SGD1.34 billion.

Operations: Bumitama Agri generates revenue primarily from its plantations and palm oil mills, amounting to IDR15.55 trillion. The company's cost structure and financial performance are influenced by various operational factors, with a notable focus on managing production expenses to optimize profitability.

Bumitama Agri, a player in the agriculture sector, has shown resilience despite challenges. The company reported half-year sales of IDR 7.6 trillion, slightly up from IDR 7.5 trillion last year, though net income fell to IDR 856 billion from IDR 1.19 trillion. Basic earnings per share decreased to IDR 494 from IDR 686, reflecting some pressures on profitability. Recent board changes and a slight reduction in dividend to SGD 0.012 per share indicate strategic adjustments amid market conditions. Despite these hurdles, Bumitama's ability to maintain robust sales figures suggests potential for future stability and growth within its industry context.

- Take a closer look at Bumitama Agri's potential here in our health report.

Gain insights into Bumitama Agri's historical performance by reviewing our past performance report.

Grinm Advanced Materials (SHSE:600206)

Simply Wall St Value Rating: ★★★★☆☆

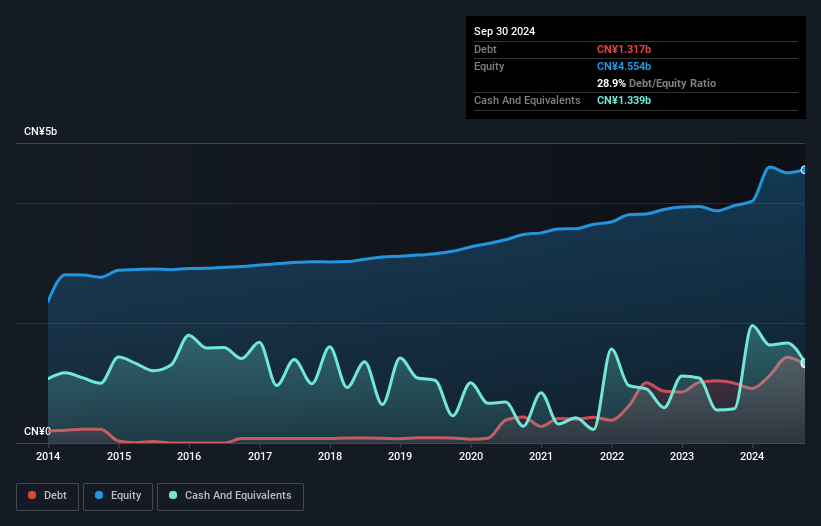

Overview: Grinm Advanced Materials Co., Ltd. focuses on the research, development, manufacture, and sale of advanced materials within China's nonferrous metals industry and has a market capitalization of CN¥9.74 billion.

Operations: Grinm Advanced Materials generates revenue primarily through the sale of advanced materials in China's nonferrous metals sector. The company's financial performance is highlighted by its net profit margin, which reflects its ability to manage costs and profitability effectively.

Grinm Advanced Materials, a relatively smaller player in its industry, has shown mixed financial performance recently. The company reported sales of CNY 6.76 billion for the first nine months of 2024, down from CNY 8.32 billion the previous year, with net income at CNY 114.58 million compared to CNY 139.71 million last year. Despite these figures, Grinm's earnings growth over the past year was an impressive 34%, outpacing the Semiconductor industry's average of about 11%. A significant one-off gain of CN¥48.9M has also impacted its recent results positively, while its debt-to-equity ratio rose to nearly 29% over five years from just under three percent previously.

- Get an in-depth perspective on Grinm Advanced Materials' performance by reading our health report here.

Evaluate Grinm Advanced Materials' historical performance by accessing our past performance report.

JBCC Holdings (TSE:9889)

Simply Wall St Value Rating: ★★★★★★

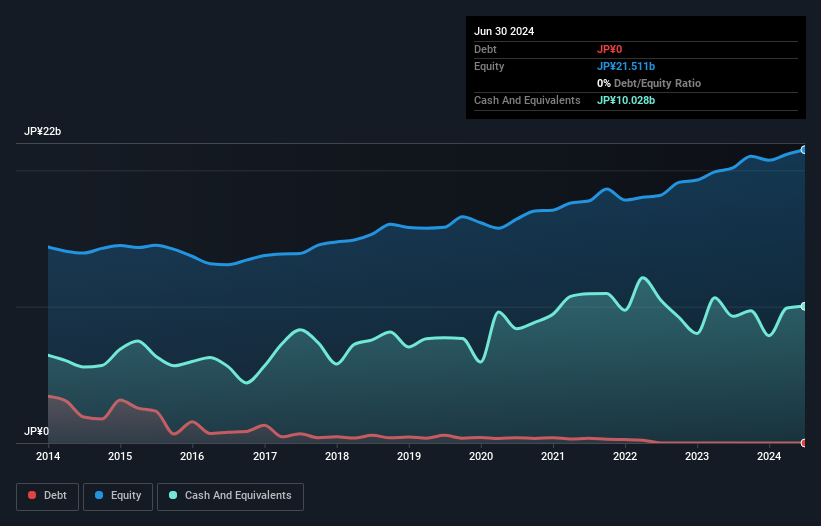

Overview: JBCC Holdings Inc. operates through its subsidiaries to provide information technology-related services in Japan, with a market capitalization of approximately ¥68.61 billion.

Operations: JBCC Holdings generates revenue primarily from its Information Solution segment, which accounts for ¥65.10 billion, and its Product Development and Manufacturing segment, contributing ¥2.69 billion.

JBCC Holdings, a small-cap player in the IT sector, stands out with its high-quality earnings and no debt burden, providing a solid foundation for growth. Over the past year, earnings surged by 23%, outpacing the industry average of 10%. The company is trading at 50% below its estimated fair value, suggesting potential upside. With free cash flow remaining positive and no interest payment concerns due to zero debt, JBCC appears financially robust. The firm's strategic position in the market likely supports its forecasted annual earnings growth of nearly 19%, highlighting promising future prospects.

- Unlock comprehensive insights into our analysis of JBCC Holdings stock in this health report.

Examine JBCC Holdings' past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Embark on your investment journey to our 4738 Undiscovered Gems With Strong Fundamentals selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade JBCC Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9889

JBCC Holdings

Through its subsidiaries, engages in the provision of information technology related services in Japan.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives