- Hong Kong

- /

- Tech Hardware

- /

- SEHK:1810

High Growth Tech Stocks To Watch In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty, with major indices like the Nasdaq Composite reaching record highs while small-cap stocks underperform, investors are keenly observing how tech stocks continue to drive growth amidst fluctuating interest rates and inflationary pressures. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation potential and resilience in adapting to changing market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1261 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Xiaomi (SEHK:1810)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiaomi Corporation is an investment holding company that offers hardware and software services both in Mainland China and internationally, with a market capitalization of HK$746.54 billion.

Operations: Xiaomi Corporation generates revenue primarily through the sale of smartphones, IoT and lifestyle products, and internet services. The company has a notable presence in both domestic and international markets. Gross profit margin trends have shown variability over recent periods.

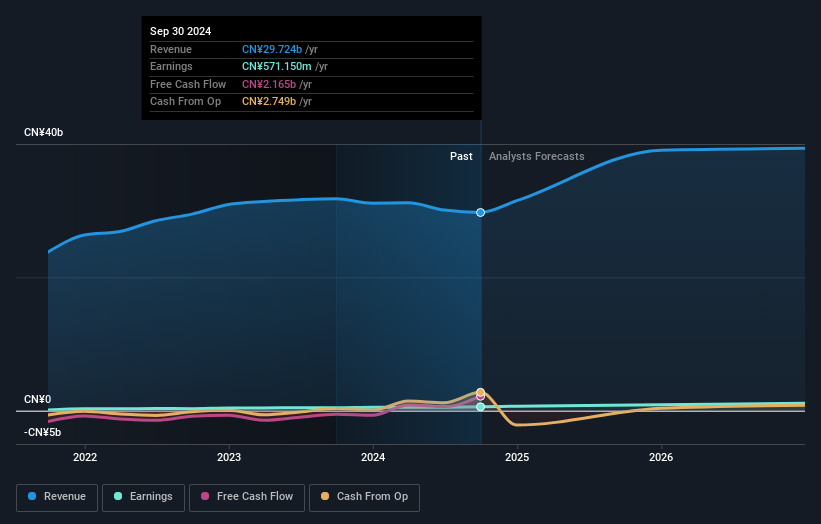

Xiaomi's recent performance underscores its robust position in the tech industry, with a notable 21.8% earnings growth over the past year, surpassing the broader tech sector's 21.5%. This growth trajectory is complemented by a revenue increase to CNY 256.9 billion from CNY 197.7 billion year-over-year, reflecting a solid annual growth rate of 15.1%. The company's commitment to innovation is evident in its R&D investments, which bolster its competitive edge and fuel these financial achievements. Moreover, Xiaomi's strategic presentations at key industry events like Hong Kong FinTech Week highlight its proactive approach in shaping future tech trends, further solidifying its market presence and appealing to forward-looking investors.

- Unlock comprehensive insights into our analysis of Xiaomi stock in this health report.

Understand Xiaomi's track record by examining our Past report.

Fiberhome Telecommunication Technologies (SHSE:600498)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fiberhome Telecommunication Technologies Co., Ltd. is a company engaged in the design and manufacture of telecommunication products and solutions, with a market cap of CN¥21.70 billion.

Operations: The company generates revenue primarily from its Optical Communication segment, which contributes CN¥29.72 billion.

Fiberhome Telecommunication Technologies has demonstrated notable financial resilience, with a 30.4% earnings growth over the past year, outpacing its sector's average decline of 3%. This growth is supported by strategic initiatives like the recent private placement agreement to issue shares worth approximately CNY 1.5 billion, enhancing its capital structure and investment capabilities. Despite a slight revenue dip to CNY 21.15 billion from CNY 22.56 billion year-over-year, the company's innovative approach in telecommunications tech and strategic equity transactions position it well for future industry demands and investor interest.

Fuji Soft (TSE:9749)

Simply Wall St Growth Rating: ★★★★★☆

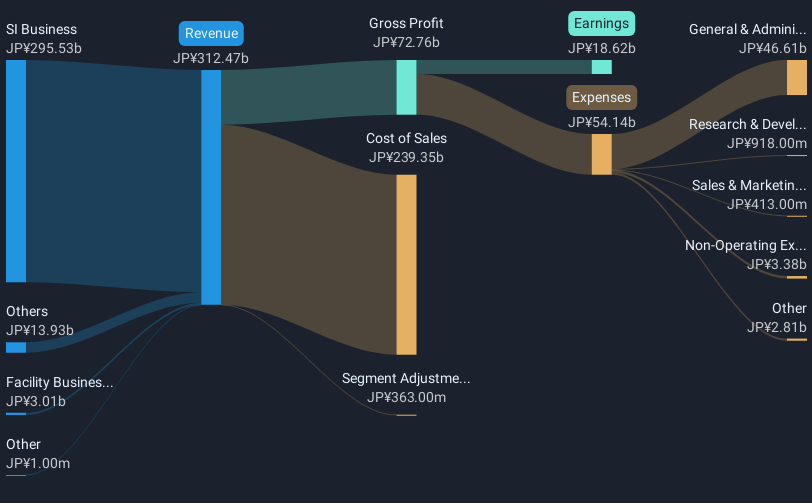

Overview: Fuji Soft Incorporated is an IT company that provides a range of technology services and solutions in Japan and internationally, with a market capitalization of ¥608.06 billion.

Operations: The company generates revenue primarily from its SI Business, which accounts for ¥295.53 billion. The Facility Business contributes an additional ¥3.01 billion to the overall revenue stream.

Fuji Soft has been a focal point in the high-stakes M&A arena, with KKR & Co. recently acquiring a significant stake for ¥560 billion, reflecting strong investor confidence and a strategic shift towards comprehensive ownership. This move comes amidst Fuji Soft's robust earnings growth of 57.1% over the past year, significantly outpacing the software industry's average of 13.5%. Despite these gains, revenue growth projections remain modest at 4.5% annually, suggesting a focus on profitability over rapid expansion. The company's commitment to innovation is underscored by R&D expenditures that align closely with industry demands for evolving software solutions, ensuring Fuji Soft remains competitive in a dynamic tech landscape.

- Take a closer look at Fuji Soft's potential here in our health report.

Examine Fuji Soft's past performance report to understand how it has performed in the past.

Make It Happen

- Gain an insight into the universe of 1261 High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1810

Xiaomi

An investment holding company, provides hardware and software services in Mainland China and internationally.

Flawless balance sheet with reasonable growth potential.