Exploring None And Two Other High Growth Tech Stocks For Your Portfolio

Reviewed by Simply Wall St

Amidst a challenging global market environment, characterized by cautious commentary from the Federal Reserve and political uncertainty in the U.S., smaller-cap indexes have notably underperformed, reflecting broader investor concerns. In such a climate, identifying high-growth tech stocks that can weather economic fluctuations and offer potential upside becomes crucial for investors seeking to enhance their portfolios.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1276 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Storytel (OM:STORY B)

Simply Wall St Growth Rating: ★★★★★☆

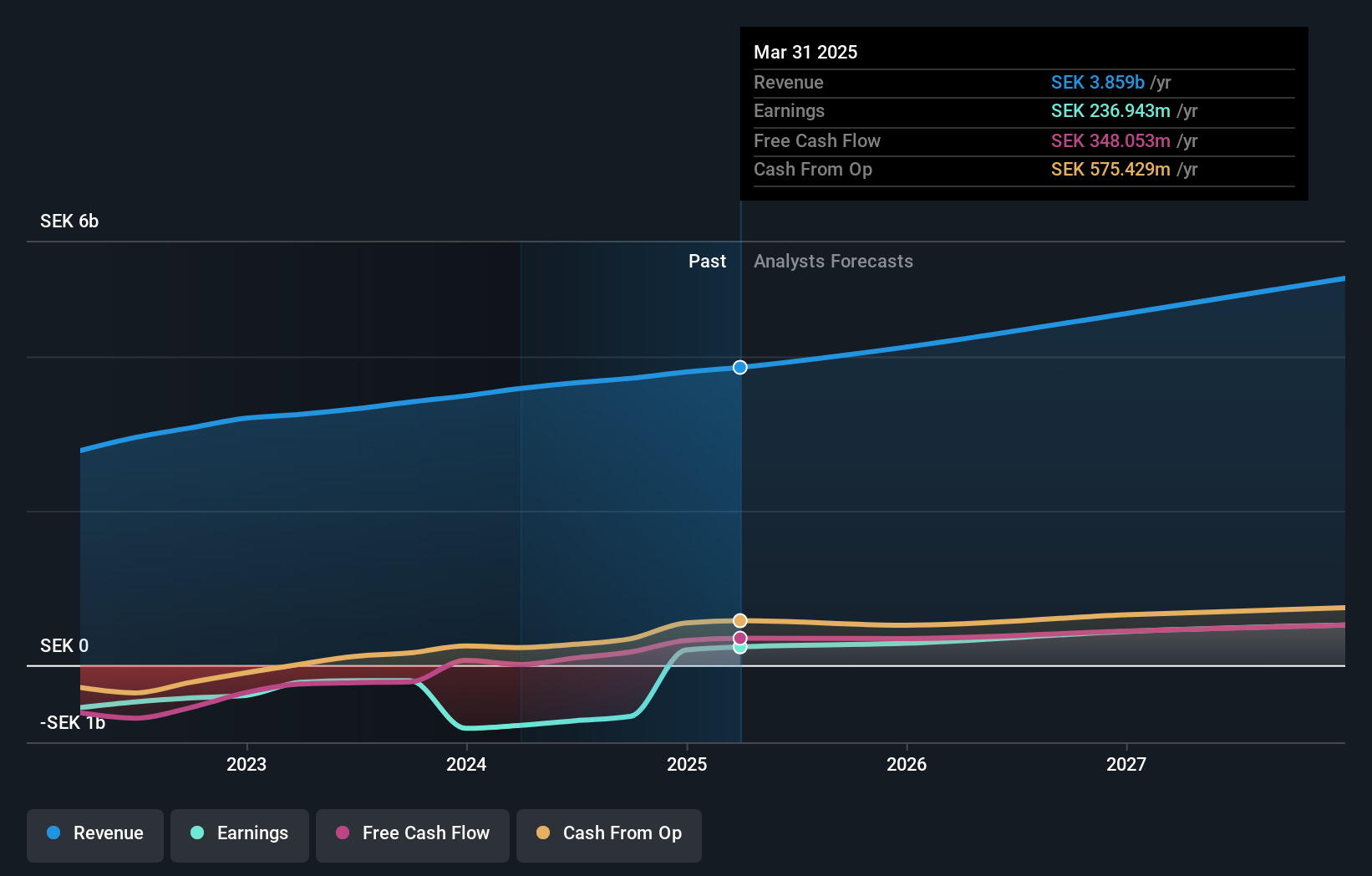

Overview: Storytel AB (publ) offers streaming services for audiobooks and e-books, with a market capitalization of SEK5.26 billion.

Operations: The company generates revenue primarily from its books segment, amounting to SEK859.34 million. A notable aspect of its financials is the inclusion of segment adjustments totaling SEK3.51 billion, which significantly impacts overall figures.

Storytel's recent financial performance highlights a significant turnaround, with third-quarter sales rising to SEK 954.02 million from SEK 895.76 million year-over-year and a shift from a net loss to a net income of SEK 51.36 million. This improvement is mirrored in the nine-month earnings report showing an increase in sales to SEK 2.77 billion, up from SEK 2.54 billion, alongside an encouraging transition from a substantial net loss last year to a positive net income of SEK 55.76 million this year. These figures underscore Storytel's robust recovery trajectory and its potential resilience amidst executive board changes, including the recent resignation of board member Joakim Rubin, which might prompt strategic shifts pending the appointment of new leadership by next year’s AGM.

- Delve into the full analysis health report here for a deeper understanding of Storytel.

Examine Storytel's past performance report to understand how it has performed in the past.

baudroieinc (TSE:4413)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Baudroie, Inc. is a company that offers optimal IT solutions in Japan with a market capitalization of ¥76.50 billion.

Operations: The company specializes in delivering IT solutions within Japan. With a market capitalization of approximately ¥76.50 billion, it focuses on providing tailored technological services to its clients.

Baudroieinc's financial maneuvers, including a recent share repurchase program for up to ¥3.5 billion and a follow-on equity offering, underscore its strategic flexibility amid evolving market conditions. The company has showcased robust growth metrics with earnings and revenue each surging by approximately 28.4% and 30.1% annually, outpacing the broader Japanese market significantly. This growth is complemented by high-quality earnings and an aggressive R&D investment strategy, positioning Baudroieinc well within the competitive tech landscape despite its relatively short financial history and high share price volatility.

- Click to explore a detailed breakdown of our findings in baudroieinc's health report.

Assess baudroieinc's past performance with our detailed historical performance reports.

giftee (TSE:4449)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: giftee Inc. operates in the Internet service sector in Japan with a market capitalization of ¥39.73 billion.

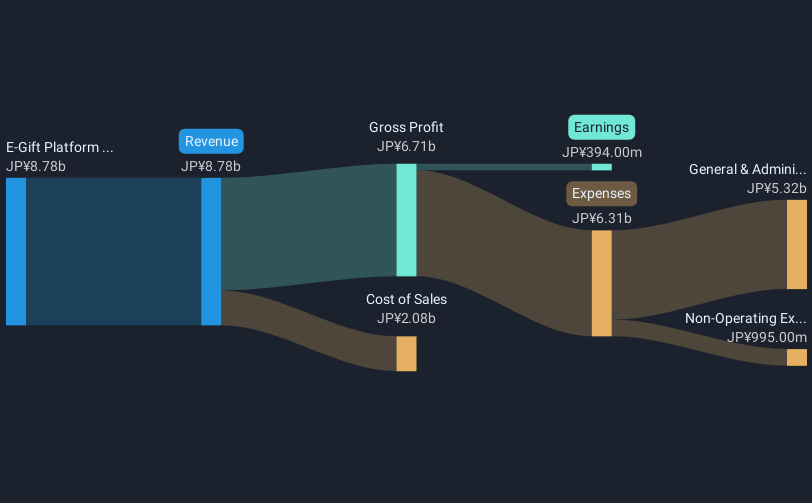

Operations: The company generates revenue primarily from its E-Gift Platform Business, which reported ¥8.78 billion in revenue.

Giftee Inc. is navigating a promising trajectory with its strategic issuance of stock acquisition rights aimed at incentivizing employees, reflecting a forward-thinking management approach as it anticipates significant financial growth. With an operating profit forecasted at JPY 1.7 billion on net sales of JPY 9.1 billion for the fiscal year ending December 2024, the company's financial outlook appears robust, supported by a solid dividend projection of JPY 10 per share. This performance is underpinned by an impressive annual earnings growth rate of 59.8%, surpassing the broader Japanese market's growth significantly and indicating strong sectoral competitiveness within Interactive Media and Services—an industry where giftee’s earnings have already outstripped industry averages by over threefold in the past year alone.

- Navigate through the intricacies of giftee with our comprehensive health report here.

Gain insights into giftee's historical performance by reviewing our past performance report.

Make It Happen

- Click through to start exploring the rest of the 1273 High Growth Tech and AI Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade baudroieinc, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4413

High growth potential with excellent balance sheet.

Market Insights

Community Narratives