- Switzerland

- /

- Semiconductors

- /

- SWX:MBTN

Meyer Burger Technology AG (VTX:MBTN) Stock Rockets 536% But Many Are Still Ignoring The Company

Meyer Burger Technology AG (VTX:MBTN) shares have had a really impressive month, gaining 536% after a shaky period beforehand. But the last month did very little to improve the 98% share price decline over the last year.

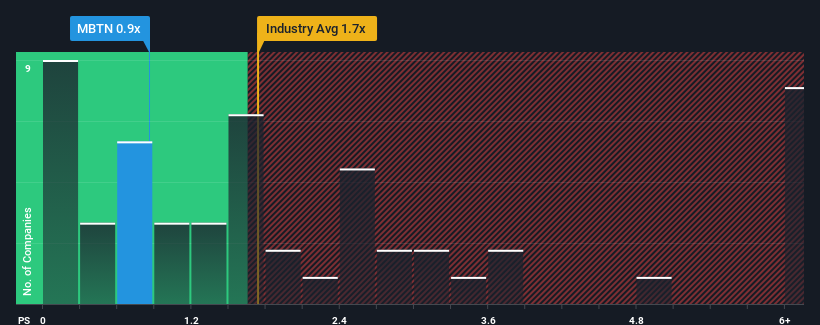

Even after such a large jump in price, Meyer Burger Technology may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.9x, since almost half of all companies in the Semiconductor industry in Switzerland have P/S ratios greater than 1.7x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Meyer Burger Technology

What Does Meyer Burger Technology's Recent Performance Look Like?

Recent times haven't been great for Meyer Burger Technology as its revenue has been falling quicker than most other companies. The P/S ratio is probably low because investors think this poor revenue performance isn't going to improve at all. You'd much rather the company improve its revenue performance if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Meyer Burger Technology will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Meyer Burger Technology?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Meyer Burger Technology's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 54%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 51% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 84% each year during the coming three years according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 14% each year, which is noticeably less attractive.

In light of this, it's peculiar that Meyer Burger Technology's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Meyer Burger Technology's P/S?

The latest share price surge wasn't enough to lift Meyer Burger Technology's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Meyer Burger Technology currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Meyer Burger Technology (2 are potentially serious!) that you need to be mindful of.

If you're unsure about the strength of Meyer Burger Technology's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:MBTN

Meyer Burger Technology

A technology company, produces and sells solar cells and modules.

Slight risk and fair value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026