As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Nasdaq Composite reaching record highs due to optimism around growth and tax policies, investors are closely watching how these developments might influence economic conditions. In such a dynamic environment, dividend stocks can offer an attractive option for those seeking stability and income, as they often provide regular payouts that can help cushion against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.18% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.03% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.17% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.57% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.31% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.68% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.91% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.51% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Innotech (TSE:9880) | 4.95% | ★★★★★★ |

Click here to see the full list of 1941 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

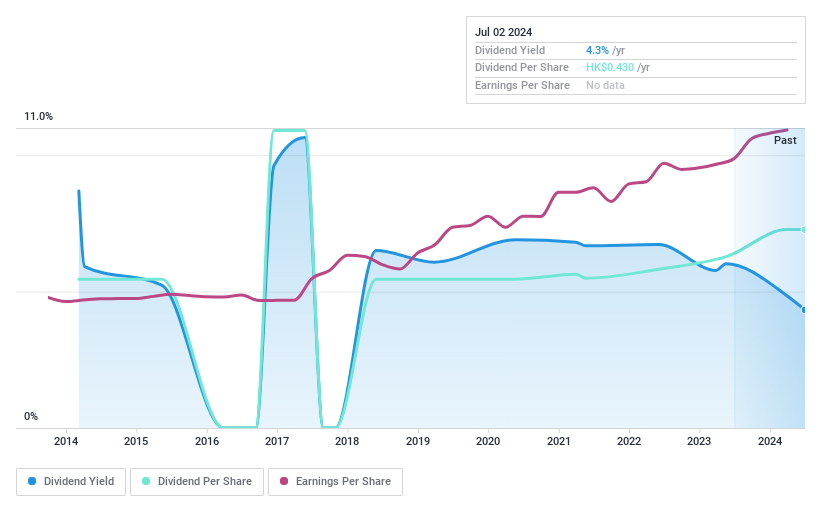

Xinhua Winshare Publishing and Media (SEHK:811)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xinhua Winshare Publishing and Media Co., Ltd. operates in the publishing and media industry, focusing on the distribution of books and educational materials, with a market cap of HK$16.36 billion.

Operations: Xinhua Winshare Publishing and Media Co., Ltd.'s revenue is primarily derived from the distribution of books and educational materials.

Dividend Yield: 4.2%

Xinhua Winshare Publishing and Media's dividend payments have been volatile and unreliable over the past decade, despite being well-covered by both earnings (payout ratio: 47.6%) and cash flows (cash payout ratio: 26%). The company recently affirmed an interim dividend of RMB 0.19 per share for H1 2024, payable in December. While trading at a significant discount to its estimated fair value, its dividend yield of 4.2% is below top-tier levels in Hong Kong.

- Click here to discover the nuances of Xinhua Winshare Publishing and Media with our detailed analytical dividend report.

- According our valuation report, there's an indication that Xinhua Winshare Publishing and Media's share price might be on the cheaper side.

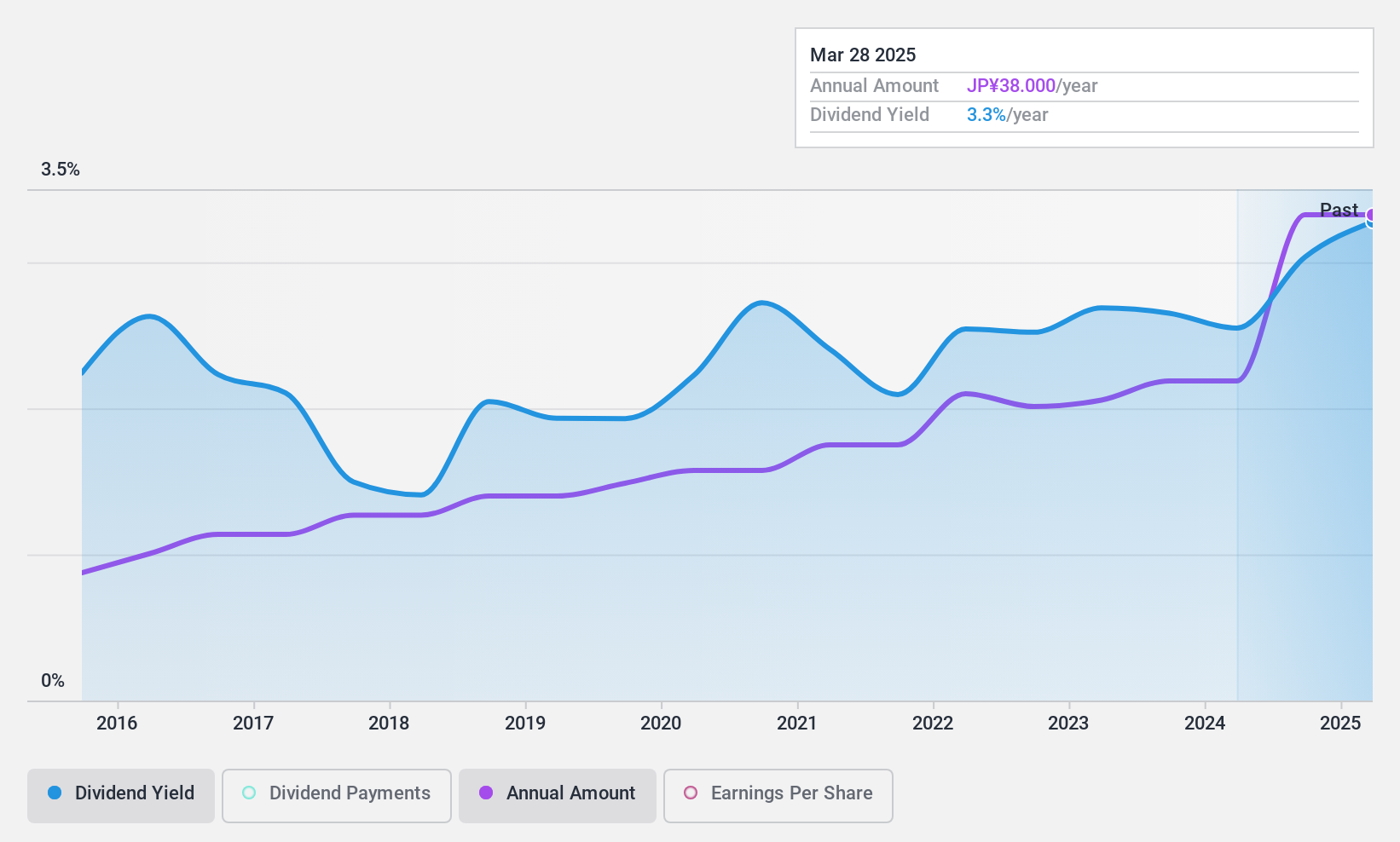

Cresco (TSE:4674)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cresco Ltd., along with its subsidiaries, provides IT services and digital solutions in Japan and has a market cap of ¥51.54 billion.

Operations: Cresco Ltd. generates revenue through its Digital Solution Business, which accounts for ¥3.83 billion, and its IT Service Business across three sectors: Finance at ¥16.15 billion, Enterprise at ¥21.15 billion, and Manufacturing at ¥14.50 billion.

Dividend Yield: 3%

Cresco's dividend payments have been volatile and unreliable over the past decade, despite being well-covered by earnings (payout ratio: 14.2%) and cash flows (cash payout ratio: 36%). Trading at a significant discount to its estimated fair value, Cresco offers a lower dividend yield of 2.97% compared to top-tier payers in Japan. Earnings have grown annually by 9.9% over five years, but the unstable dividend track record remains a concern for investors.

- Click to explore a detailed breakdown of our findings in Cresco's dividend report.

- The valuation report we've compiled suggests that Cresco's current price could be quite moderate.

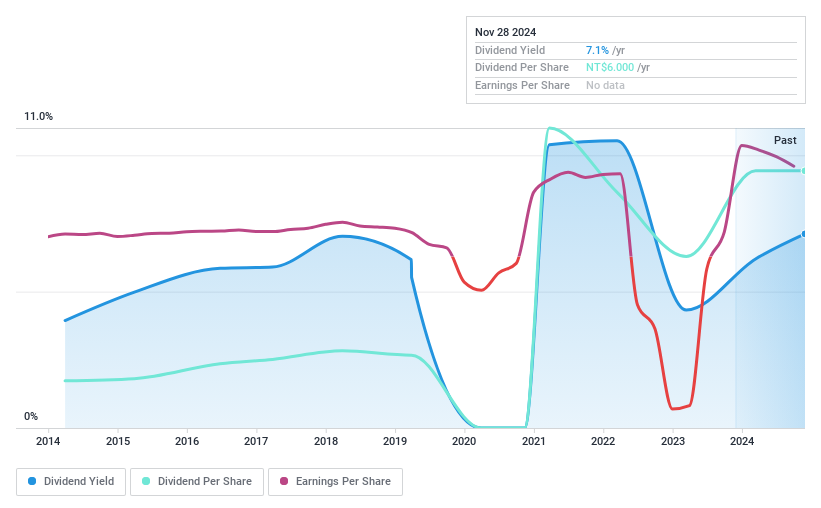

China Motor (TWSE:2204)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Motor Corporation manufactures and sells automobiles and related parts both in Taiwan and internationally, with a market cap of NT$39.09 billion.

Operations: China Motor Corporation generates revenue primarily from its Manufacturing segment, amounting to NT$42.05 billion, and its Channel segment, contributing NT$2.44 billion.

Dividend Yield: 8.1%

China Motor's dividend yield of 8.14% ranks in the top 25% of Taiwan's market, yet its sustainability is questionable due to a lack of free cash flows and volatile payments over the past decade. Despite becoming profitable this year with a reasonable payout ratio of 64.4%, dividends are not fully covered by earnings or cash flows, making them unreliable. The stock trades at a discount to its estimated fair value, adding potential appeal for value-focused investors.

- Get an in-depth perspective on China Motor's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of China Motor shares in the market.

Where To Now?

- Unlock our comprehensive list of 1941 Top Dividend Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:811

Xinhua Winshare Publishing and Media

Xinhua Winshare Publishing and Media Co., Ltd.

Flawless balance sheet, undervalued and pays a dividend.