Some Fabrica Holdings Co., Ltd. (TSE:4193) Shareholders Look For Exit As Shares Take 28% Pounding

The Fabrica Holdings Co., Ltd. (TSE:4193) share price has fared very poorly over the last month, falling by a substantial 28%. Looking back over the past twelve months the stock has been a solid performer regardless, with a gain of 14%.

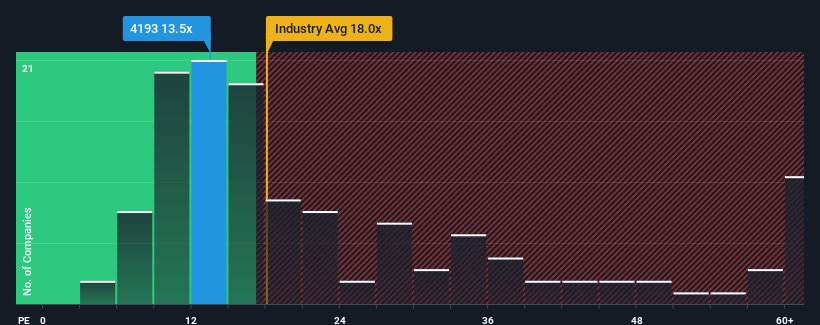

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Fabrica Holdings' P/E ratio of 13.5x, since the median price-to-earnings (or "P/E") ratio in Japan is also close to 12x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Fabrica Holdings certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Fabrica Holdings

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Fabrica Holdings' is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 15%. EPS has also lifted 26% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings growth is heading into negative territory, declining 7.0% over the next year. That's not great when the rest of the market is expected to grow by 10%.

With this information, we find it concerning that Fabrica Holdings is trading at a fairly similar P/E to the market. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

What We Can Learn From Fabrica Holdings' P/E?

With its share price falling into a hole, the P/E for Fabrica Holdings looks quite average now. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Fabrica Holdings currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. Right now we are uncomfortable with the P/E as the predicted future earnings are unlikely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you take the next step, you should know about the 1 warning sign for Fabrica Holdings that we have uncovered.

If you're unsure about the strength of Fabrica Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4193

Fabrica Holdings

Engages in the business communication activities in Japan.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026