As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainty, smaller-cap indexes have experienced notable declines, reflecting broader investor apprehension. Amid these conditions, identifying high-growth tech stocks requires a focus on companies with robust innovation capabilities and adaptability to economic shifts, making them potential standouts in an evolving market environment.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1276 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

RS (SET:RS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RS Public Company Limited, along with its subsidiaries, operates in the commerce, media, and music sectors in Thailand and has a market capitalization of THB11.89 billion.

Operations: RS Public Company Limited generates revenue primarily from its Multi-Platform Commerce and Media Business segments, contributing THB1.46 billion and THB1.37 billion, respectively. The company also engages in Music, Showbiz, Digital Asset, and Other Services sectors within Thailand.

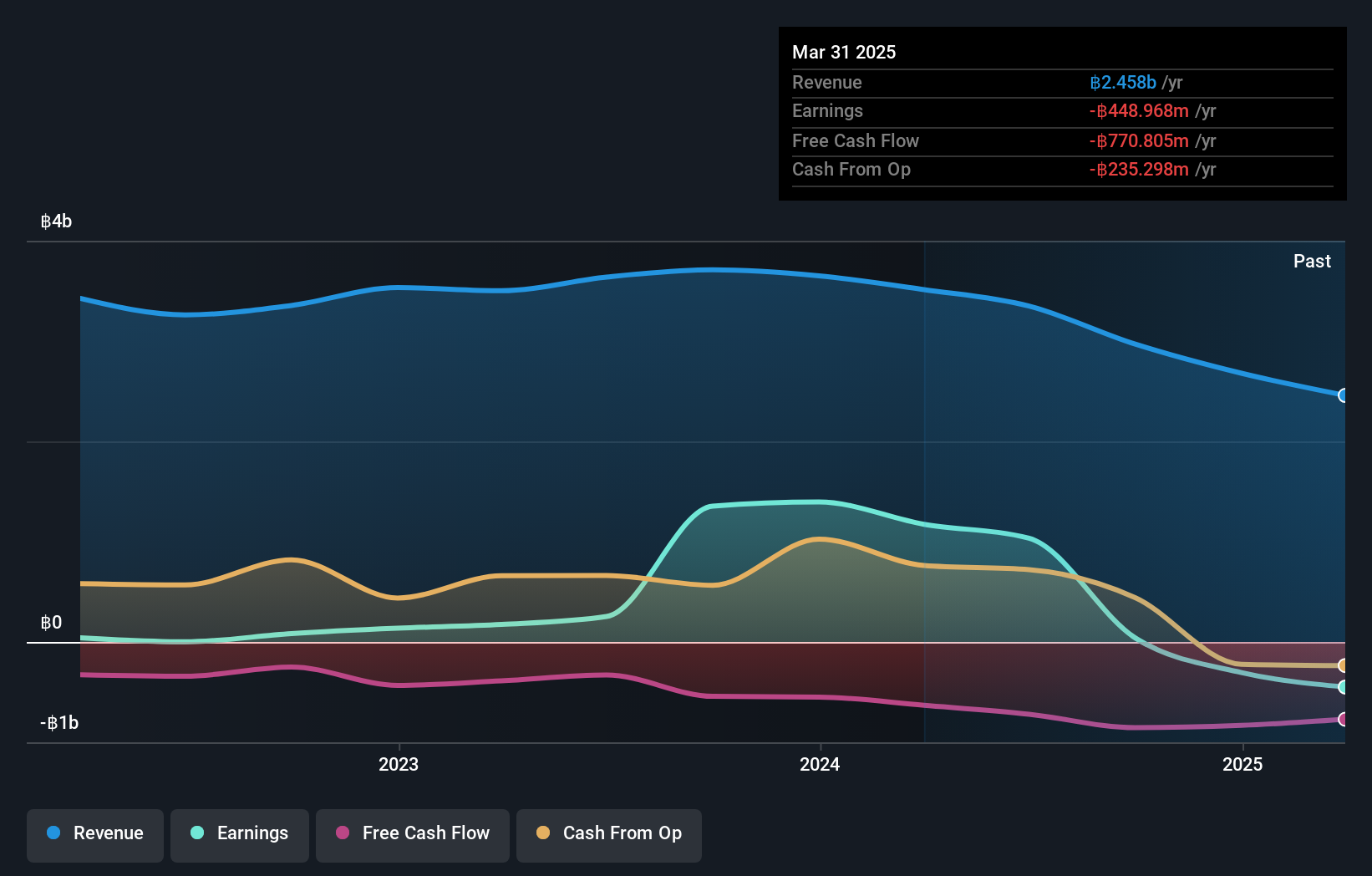

RS's financial landscape presents a mixed picture, with its revenue growth at 11.8% annually, slightly outpacing the Thai market's 6.6%, yet its earnings have dramatically fluctuated due to significant one-off gains of THB 777.8 million impacting results as of September 2024. Despite these spikes, RS faces challenges with a sharp decline in net income from THB 1,182.41 million in Q3 last year to THB 188.97 million this year and an overall negative earnings growth of -97% over the past year compared to the industry average of 4.9%. This volatility underscores potential risks despite high projected earnings growth (47.78% annually). Recent strategic moves include restructuring plans and canceled investments aimed at synergizing and expanding its multi-channel distribution and wellness sectors, indicating a pivot towards stabilizing and potentially enhancing future operations.

- Get an in-depth perspective on RS' performance by reading our health report here.

Assess RS' past performance with our detailed historical performance reports.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

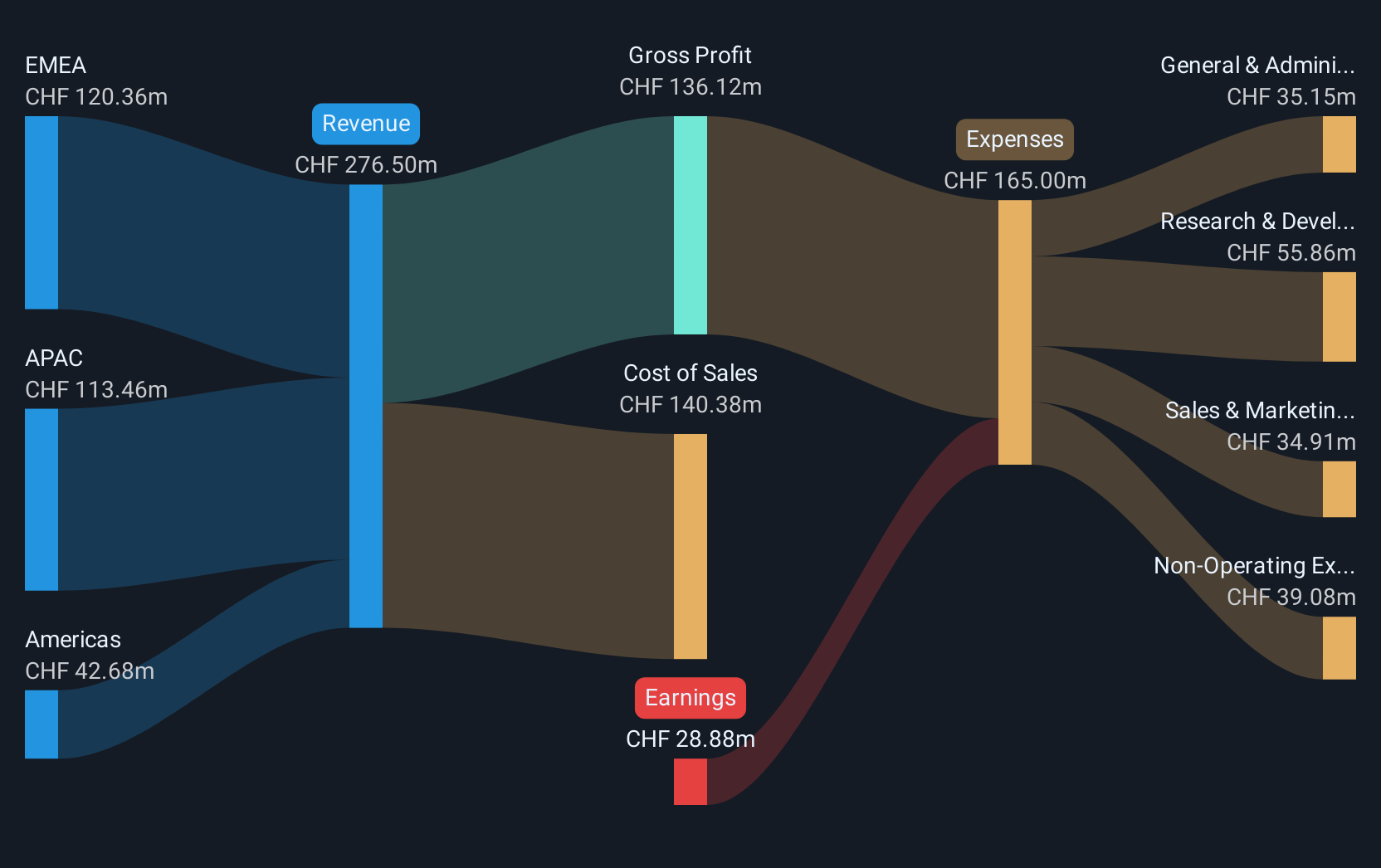

Overview: Sensirion Holding AG is a company that develops, produces, sells, and services sensor systems, modules, and components globally with a market cap of CHF858.74 million.

Operations: Sensirion Holding AG generates revenue primarily from its sensor systems, modules, and components segment, amounting to CHF237.91 million. The company operates globally through the development, production, sale, and servicing of these products.

Sensirion Holding AG, navigating through a volatile market, has demonstrated robust revenue growth at 13.9% annually, outstripping the Swiss market's average of 4.2%. Despite its current unprofitability, the company is poised for significant earnings expansion with an expected surge of 102.6% annually over the next three years. Sensirion's commitment to innovation is evident in its R&D investments which are crucial for maintaining its competitive edge in sensor and environmental measurement technologies. This strategic focus not only supports future profitability but also aligns with industry demands for advanced tech solutions, positioning Sensirion favorably in high-growth sectors despite a highly volatile share price recently.

Sansan (TSE:4443)

Simply Wall St Growth Rating: ★★★★★☆

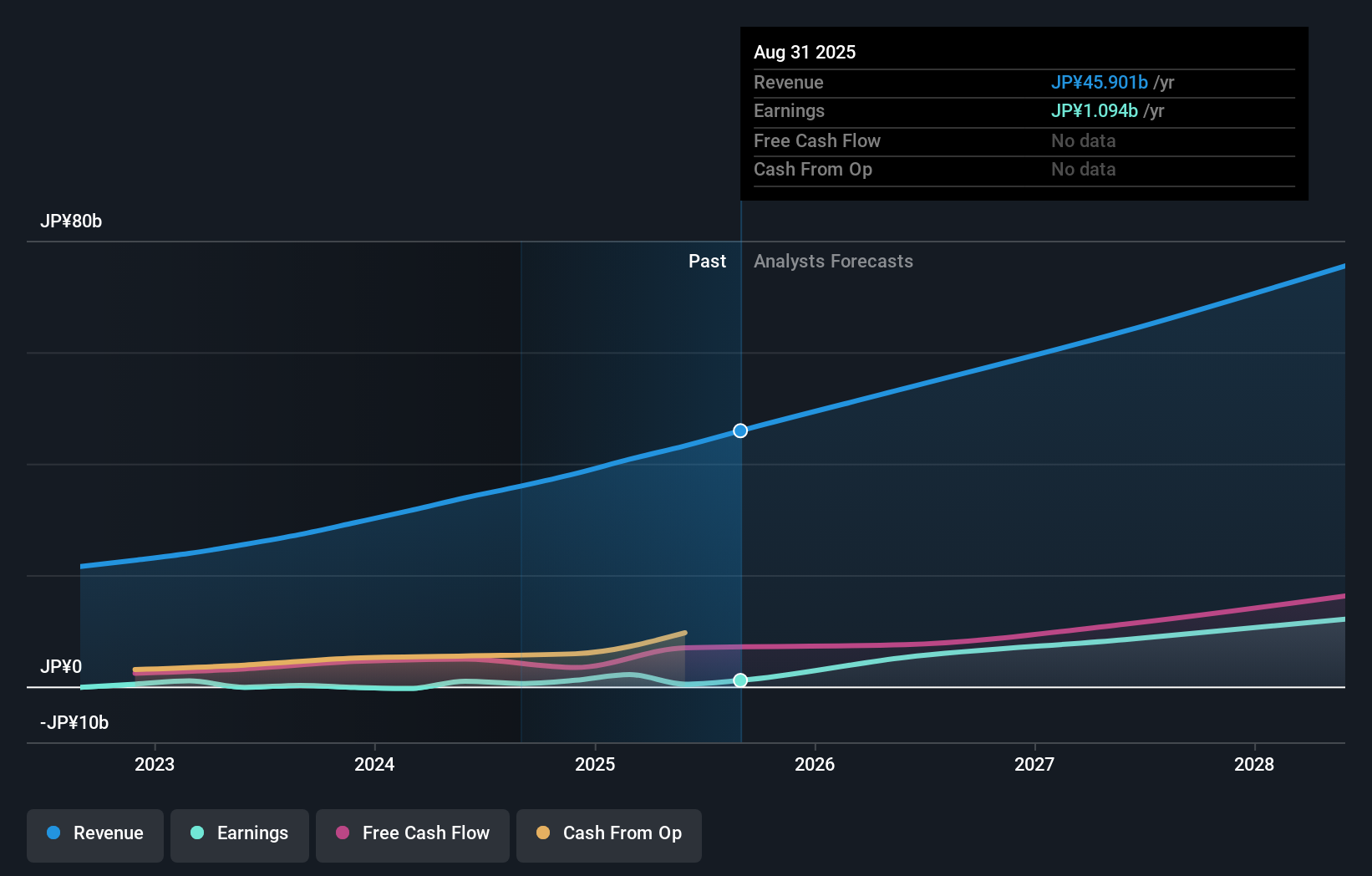

Overview: Sansan, Inc. focuses on the planning, development, and selling of cloud-based solutions in Japan with a market capitalization of approximately ¥300 billion.

Operations: Sansan, Inc. generates revenue primarily through its Sansan/Bill One Business, which contributes ¥31.79 billion, and the Eight Business segment, contributing ¥3.8 billion.

Sansan, Inc. stands out in the high-growth tech sector with its impressive annual revenue growth of 16.3%, significantly outpacing the Japanese market average of 4.2%. Despite recent fluctuations in share price, Sansan's commitment to innovation is underscored by substantial R&D investments, aligning with industry trends towards enhanced digital solutions. The company's earnings have surged by 163.2% over the past year, and an anticipated earnings growth rate of 40% per annum positions it well for future expansion within the software industry.

- Navigate through the intricacies of Sansan with our comprehensive health report here.

Understand Sansan's track record by examining our Past report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1276 High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components worldwide.

Flawless balance sheet with reasonable growth potential.