- Taiwan

- /

- Marine and Shipping

- /

- TWSE:2609

Asian Dividend Stocks To Consider Now

Reviewed by Simply Wall St

Amid a backdrop of easing U.S.-China trade tensions and rising optimism in global markets, Asian stocks have shown resilience with notable gains in major indices. In such an environment, dividend stocks can offer investors a blend of potential income and stability, making them an attractive consideration for those seeking to navigate the current economic landscape.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.84% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.24% | ★★★★★★ |

| Chudenko (TSE:1941) | 3.98% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.08% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.69% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.23% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.98% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.32% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.43% | ★★★★★★ |

Click here to see the full list of 1229 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

Cresco (TSE:4674)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cresco Ltd., along with its subsidiaries, provides IT services and digital solutions in Japan, with a market cap of ¥61.03 billion.

Operations: Cresco Ltd. generates revenue through its IT services and digital solutions offerings in Japan.

Dividend Yield: 3.9%

Cresco's dividend history is mixed, with recent increases in payouts and a revised policy aiming to distribute 50% of profits. Despite past volatility, dividends are currently well-covered by earnings and cash flows. The company trades below its estimated fair value but has a volatile share price. Recent actions include a share buyback program aimed at enhancing capital efficiency and shareholder returns, reflecting Cresco's focus on balancing growth investments with stable dividends.

- Click to explore a detailed breakdown of our findings in Cresco's dividend report.

- Our valuation report here indicates Cresco may be undervalued.

Hirata (TSE:6258)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hirata Corporation manufactures and sells manufacturing line systems, industrial robots, and logistic equipment in Japan and internationally, with a market cap of ¥55.83 billion.

Operations: Hirata Corporation generates revenue from its segments as follows: Automobile Related at ¥43.06 billion, Semiconductor Related at ¥30.19 billion, and Other Automatic Labor-Saving Devices at ¥13.10 billion.

Dividend Yield: 3.6%

Hirata's dividend history shows volatility, with recent increases followed by a forecasted decrease due to a 3-for-1 share split. Despite this, dividends remain well-covered by earnings and cash flows, supported by low payout ratios. The company's price-to-earnings ratio is favorable compared to the market average. However, the stock's high volatility may concern risk-averse investors. Recent guidance indicates stable financial performance with expected net sales of ¥96 billion and operating profit of ¥8.4 billion for FY2026.

- Take a closer look at Hirata's potential here in our dividend report.

- The analysis detailed in our Hirata valuation report hints at an inflated share price compared to its estimated value.

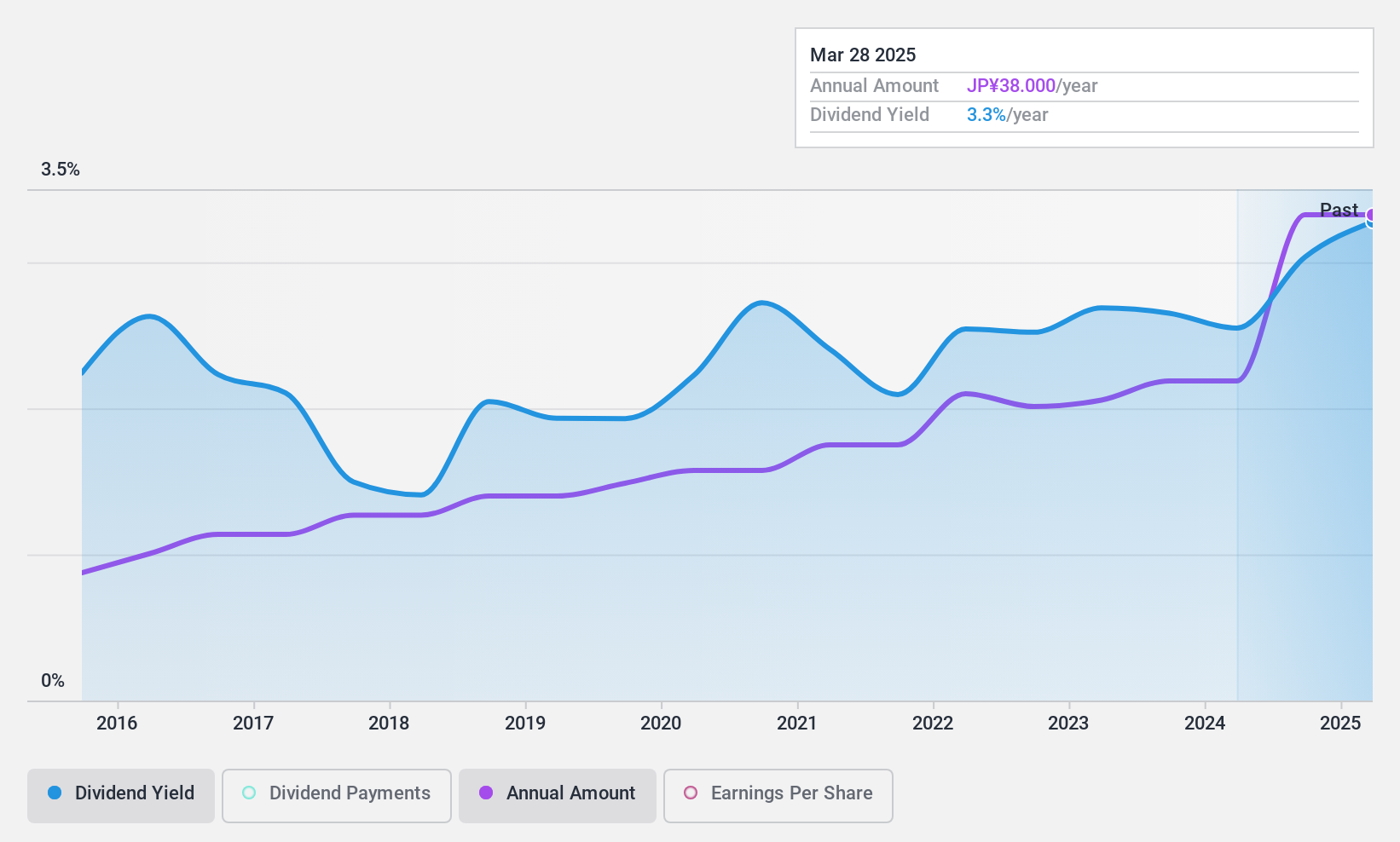

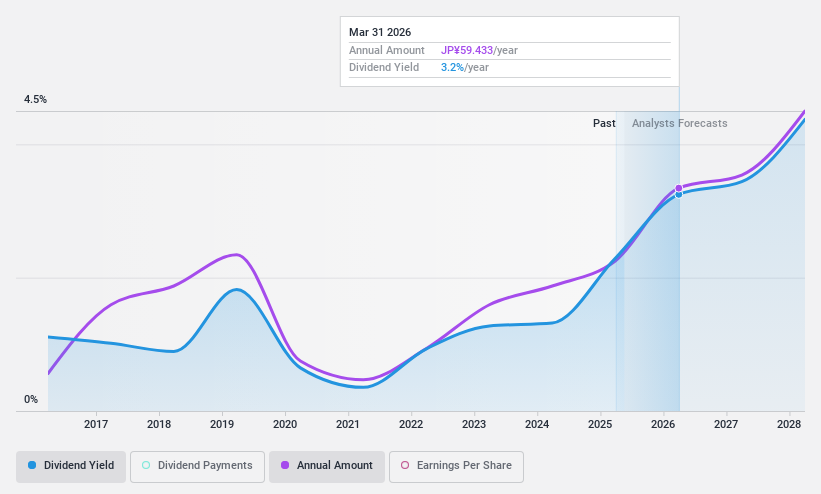

Yang Ming Marine Transport (TWSE:2609)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yang Ming Marine Transport Corporation, along with its subsidiaries, offers shipping, repair, and chartering services across Taiwan, the Americas, Europe, Asia, and globally with a market cap of NT$293.34 billion.

Operations: Yang Ming Marine Transport Corporation's revenue is primarily derived from Containers Transportation, which accounts for NT$216.60 billion, and Bulk Transportation, contributing NT$3.08 billion.

Dividend Yield: 8.9%

Yang Ming Marine Transport's dividend yield is among the top 25% in Taiwan, supported by a low payout ratio of 41.9%, ensuring dividends are well-covered by earnings and cash flows. However, its short three-year dividend history shows instability and declining payments. The stock's price-to-earnings ratio of 4.7x suggests good value compared to the market average of 19x. Recent Q1 results show decreased net income to TWD 7,776 million from TWD 9,379.5 million year-on-year.

- Delve into the full analysis dividend report here for a deeper understanding of Yang Ming Marine Transport.

- Insights from our recent valuation report point to the potential overvaluation of Yang Ming Marine Transport shares in the market.

Next Steps

- Click here to access our complete index of 1229 Top Asian Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2609

Yang Ming Marine Transport

Provides shipping, repair, and chartering services in Taiwan, the America, Europe, Asia, and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026