Is Trend Micro (TSE:4704) Undervalued After Recent 13% Share Price Decline? A Fresh Look at Valuation

Reviewed by Kshitija Bhandaru

Trend Micro (TSE:4704) shares have seen a downward trend over the past month, with the stock losing around 13%. Investors are eyeing the company’s recent performance and fundamentals to assess its current valuation and future prospects.

See our latest analysis for Trend Micro.

This latest drop adds to a slide that has been building over the past few months, with Trend Micro posting a 13.4% 1-month share price return and now sitting down over 21% across the past quarter. While the short-term picture has been volatile, long-term investors have still seen a total shareholder return of nearly 13% over three years. This suggests underlying momentum is fading but not lost entirely.

If recent tech sector swings have you searching for standout names, now’s a great time to discover See the full list for free.

With shares trading nearly 25% below analyst price targets and recent earnings showing solid growth, the question facing investors now is whether Trend Micro represents a rare value opportunity or if the market has already taken its future potential into account.

Most Popular Narrative: 20% Undervalued

With Trend Micro closing at ¥7,401, while the widely followed narrative assigns a fair value of ¥9,250, there is a notable gap between the market price and expected value. This sets the stage for a detailed look at the assumptions and catalysts behind this higher valuation.

The company's strategic focus on its enterprise segment, with plans to leverage Vision One and managed security service provider (MSP) partners, suggests potential for increased annual recurring revenue (ARR) and operating income as they expand their market share and offer comprehensive security solutions.

Want to know the secret behind this bullish price target? The narrative leans on enterprise transformation and next-gen AI initiatives, with bold expectations for margin expansion. Which projections fuel confidence in this premium valuation? The full narrative reveals all.

Result: Fair Value of ¥9,250 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges such as persistent struggles in the consumer segment and declining perpetual license renewals could affect Trend Micro’s growth outlook in the future.

Find out about the key risks to this Trend Micro narrative.

Another View: Multiples Tell a Different Story

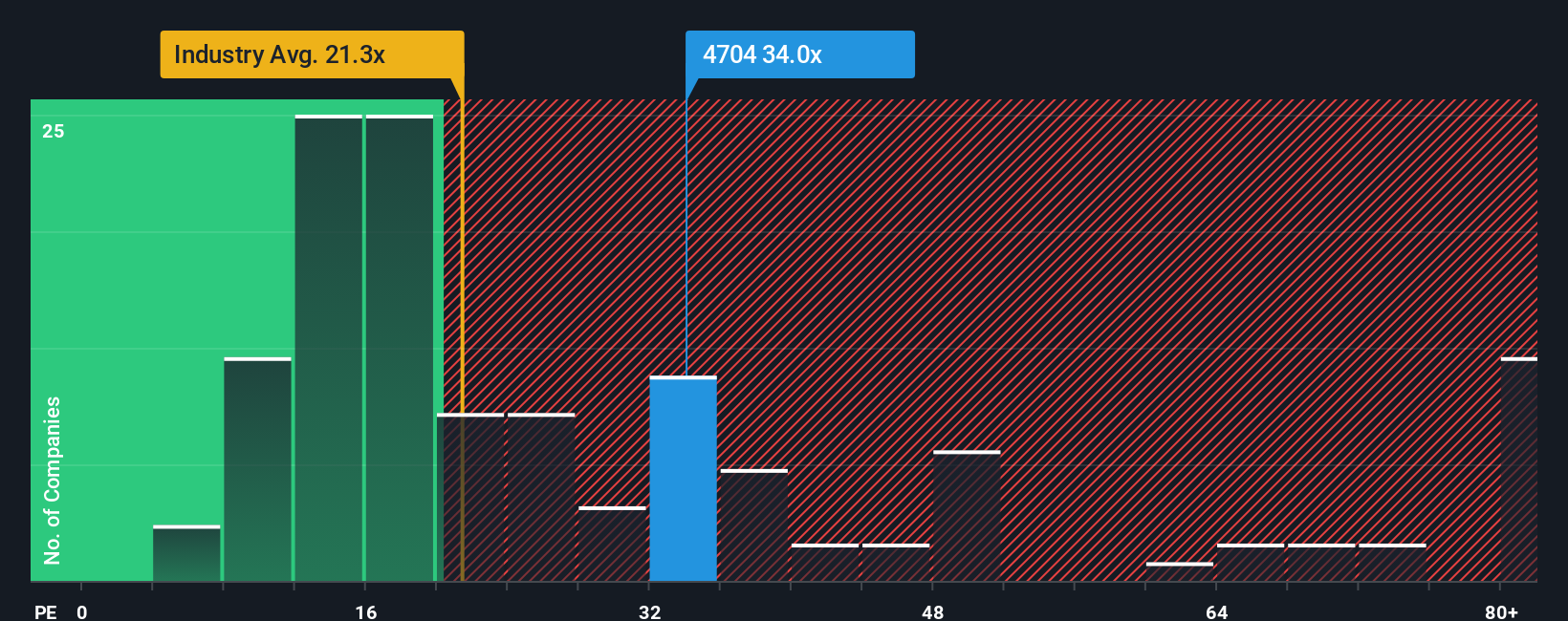

While analysts see Trend Micro as undervalued based on future growth, the current price-to-earnings ratio of 31.7x paints a less optimistic picture. That is higher than both the industry average (21.6x), the peer average (24.9x), and above the fair ratio of 30.6x. This could mean investors are pricing in more risk, or that optimism is stretched. Is the market right to be cautious, or is opportunity hiding in plain sight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trend Micro Narrative

Rather dig into the numbers and shape your own view? With just a few minutes, you can explore the data firsthand and piece together your personal perspective, then Do it your way.

A great starting point for your Trend Micro research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your portfolio to just one opportunity. Stay ahead of the market by acting now to uncover unique growth stories and hidden value.

- Capture opportunities in fast-growing digital currencies when you check out these 79 cryptocurrency and blockchain stocks that are reshaping global finance and payment innovation.

- Seize high-yield potential with these 18 dividend stocks with yields > 3% that deliver reliable income and could boost your portfolio’s total return.

- Tap into breakthrough healthcare technology with these 33 healthcare AI stocks that are creating smarter medical innovations and new growth frontiers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trend Micro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4704

Trend Micro

Develops and sells security-related software for computers and related services in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives