Computer Engineering & Consulting (TSE:9692) Q3 EPS Growth Tests Margin-Concern Narrative

Reviewed by Simply Wall St

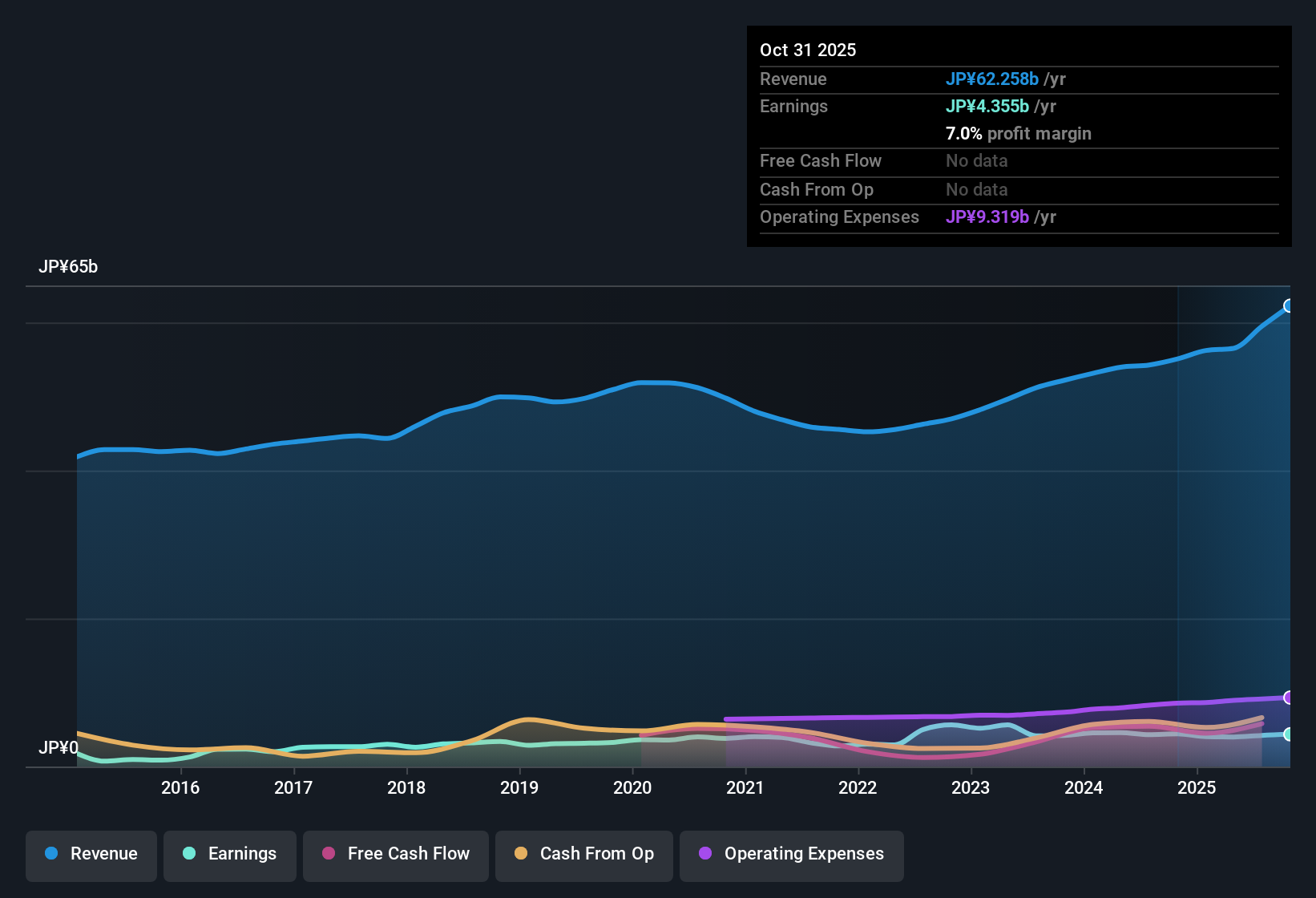

Computer Engineering & Consulting (TSE:9692) has posted Q3 2026 results with revenue of ¥16.4 billion and basic EPS of ¥38.7, while net income excluding extra items came in at ¥1.2 billion, setting a clear marker for the latest quarter. The company has seen quarterly revenue move from ¥13.7 billion in Q3 2025 to ¥16.4 billion in Q3 2026, alongside basic EPS rising from ¥32.5 to ¥38.7. This gives investors a numbers-first view of how the top and bottom line are tracking as margins do a bit more of the talking this time around.

See our full analysis for Computer Engineering & Consulting.With the headline figures on the table, the next step is to see how these results line up with the dominant market narratives around growth, profitability, and execution risk.

Curious how numbers become stories that shape markets? Explore Community Narratives

Forecasts Call For 7.5% Revenue And 14.2% Earnings Growth

- Forward looking estimates point to about 7.5% annual revenue growth and roughly 14.2% annual earnings growth, both ahead of the wider Japanese market expectations.

- Bullish investors see these faster growth forecasts as a key support for the story, yet

- the latest trailing net profit margin of 7% versus 8% a year ago shows profitability has recently moved the other way, so the near term picture is not as strong as the future growth rates suggest.

- recent quarterly net income excluding extra items, at ¥1.2 billion in Q3 2026 versus ¥1.06 billion in Q3 2025, gives some backing to the growth angle but still leaves the margin trend as something bulls need to keep an eye on.

To see how the projected growth story stacks up against longer term trends and valuation, many investors dig deeper into the broader narrative around this name. 📊 Read the full Computer Engineering & Consulting Consensus Narrative.

Margins Slip Even As TTM Profit Reaches ¥4.4 Billion

- On a trailing basis, net income excluding extra items is ¥4.4 billion on ¥62.3 billion of revenue, giving a 7% net margin versus 8% a year earlier.

- Bears focus on this 1 percentage point margin decline as a sign of pressure, but

- the trailing revenue base has still stepped up from ¥55.1 billion to ¥62.3 billion, so the business is handling a larger scale even if each yen of sales currently converts into slightly less profit.

- five year compound earnings growth of 3.8% a year and the assessment of high quality past earnings mean the margin dip sits against a longer record of generally reliable profitability rather than a one off spike.

P E Of 16.5x And 42.7% DCF Discount Stand Out

- The shares trade at ¥2,305 with a trailing P E of 16.5 times, below the Japan software industry average of 19.5 times and peers at 19.3 times, and about 42.7% below the DCF fair value of roughly ¥4,021.68.

- What stands out for value oriented investors is how this lower multiple combines with income and growth metrics

- the dividend yield of about 2.82% sits on top of the forecast 14.2% annual earnings growth, a mix that often commands a richer valuation than 16.5 times if the market is fully convinced.

- the gap between the current price and both the sector valuation and the DCF fair value leaves room for re rating if the company can align its 7% trailing margin more closely with the stronger growth outlook.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Computer Engineering & Consulting's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Computer Engineering & Consulting pairs solid top line growth with slipping margins and a valuation implying upside, which leaves execution risk around profitability and rerating potential.

If the margin pressure and uncertain rerating path give you pause, use our stable growth stocks screener (2088 results) to quickly focus on businesses already delivering consistent earnings momentum and steadier performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9692

Computer Engineering & Consulting

Engages in digital industry and system integration businesses in Japan.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026