- Japan

- /

- Professional Services

- /

- TSE:290A

3 Growth Stocks With High Insider Ownership To Consider

Reviewed by Simply Wall St

As global markets react to the Trump administration's emerging policies, U.S. stocks have been buoyed by AI enthusiasm and hopes for softer tariffs, with major indices reaching record highs. In this environment of optimism and growth, investors often seek companies where insiders hold significant ownership stakes, as this can indicate confidence in the company's future prospects and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.2% |

| Duc Giang Chemicals Group (HOSE:DGC) | 31.4% | 25.7% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.6% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| HANA Micron (KOSDAQ:A067310) | 18.2% | 119.4% |

Let's explore several standout options from the results in the screener.

Bilia (OM:BILI A)

Simply Wall St Growth Rating: ★★★★★☆

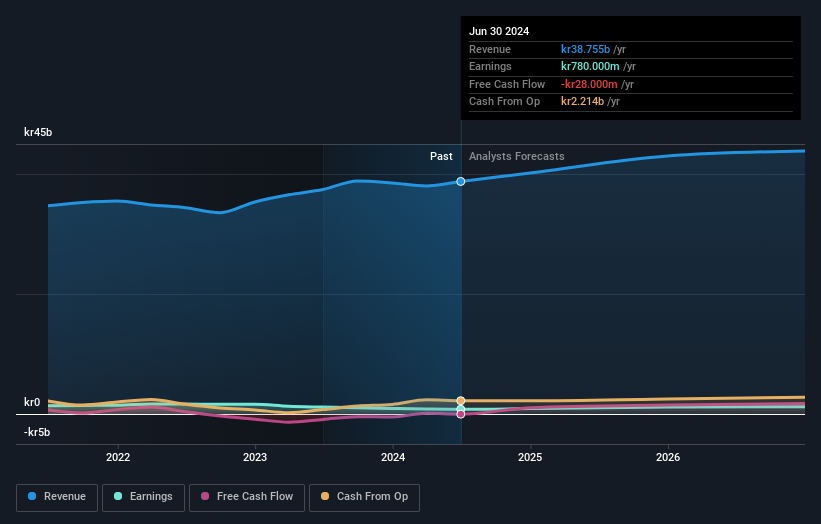

Overview: Bilia AB (publ) is a full-service supplier for car ownership, operating in Sweden, Norway, Luxembourg, and Belgium with a market cap of SEK11.79 billion.

Operations: The company's revenue segments include Car - Sweden (SEK19.85 billion), Car - Norway (SEK7.39 billion), Service - Sweden (SEK6.50 billion), Car - Western Europe (SEK3.53 billion), Service - Norway (SEK2.29 billion), Fuel (SEK964 million), and Service - Western Europe (SEK678 million).

Insider Ownership: 17%

Bilia's earnings are forecast to grow significantly at 24.53% annually, outpacing the Swedish market's 13.3%. Despite a high debt level, it trades at a substantial discount to its estimated fair value and offers good relative value compared to peers. Recent partnership with Polestar Sweden may enhance growth prospects, though profit margins have declined from last year. Revenue growth of 5.9% is above the Swedish market average but below significant growth thresholds.

- Delve into the full analysis future growth report here for a deeper understanding of Bilia.

- The valuation report we've compiled suggests that Bilia's current price could be quite moderate.

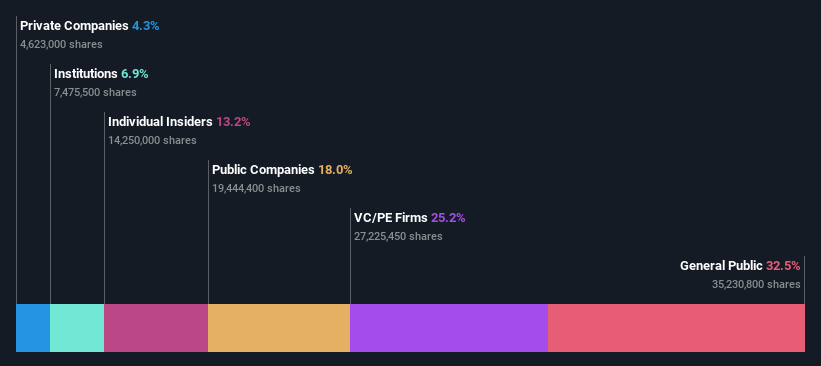

Synspective (TSE:290A)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Synspective Inc. designs, builds, and operates a fleet of synthetic aperture radar satellites to detect and understand changes, with a market cap of ¥60.29 billion.

Operations: Revenue segments for Synspective Inc. are not provided in the available text.

Insider Ownership: 13.2%

Synspective, with substantial insider ownership, is positioned for robust growth. Its revenue surged 181.7% last year and is projected to grow at 40.4% annually, surpassing the JP market's expectations. Despite shares being highly illiquid and trading significantly below estimated fair value, Synspective's recent ¥10.23 billion IPO and Mitsubishi Electric's investment underscore confidence in its potential. Supported by JAXA funding for satellite deployment, Synspective aims to achieve profitability within three years.

- Dive into the specifics of Synspective here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Synspective shares in the market.

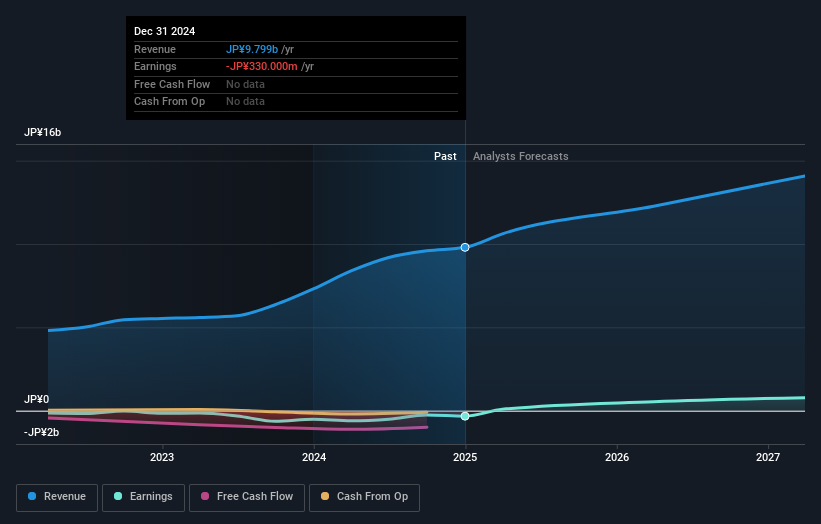

ExaWizards (TSE:4259)

Simply Wall St Growth Rating: ★★★★★★

Overview: ExaWizards Inc. develops AI-enabled services aimed at industrial innovation and solving social problems in Japan, with a market cap of ¥41.55 billion.

Operations: The company's revenue is derived from its AI Platform segment, contributing ¥1.85 billion, and AI Products segment, generating ¥6.14 billion.

Insider Ownership: 21.9%

ExaWizards is poised for significant growth, with revenue expected to increase by 22.5% annually, outpacing the JP market's average. The company anticipates becoming profitable within three years, aligning with its high return on equity forecast of 23.9%. Recent developments include a new AI-driven HR service and collaborations with major firms like Konica Minolta and Mitsubishi Heavy Industries. Despite share price volatility, these strategic initiatives highlight ExaWizards' focus on leveraging AI for organizational transformation and productivity enhancement.

- Click here and access our complete growth analysis report to understand the dynamics of ExaWizards.

- In light of our recent valuation report, it seems possible that ExaWizards is trading beyond its estimated value.

Taking Advantage

- Investigate our full lineup of 1482 Fast Growing Companies With High Insider Ownership right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:290A

Synspective

Designs, builds, and operates a fleet of synthetic aperture radar satellites (SAR) to detect and understand changes.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives