- China

- /

- Tech Hardware

- /

- SHSE:688636

Asian Stocks Trading Below Estimated Value In September 2025

Reviewed by Simply Wall St

As global markets respond to the Federal Reserve's recent interest rate cut and ongoing trade discussions between the U.S. and China, Asian markets are navigating a complex economic landscape marked by China's economic slowdown and Japan's cautious monetary policy shifts. In this environment, identifying undervalued stocks can offer potential opportunities for investors seeking value in companies that may be trading below their estimated worth due to broader market fluctuations or specific regional challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Taiyo Yuden (TSE:6976) | ¥3145.00 | ¥6228.15 | 49.5% |

| Pansoft (SZSE:300996) | CN¥17.14 | CN¥33.77 | 49.2% |

| Meitu (SEHK:1357) | HK$9.28 | HK$18.03 | 48.5% |

| Kolmar Korea (KOSE:A161890) | ₩79700.00 | ₩155805.97 | 48.8% |

| Japan Data Science ConsortiumLtd (TSE:4418) | ¥968.00 | ¥1932.52 | 49.9% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.45 | CN¥77.81 | 49.3% |

| FP Partner (TSE:7388) | ¥2245.00 | ¥4425.25 | 49.3% |

| Dizal (Jiangsu) Pharmaceutical (SHSE:688192) | CN¥69.97 | CN¥135.79 | 48.5% |

| Beijing LongRuan Technologies (SHSE:688078) | CN¥30.44 | CN¥59.33 | 48.7% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥49.70 | CN¥96.92 | 48.7% |

We're going to check out a few of the best picks from our screener tool.

Chengdu Zhimingda Electronics (SHSE:688636)

Overview: Chengdu Zhimingda Electronics Co., Ltd. operates in China, offering customized embedded modules and solutions, with a market cap of CN¥5.82 billion.

Operations: The company generates revenue of CN¥573.21 million from its Aerospace & Defense segment.

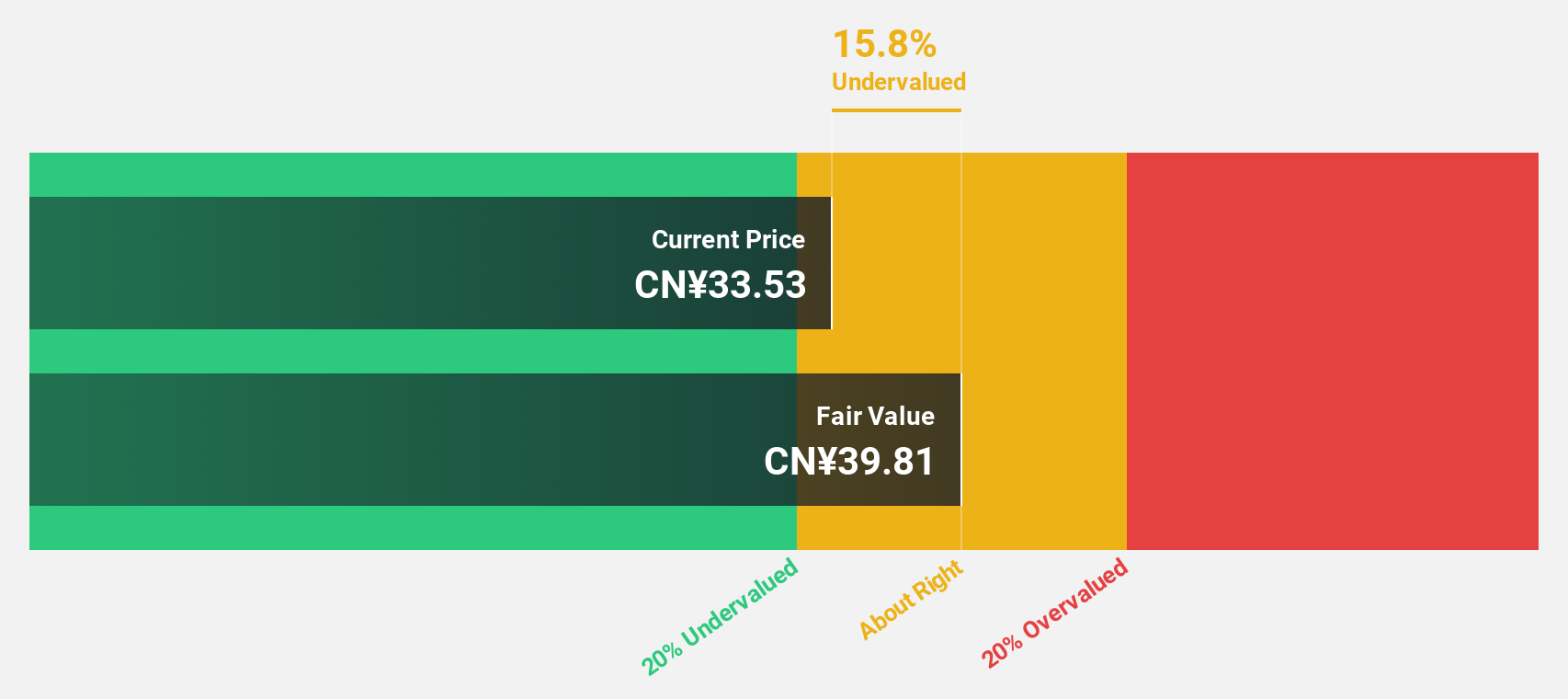

Estimated Discount To Fair Value: 12.8%

Chengdu Zhimingda Electronics is trading at CN¥34.71, slightly below its estimated fair value of CN¥39.81, indicating it may be undervalued based on discounted cash flow analysis. The company reported significant growth in earnings and sales for H1 2025, with net income rising to CN¥38.3 million from CN¥1.7 million a year ago. Despite high expected revenue and profit growth surpassing market averages, its forecasted return on equity remains modest at 14.3%.

- Our earnings growth report unveils the potential for significant increases in Chengdu Zhimingda Electronics' future results.

- Dive into the specifics of Chengdu Zhimingda Electronics here with our thorough financial health report.

Densan System Holdings (TSE:4072)

Overview: Densan System Holdings Co., Ltd. operates in Japan, providing information services and collection agency services, with a market cap of ¥40.94 billion.

Operations: The company generates revenue from its information technology service segment, contributing ¥38.68 billion, and its collection agency services segment, adding ¥24.66 billion.

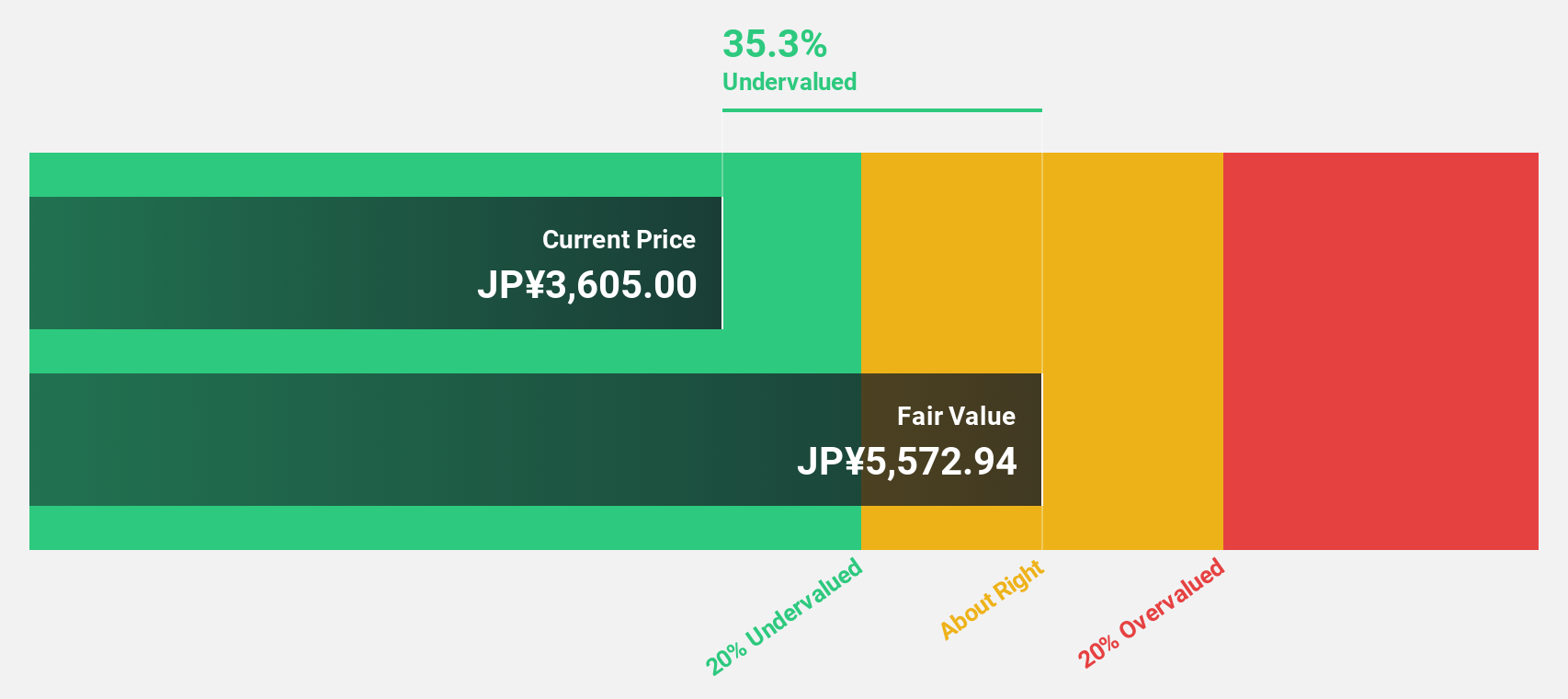

Estimated Discount To Fair Value: 30.1%

Densan System Holdings is trading at ¥3,830, significantly below its estimated fair value of ¥5,476.96, highlighting undervaluation based on cash flows. The company recently doubled its dividend to ¥40 per share for Q2 2025. Earnings have grown by 18.9% over the past year and are forecasted to grow annually by 22.08%, outpacing the JP market's average growth rate of 8.2%. However, its return on equity is expected to remain modest at 13.9%.

- Our expertly prepared growth report on Densan System Holdings implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Densan System Holdings with our comprehensive financial health report here.

Medley (TSE:4480)

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States, with a market cap of ¥78.41 billion.

Operations: The company generates revenue from its Human Resource Platform Business, which accounts for ¥23.65 billion, and its Medical Platform Business, contributing ¥8.31 billion, along with new services totaling ¥1.11 billion.

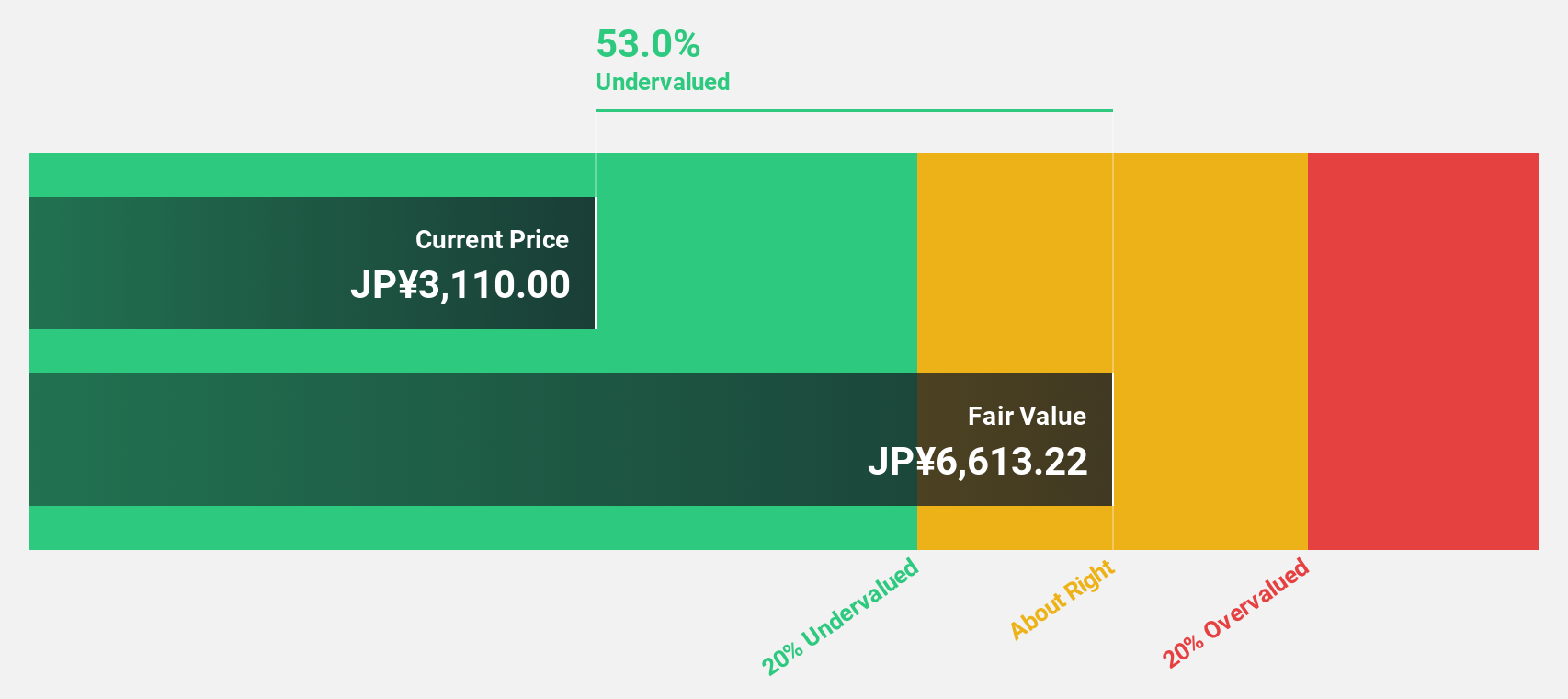

Estimated Discount To Fair Value: 38.3%

Medley is trading at ¥2,500, significantly below its estimated fair value of ¥4,052.98, indicating undervaluation based on cash flows. Despite a volatile share price recently and lower profit margins than last year (4.3% vs 11%), earnings are expected to grow significantly by 30.48% annually over the next three years, outpacing the JP market's growth rate of 8.2%. The company completed a buyback of 1,050,000 shares worth ¥2,848.75 million as part of its capital strategy.

- Insights from our recent growth report point to a promising forecast for Medley's business outlook.

- Get an in-depth perspective on Medley's balance sheet by reading our health report here.

Summing It All Up

- Click this link to deep-dive into the 273 companies within our Undervalued Asian Stocks Based On Cash Flows screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688636

Chengdu Zhimingda Electronics

Provides customized embedded modules and solutions in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives