- China

- /

- Aerospace & Defense

- /

- SZSE:002025

3 Global Stocks Estimated To Be Up To 48.4% Below Intrinsic Value

Reviewed by Simply Wall St

Global markets have recently been under pressure due to tariff fears, inflation concerns, and fluctuating growth prospects, leading to a significant sell-off in U.S. stocks and mixed performances across Europe and Asia. Amid this climate of uncertainty, identifying undervalued stocks can be an opportunity for investors seeking assets that may offer potential value when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| DIT (KOSDAQ:A110990) | ₩13910.00 | ₩27542.25 | 49.5% |

| Precision Tsugami (China) (SEHK:1651) | HK$21.00 | HK$41.82 | 49.8% |

| Avant Group (TSE:3836) | ¥1789.00 | ¥3553.81 | 49.7% |

| Hyosung Heavy Industries (KOSE:A298040) | ₩424000.00 | ₩847815.56 | 50% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.21 | CN¥30.41 | 50% |

| Comet Holding (SWX:COTN) | CHF233.00 | CHF461.06 | 49.5% |

| adidas (XTRA:ADS) | €226.80 | €451.85 | 49.8% |

| Takara Bio (TSE:4974) | ¥856.00 | ¥1702.96 | 49.7% |

| Star7 (BIT:STAR7) | €6.15 | €12.26 | 49.8% |

| Zhejiang Leapmotor Technology (SEHK:9863) | HK$41.50 | HK$82.37 | 49.6% |

We're going to check out a few of the best picks from our screener tool.

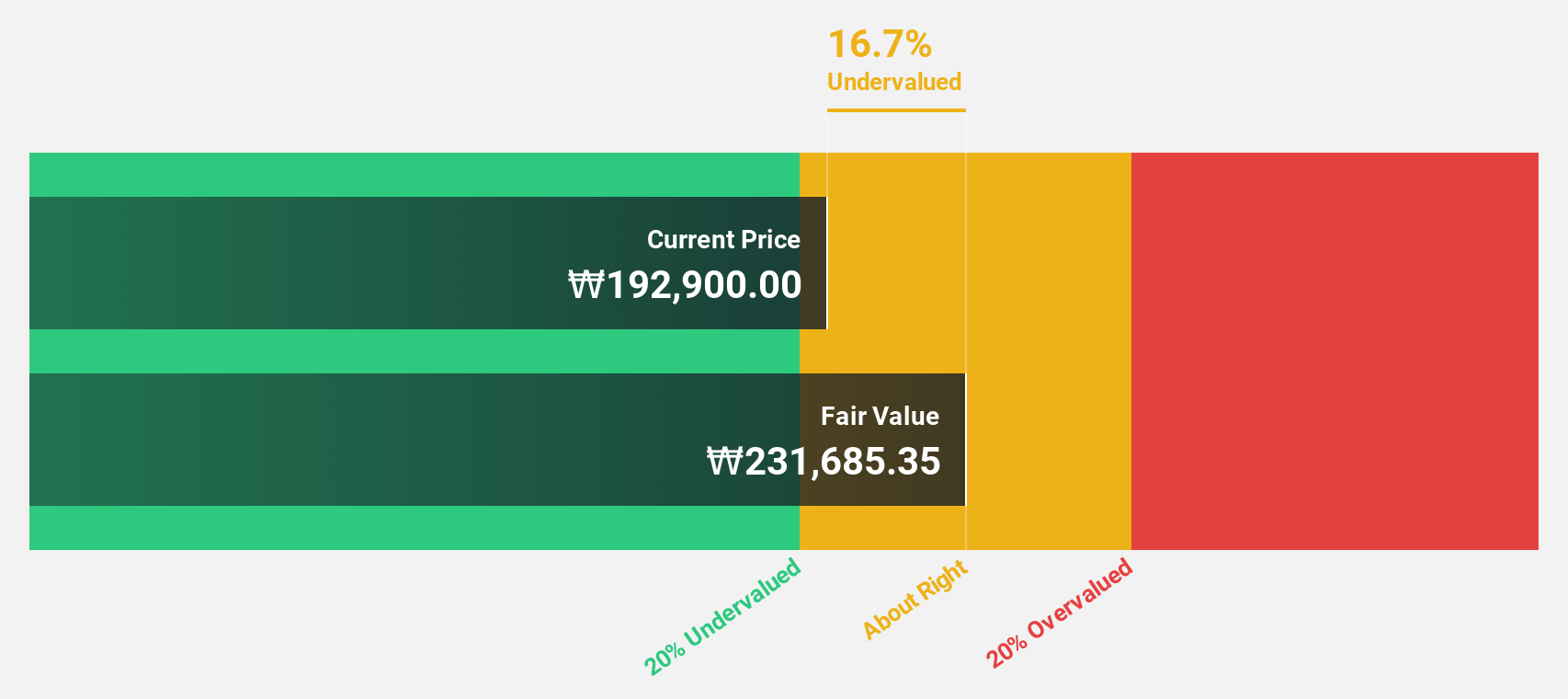

Hyundai Rotem (KOSE:A064350)

Overview: Hyundai Rotem Company manufactures and sells railway vehicles, defense systems, and plants and machinery both in South Korea and internationally, with a market cap of ₩10.07 billion.

Operations: Hyundai Rotem generates revenue through its three main segments: railway vehicles, defense systems, and plants and machinery.

Estimated Discount To Fair Value: 17%

Hyundai Rotem is trading at ₩92,100, below its estimated fair value of ₩111,009.06. Earnings are forecast to grow significantly at 27.72% annually over the next three years, outpacing the Korean market's growth rate. Despite high volatility in its share price recently, Hyundai Rotem reported strong financial performance with sales of ₩4.38 trillion and net income of ₩406.9 billion for 2024, showcasing robust cash flow potential amid high non-cash earnings levels.

- According our earnings growth report, there's an indication that Hyundai Rotem might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of Hyundai Rotem.

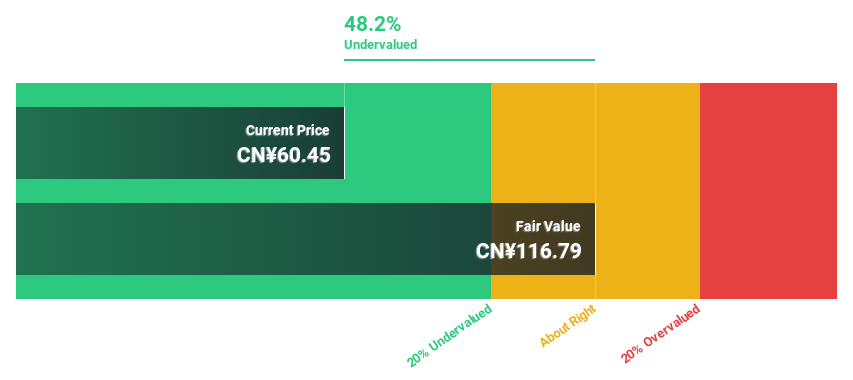

Guizhou Space Appliance (SZSE:002025)

Overview: Guizhou Space Appliance Co., LTD specializes in the R&D, production, and sale of connectors, micro-motors and control components, relays, optoelectronic and optical communication devices, and cable assemblies in China with a market cap of CN¥26.41 billion.

Operations: The company generates revenue primarily from its Electronic Component Manufacturing segment, totaling CN¥4.94 billion.

Estimated Discount To Fair Value: 48.4%

Guizhou Space Appliance, trading at CN¥60.45, is significantly undervalued compared to its estimated fair value of CN¥117.05. The company's earnings are projected to grow by 34.29% annually, surpassing the Chinese market's average growth rate of 25.5%. Despite a history of unstable dividends and low forecasted return on equity (13.3%), its revenue growth forecast of 24.1% per year highlights strong cash flow potential in the coming years.

- Our growth report here indicates Guizhou Space Appliance may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Guizhou Space Appliance.

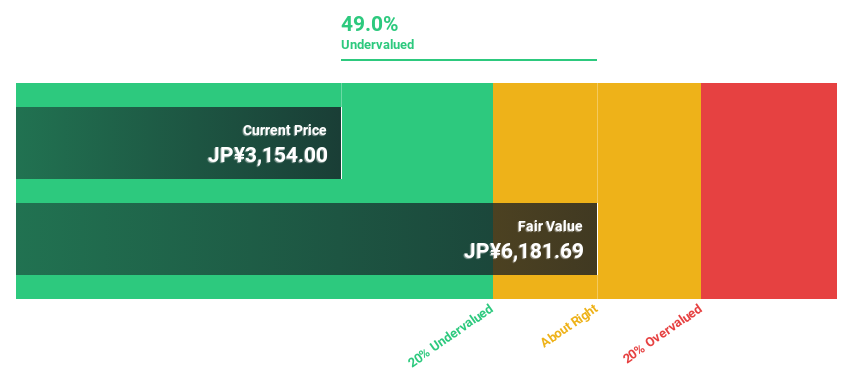

GMO internet group (TSE:9449)

Overview: GMO Internet Group, Inc. offers a range of internet services globally and has a market cap of ¥308.65 billion.

Operations: The company's revenue segments include Internet Infrastructure at ¥184.91 billion, Internet Finance Business generating ¥43.73 billion, Internet Advertising and Media Business contributing ¥34.07 billion, and the Crypto Asset Business with ¥9.13 billion in revenue.

Estimated Discount To Fair Value: 41.9%

GMO Internet Group, trading at ¥3,134, is undervalued relative to its estimated fair value of ¥5,395.86. Its earnings are projected to grow at 18.8% annually, outpacing the Japanese market's average growth rate of 8%. The company has initiated a share buyback program aimed at enhancing capital efficiency and shareholder returns. Despite slower revenue growth forecasts of 7.4% per year compared to earnings, the stock offers strong cash flow potential and high return on equity prospects.

- Our comprehensive growth report raises the possibility that GMO internet group is poised for substantial financial growth.

- Get an in-depth perspective on GMO internet group's balance sheet by reading our health report here.

Next Steps

- Discover the full array of 508 Undervalued Global Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002025

Guizhou Space Appliance

Engages in the research and development, production, and sale of connectors, micro-motors and control components, relays, optoelectronic and optical communication devices, and cable assemblies in China.

High growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion