Did SCSK’s (TSE:9719) SDVerse Collaboration Just Shift Its Automotive Tech Investment Narrative?

Reviewed by Sasha Jovanovic

- On September 24, 2025, SCSK Corporation announced it has joined the SDVerse platform to expand the marketplace with its portfolio of mobility solutions and services for the automotive sector.

- This move harnesses SCSK’s more than 40 years of experience in developing in-vehicle systems, signaling deeper integration with global automotive OEMs and suppliers in the fast-evolving software-defined vehicle ecosystem.

- We'll explore how SCSK's push into the software-defined vehicle market through SDVerse impacts its broader investment narrative in automotive technology.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is SCSK's Investment Narrative?

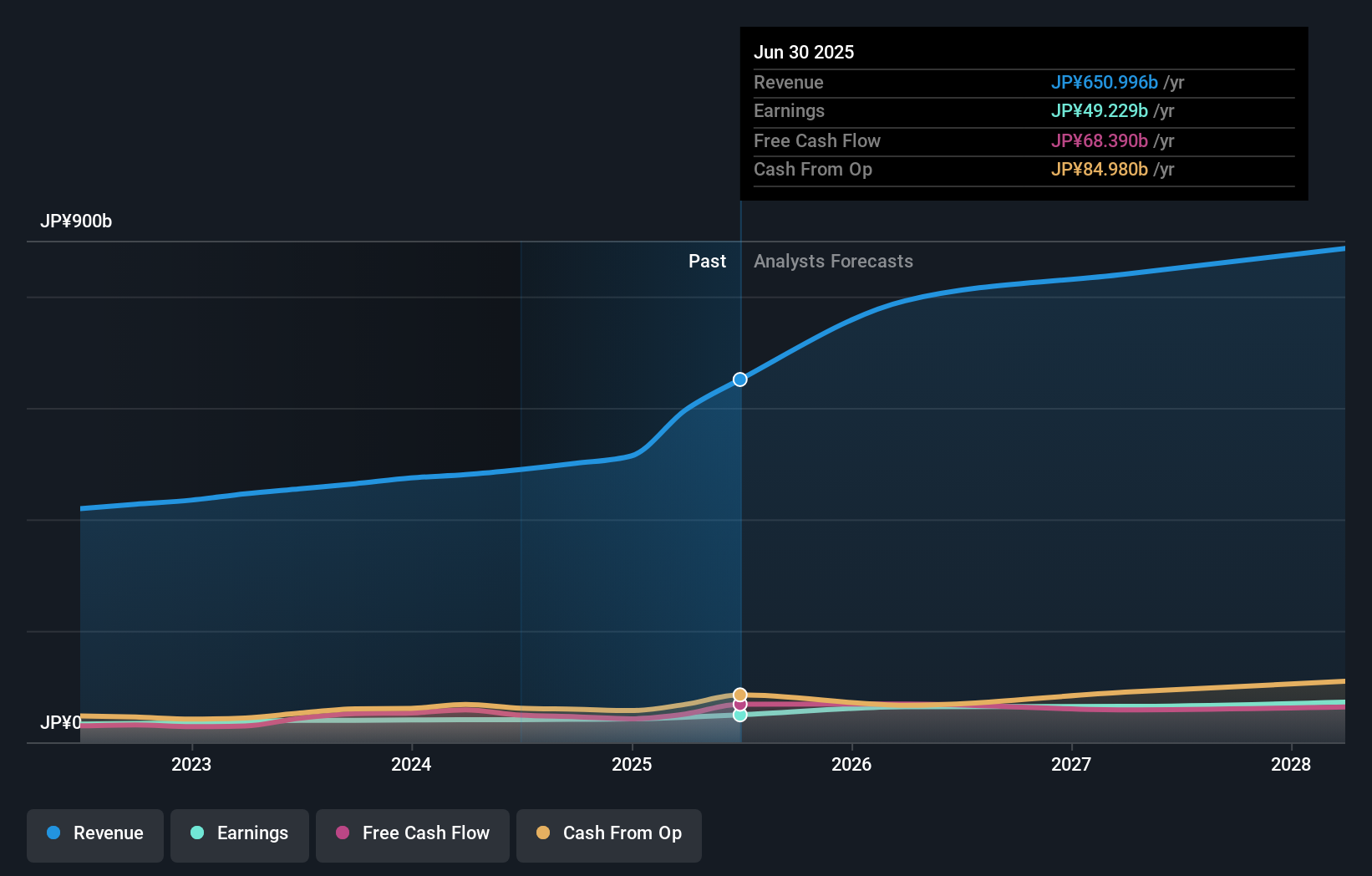

SCSK’s move to join the SDVerse platform comes at a moment when the race to dominate the software-defined vehicle space is picking up speed. For investors, the big picture to believe in is SCSK’s ability to convert its four decades of automotive IT experience into new growth avenues as the industry shifts toward digital and connected mobility. Previously, catalysts included a healthy earnings momentum, a reliable dividend, and strong recent share price returns; risks centered on below-average profit margins, a high board turnover, and limited past board experience. The SDVerse news could meaningfully reframe the near-term outlook by positioning SCSK closer to influential automotive OEMs and future software platforms, potentially increasing the company’s relevance and opening up fresh revenue channels. That said, any material impact on margins or profit growth will be clearer as the partnership matures and ahead of the upcoming earnings release. Yet, SCSK’s rapid board turnover and relatively inexperienced directors remain critical watchpoints for shareholders.

SCSK's shares are on the way up, but they could be overextended by 20%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on SCSK - why the stock might be worth 17% less than the current price!

Build Your Own SCSK Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SCSK research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SCSK research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SCSK's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9719

SCSK

Provides information technology (IT) services in Japan and internationally.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives