- Taiwan

- /

- Tech Hardware

- /

- TWSE:2387

3 Top Dividend Stocks Offering Up To 4.8% Yield

Reviewed by Simply Wall St

As global markets navigate a mixed start to the new year, with major indices showing varied performances and economic indicators like the Chicago PMI signaling contraction, investors are keenly assessing opportunities that can offer stability amid uncertainty. In such an environment, dividend stocks stand out as they provide a potential source of regular income and may offer some resilience against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.83% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.95% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.35% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

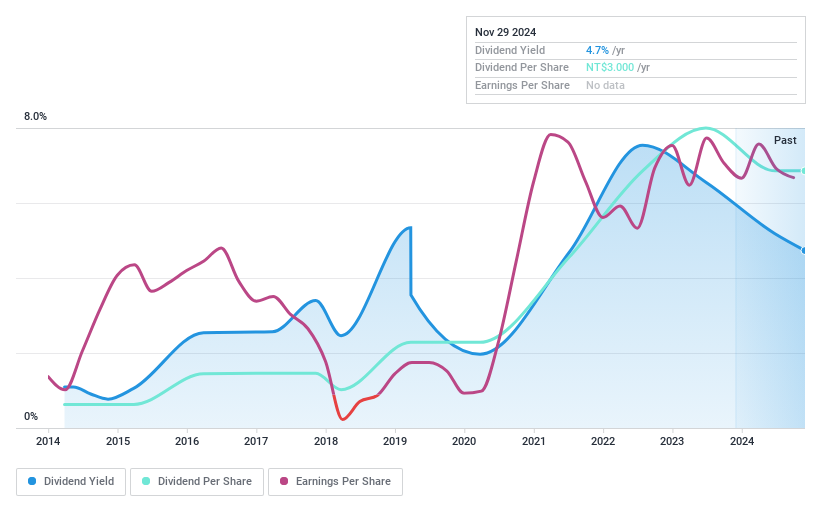

Jiin Yeeh Ding Enterprises (TPEX:8390)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiin Yeeh Ding Enterprises Corp., with a market cap of NT$5.97 billion, is a professional electronic waste recycling and treatment company offering e-waste disposal services for technology companies in Taiwan.

Operations: Jiin Yeeh Ding Enterprises generates its revenue primarily from Waste Management, amounting to NT$4.60 billion.

Dividend Yield: 3.5%

Jiin Yeeh Ding Enterprises has demonstrated stable and reliable dividend payments over the past decade, with dividends growing consistently. However, the current dividend yield of 3.54% is lower than the top tier in Taiwan's market and not well covered by free cash flows due to a high cash payout ratio of 196.4%. Despite a reasonable earnings payout ratio of 51.3%, profit margins have declined from last year, impacting sustainability concerns.

- Get an in-depth perspective on Jiin Yeeh Ding Enterprises' performance by reading our dividend report here.

- Our valuation report here indicates Jiin Yeeh Ding Enterprises may be overvalued.

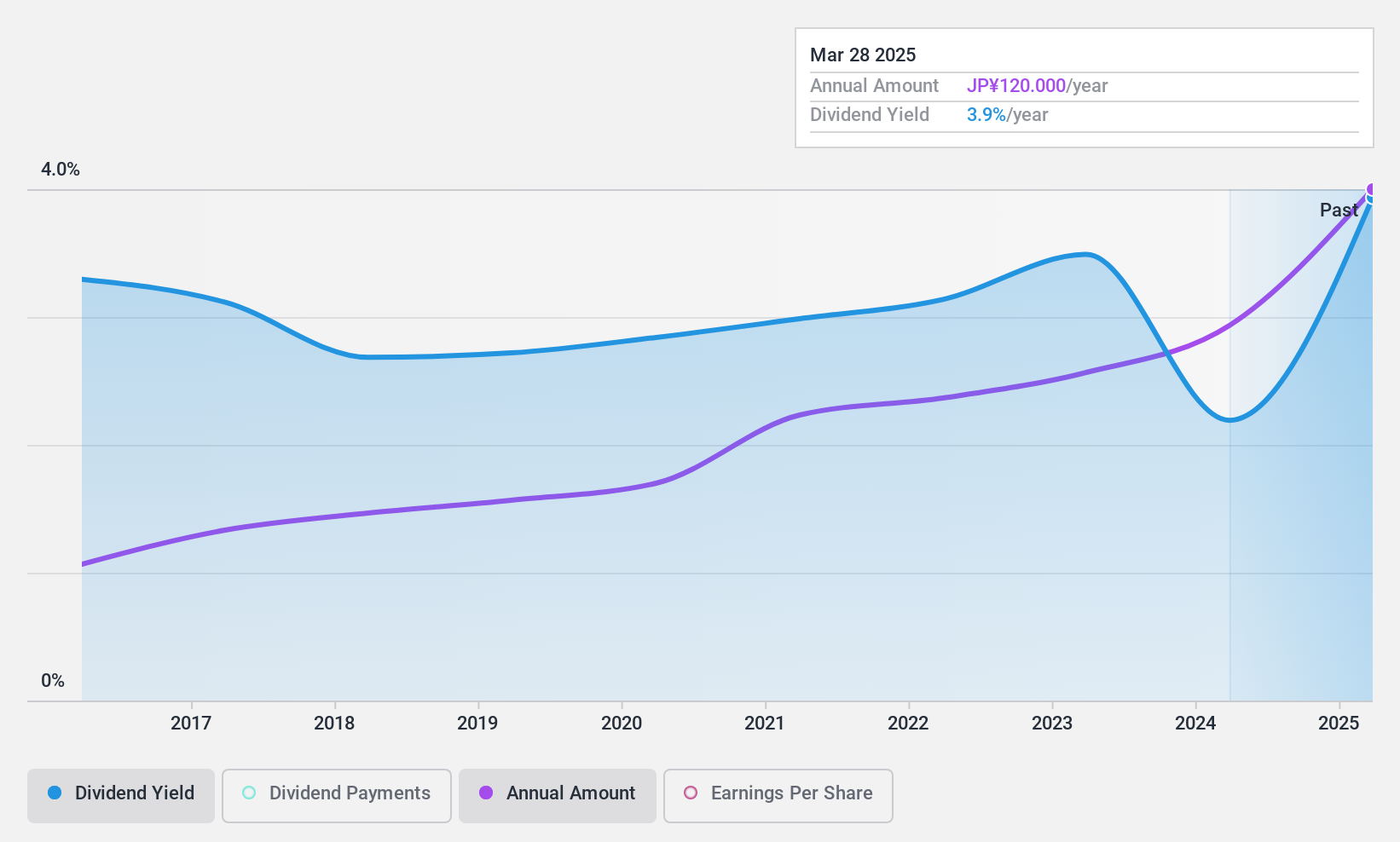

KSKLtd (TSE:9687)

Simply Wall St Dividend Rating: ★★★★★★

Overview: KSK Co., Ltd. operates in the LSI, software, hardware, customer service, and data entry sectors with a market capitalization of approximately ¥18.25 billion.

Operations: KSK Co., Ltd.'s revenue is primarily derived from its IT Solution Business at ¥5.31 billion, System Core Business at ¥3.99 billion, and Network Service Business at ¥13.27 billion.

Dividend Yield: 4%

KSK Ltd. offers a robust dividend yield of 3.96%, placing it in the top 25% of dividend payers in Japan. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 32.7% and 55%, respectively, indicating sustainability. Over the past decade, KSK's dividends have been stable and consistently growing, supported by an annual earnings growth rate of 8.5%. Additionally, the stock trades at a discount to its estimated fair value.

- Navigate through the intricacies of KSKLtd with our comprehensive dividend report here.

- According our valuation report, there's an indication that KSKLtd's share price might be on the cheaper side.

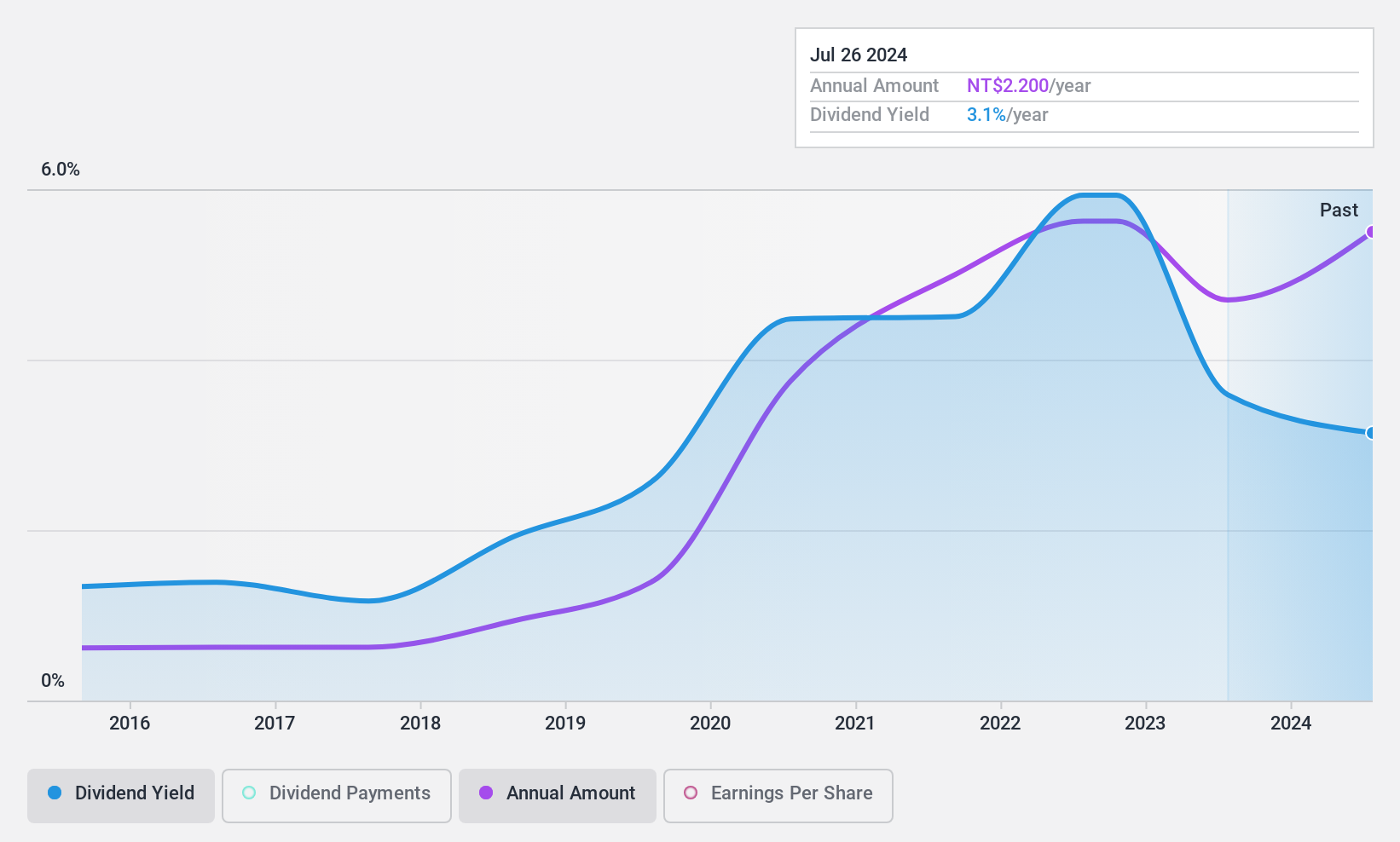

Sunrex Technology (TWSE:2387)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sunrex Technology Corporation manufactures and sells laptop computer keyboards globally, with a market cap of NT$11.94 billion.

Operations: Sunrex Technology Corporation's revenue segments include NT$12.97 billion from Sunrex Taiwan, NT$19.77 billion from the Central Region of Mainland China, and NT$1.23 billion from the Southern Region of Mainland China.

Dividend Yield: 4.9%

Sunrex Technology's dividend yield of 4.86% ranks it among the top 25% of dividend payers in Taiwan, supported by a low payout ratio of 46.1%, indicating strong coverage by earnings and cash flows (31.5%). Despite this, its dividend history is marked by volatility and unreliability over the past decade, with significant annual drops exceeding 20%. The stock trades at a favorable price-to-earnings ratio of 9.5x compared to the Taiwanese market average.

- Dive into the specifics of Sunrex Technology here with our thorough dividend report.

- The valuation report we've compiled suggests that Sunrex Technology's current price could be inflated.

Next Steps

- Investigate our full lineup of 1983 Top Dividend Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2387

Sunrex Technology

Engages in the manufacture and sale of laptop computer keyboards worldwide.

Excellent balance sheet established dividend payer.