Trend Micro (TSE:4704): Evaluating Valuation After Leadership Recognition in IDC MarketScape for XDR Software

Reviewed by Kshitija Bhandaru

Trend Micro (TSE:4704) grabbed attention after being named a Leader in the IDC MarketScape Worldwide Extended Detection and Response Software assessment. This recognition highlights its AI-powered platform and pricing approach, both of which help it stand out in the cybersecurity sector.

See our latest analysis for Trend Micro.

Following the IDC MarketScape recognition, Trend Micro’s share price has remained steady in the short term. Its strong three- and five-year total shareholder returns of 20% and 55% point to solid long-term momentum as investor confidence builds around its platform innovations.

If you’re interested in where cybersecurity leaders are heading, consider exploring the broader landscape of tech and AI stocks. There is a full list to discover here: See the full list for free..

Yet with shares holding near recent levels despite this recognition, investors now face a critical question: does Trend Micro offer hidden value, or is the stock already reflecting expectations for future growth?

Most Popular Narrative: 13.8% Undervalued

With the narrative's fair value of ¥9,371 standing about 16% above the last close, Trend Micro’s future prospects are drawing sharper focus as its share price moves slowly.

Trend Micro is investing heavily in AI technology, aiming to democratize AI access and enable proactive cybersecurity. This could lead to revenue growth through new service offerings and improved customer retention as clients adopt AI-driven solutions. These factors are expected to have a positive impact on revenue.

Which bold assumptions are fueling this valuation? The story centers on rapid profit gains, margin expansion, and an earnings forecast with ambitious expectations for the coming years. Discover what drives this price target and the tension between innovation and execution that underpins the narrative's fair value projection.

Result: Fair Value of ¥9,371 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing struggles in the consumer business outside Japan and delays in switching online payment providers could present challenges to the optimistic outlook for Trend Micro.

Find out about the key risks to this Trend Micro narrative.

Another View: Valuation by Earnings Multiple

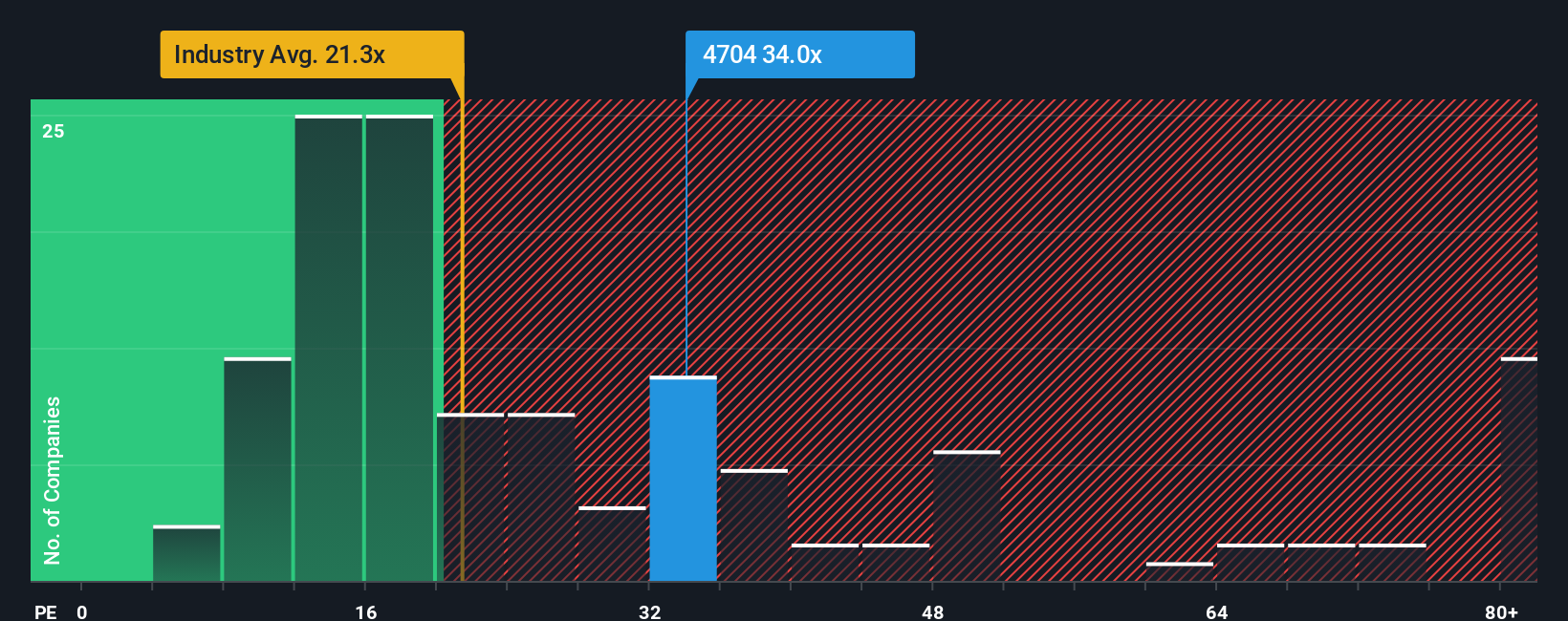

Taking a practical look at valuation based on the price-to-earnings ratio, Trend Micro currently trades at 34.6 times earnings. This is much higher than both its peers (26x) and the broader JP software industry average (21.1x), and it is also above the fair ratio estimate of 30.8x. Such a premium suggests investors are paying up for future growth or innovation, but how much runway is realistically left for upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trend Micro Narrative

If you see the story differently or want to test your own perspective, explore the figures and build your narrative in just a few minutes with Do it your way.

A great starting point for your Trend Micro research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investing means never settling for your first idea. Unlock even more opportunities with handpicked stocks from the Simply Wall Street Screener and get ahead of the crowd by acting before the next big story breaks.

- Spot companies with high yield potential and strong income records by using these 19 dividend stocks with yields > 3% to track down stocks that can power up your portfolio with reliable dividends.

- Catch breakthroughs in medical innovation and technology by tapping into these 32 healthcare AI stocks, where AI-driven healthcare businesses are reshaping diagnostics and treatments.

- Capitalize on undervalued opportunities hiding in plain sight when you use these 886 undervalued stocks based on cash flows and let market mispricings work in your favor.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trend Micro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4704

Trend Micro

Develops and sells security-related software for computers and related services in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives