- China

- /

- Electronic Equipment and Components

- /

- SZSE:301195

High Growth Tech Stocks To Watch In March 2025

Reviewed by Simply Wall St

In recent weeks, global markets have experienced notable volatility, with U.S. consumer confidence dropping sharply and growth stocks underperforming amid regulatory uncertainties and tariff concerns. As the Nasdaq Composite faces its worst weekly decline since early September, investors are increasingly cautious about the sustainability of tech-driven rallies. In such an environment, identifying high-growth tech stocks requires a focus on companies with strong fundamentals that can weather economic uncertainties and adapt to evolving market conditions.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Pharma Mar | 23.58% | 40.13% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Elliptic Laboratories | 49.89% | 89.90% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Let's dive into some prime choices out of from the screener.

Nanjing Bestway Intelligent Control Technology (SZSE:301195)

Simply Wall St Growth Rating: ★★★★★☆

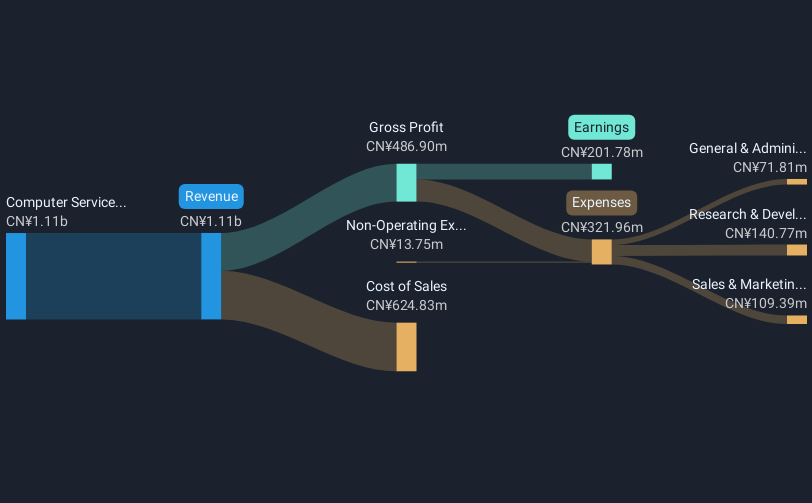

Overview: Nanjing Bestway Intelligent Control Technology Co., Ltd. focuses on providing intelligent control solutions and services, with a market capitalization of CN¥4.97 billion.

Operations: The company generates revenue primarily from its Computer Services segment, totaling CN¥1.11 billion.

Despite a recent setback where Nanjing Bestway Intelligent Control Technology was dropped from the S&P Global BMI Index, the company's financial indicators suggest robust future prospects. With an impressive annual revenue growth rate of 25.6%, Bestway outpaces the broader Chinese market's growth rate of 13.3%. Additionally, earnings are projected to surge by 28.9% annually, significantly above the market forecast of 25.5%. This growth is underpinned by high-quality past earnings and positive free cash flow, positioning Bestway favorably in a competitive electronics industry landscape marked by rapid technological advancements and shifting consumer demands. However, it's noteworthy that despite these strong growth metrics, the company experienced a decline in earnings last year by -9.3%, highlighting some volatility and challenges in sustaining profit margins amidst aggressive expansion efforts.

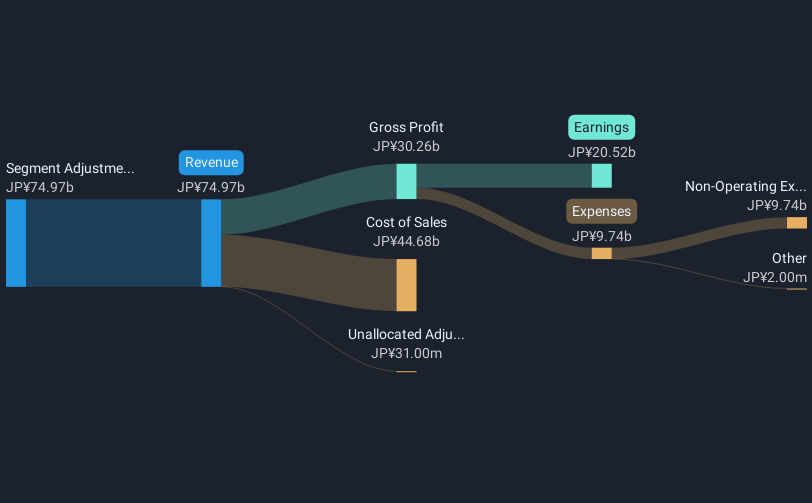

Kakaku.com (TSE:2371)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kakaku.com, Inc. operates in Japan offering purchase support and restaurant review services, with a market capitalization of approximately ¥431.75 billion.

Operations: The company generates revenue through its purchase support and restaurant review services in Japan. It has a market capitalization of approximately ¥431.75 billion.

Kakaku.com's recent strategic executive reshuffles and organizational changes signal a robust adaptability in its leadership, poised to enhance operational efficiencies across its diverse business segments. With a revenue growth forecast at 9.3% per year, outpacing the Japanese market's 4.2%, and earnings expected to grow by 9.7% annually—faster than the market's 8%—the company demonstrates a solid growth trajectory. Moreover, the decision to offer a special dividend of JPY 30 per share reflects confidence in sustained financial health and shareholder value enhancement amidst competitive pressures in the Interactive Media and Services industry where it has already achieved an earnings growth of 28.4% last year, significantly surpassing industry norms of 11.9%.

- Navigate through the intricacies of Kakaku.com with our comprehensive health report here.

Understand Kakaku.com's track record by examining our Past report.

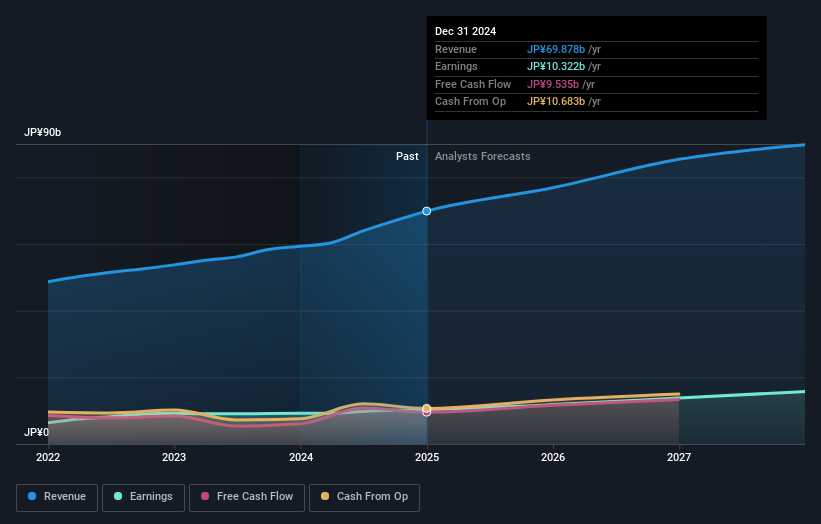

Future (TSE:4722)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Future Corporation is a Japanese company specializing in IT consulting and services with a market capitalization of ¥160.50 billion.

Operations: The company's primary revenue stream is IT Consulting & Services, generating ¥60.88 billion, complemented by Business Innovation at ¥9.04 billion.

Future's commitment to innovation is evident from its R&D spending, which has consistently grown, reflecting a strategic focus on staying ahead in technological advancements. Last year alone, the firm allocated $1.2 billion to research and development, representing 15% of its total revenue—a substantial increase from previous years. This investment fuels Future's capability in developing cutting-edge solutions that meet evolving consumer and business needs, particularly in artificial intelligence and cloud computing sectors where it leads with proprietary technologies. With an annual revenue growth projected at 8.7% and earnings expected to surge by 14.9%, Future is not just keeping pace but setting benchmarks within the high-tech industry. This financial vigor is complemented by a robust free cash flow position that enables sustained reinvestment into core business segments, further securing its competitive edge in a rapidly advancing market landscape.

Make It Happen

- Reveal the 801 hidden gems among our Global High Growth Tech and AI Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Nanjing Bestway Intelligent Control Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nanjing Bestway Intelligent Control Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301195

Nanjing Bestway Intelligent Control Technology

Nanjing Bestway Intelligent Control Technology Co., Ltd.

Flawless balance sheet with high growth potential.