Undiscovered Gems Highlight These 3 Small Cap Stocks with Promising Potential

Reviewed by Simply Wall St

Amidst a mixed performance in global markets, with U.S. indices like the S&P 500 and Nasdaq Composite closing out a strong year despite recent volatility, small-cap stocks have been garnering attention as potential opportunities for investors seeking growth. The Russell 2000 Index's positive movement highlights the resilience of smaller companies even as economic indicators such as the Chicago PMI signal challenges in manufacturing. In this environment, identifying promising small-cap stocks involves looking for those with solid fundamentals and innovative strategies that can navigate economic fluctuations effectively.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Kardemir Karabük Demir Çelik Sanayi Ve Ticaret (IBSE:KRDMD)

Simply Wall St Value Rating: ★★★★★★

Overview: Kardemir Karabük Demir Çelik Sanayi Ve Ticaret A.S. is a Turkish company engaged in the production and sale of iron and steel products, with a market cap of TRY32.21 billion.

Operations: Kardemir derives its revenue primarily from the production and sale of iron and steel products. The company's net profit margin has shown variable trends over recent periods.

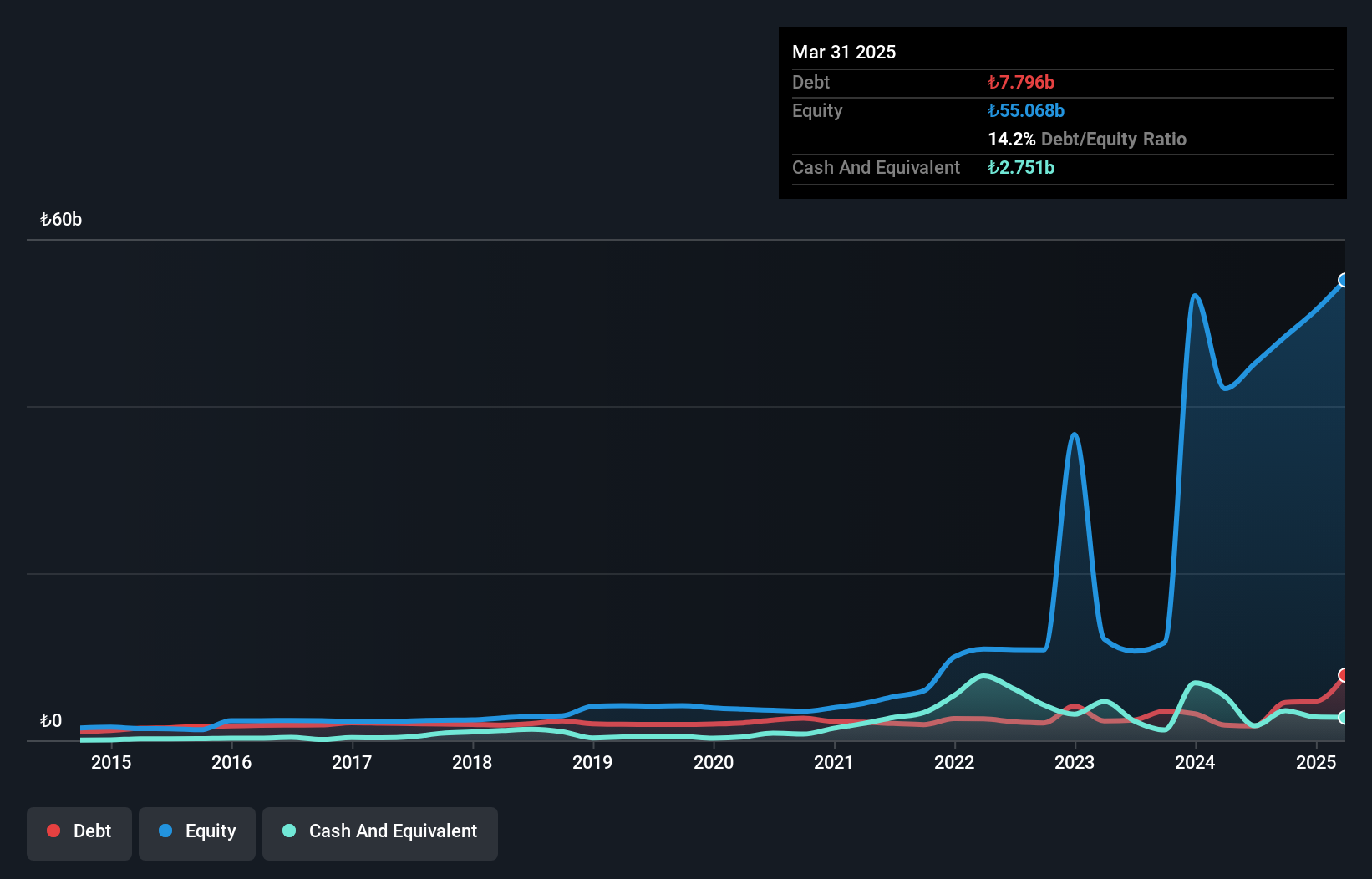

Kardemir Karabük, a notable player in the steel industry, has shown resilience despite recent challenges. The company reported a net loss of TRY 970.81 million for Q3 2024, an improvement from TRY 1,465.46 million last year, while sales decreased to TRY 14.55 billion from TRY 17.93 billion. Over the past five years, Kardemir's debt-to-equity ratio impressively dropped from 45.6% to just 9.4%, reflecting strong financial management with a satisfactory net debt-to-equity ratio of 2%. Trading at about 75% below its estimated fair value suggests potential undervaluation amidst high-quality earnings and positive free cash flow dynamics.

Baoding Technology (SZSE:002552)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Baoding Technology Co., Ltd. is involved in the research, development, manufacture, and sale of various forgings and castings in China with a market capitalization of approximately CN¥6.51 billion.

Operations: Baoding Technology generates revenue primarily from its Forging and Casting Division, amounting to CN¥299.93 million. The segment adjustment is noted at CN¥2.62 billion.

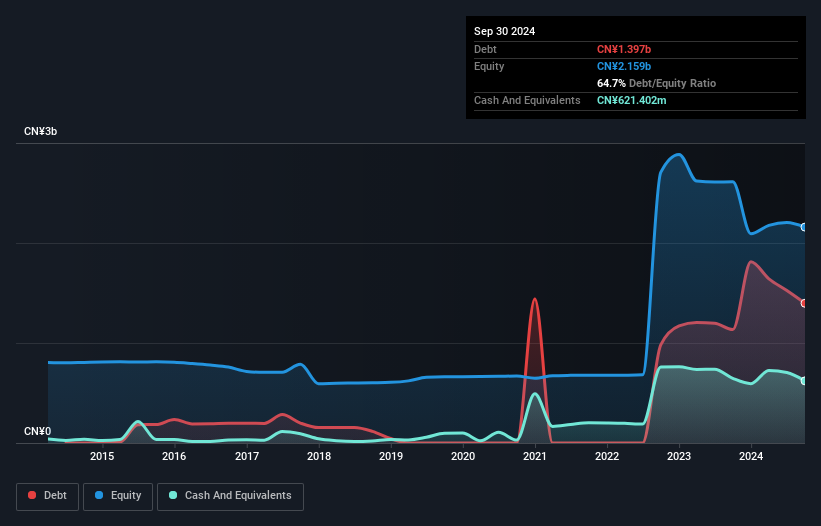

Tucked away in the bustling tech sector, Baoding Technology showcases intriguing potential with its recent earnings report revealing net income of CNY 112.55 million for the nine months ending September 2024, up from CNY 93.61 million the previous year. This improvement was accompanied by a basic earnings per share increase to CNY 0.27 from CNY 0.22, despite sales dipping slightly to CNY 2,106.1 million from CNY 2,227.8 million a year ago. The company’s debt-to-equity ratio has risen to a significant yet manageable level of 64.7% over five years, while its price-to-earnings ratio remains competitive at 31.9x against the CN market's average of 32.8x.

- Click here and access our complete health analysis report to understand the dynamics of Baoding Technology.

Understand Baoding Technology's track record by examining our Past report.

Taiwan Speciality Chemicals (TPEX:4772)

Simply Wall St Value Rating: ★★★★★★

Overview: Taiwan Speciality Chemicals Corporation focuses on the manufacturing and sale of specialty electronic-graded gases and chemicals in Taiwan, with a market capitalization of NT$26.73 billion.

Operations: The primary revenue stream for Taiwan Speciality Chemicals comes from the research, development, and sales of precision chemical materials, generating NT$808.72 million.

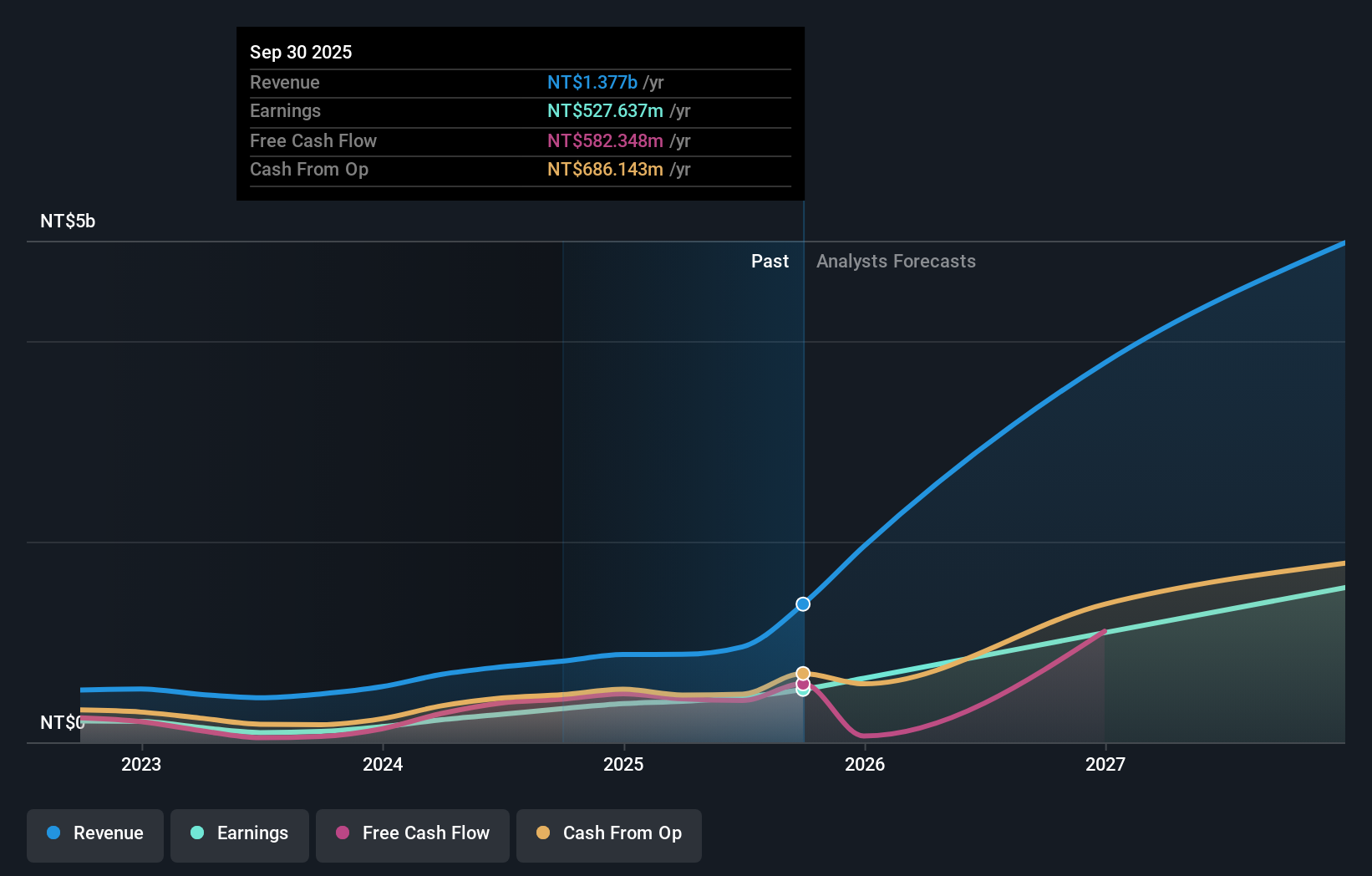

Taiwan Speciality Chemicals, a smaller player in the industry, has shown impressive financial performance recently. Its earnings surged by 209% over the past year, outpacing the broader chemicals sector's growth of 14%. The company reported third-quarter sales of TWD 213.97 million, up from TWD 156.93 million a year earlier, with net income jumping to TWD 99.56 million from TWD 43.63 million previously. Despite shareholder dilution over the past year, Taiwan Speciality remains debt-free and boasts high-quality earnings. Recent leadership changes include Cheng-Chien Chen's appointment as Vice Chairperson effective November 2024, reflecting strategic shifts in governance.

Next Steps

- Reveal the 4672 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Speciality Chemicals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:4772

Taiwan Speciality Chemicals

Manufactures and sells specialty electronic-graded gases and chemicals in Taiwan.

Flawless balance sheet with solid track record.