- Japan

- /

- Entertainment

- /

- TSE:5253

Exploring High Growth Tech Stocks in Asia for August 2025

Reviewed by Simply Wall St

As global markets face uncertainty due to renewed tariffs and trade policy challenges, Asian tech stocks are drawing attention for their potential to drive growth in a turbulent economic landscape. In the midst of these market dynamics, identifying high-growth tech companies with robust fundamentals and innovative capabilities can be key to navigating the current environment.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 22.05% | 23.29% | ★★★★★★ |

| Zhejiang Lante Optics | 21.61% | 23.73% | ★★★★★★ |

| PharmaEssentia | 31.60% | 57.71% | ★★★★★★ |

| Fositek | 31.29% | 38.34% | ★★★★★★ |

| Eoptolink Technology | 32.53% | 32.58% | ★★★★★★ |

| Gold Circuit Electronics | 20.97% | 26.54% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.08% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Naruida Technology | 47.72% | 54.38% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

We'll examine a selection from our screener results.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kuaishou Technology is an investment holding company offering live streaming, online marketing, and additional services primarily in the People's Republic of China, with a market capitalization of approximately HK$340.90 billion.

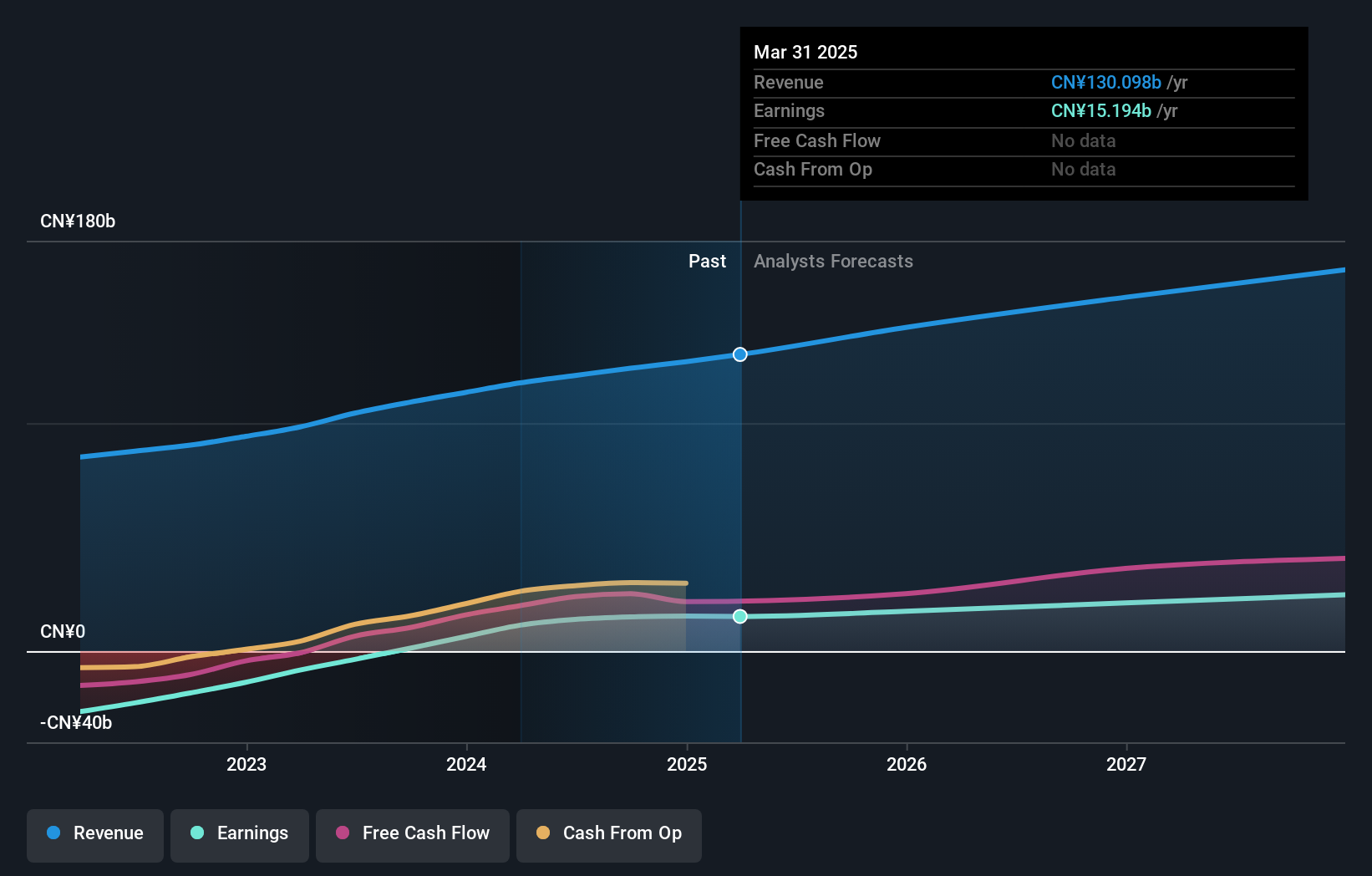

Operations: Kuaishou Technology generates revenue mainly from its domestic operations, totaling CN¥125.08 billion, with a smaller contribution from overseas markets at CN¥5.02 billion. The company focuses on live streaming and online marketing services within China.

Kuaishou Technology, a key player in the Interactive Media and Services sector, has demonstrated robust growth with earnings expanding by 33.4% over the past year, outpacing the industry average of 6.8%. This performance is coupled with a revenue forecast growing at 8.5% annually, slightly ahead of Hong Kong's market projection of 8.1%. The company's commitment to innovation is evident from its R&D investments which have been strategically aligned to bolster its technological capabilities and product offerings. Recent activities include substantial share repurchases amounting to HKD 5.15 billion since January last year, emphasizing confidence in its operational strategy and future prospects despite a slight dip in net income for Q1 2025 compared to the previous year.

- Click to explore a detailed breakdown of our findings in Kuaishou Technology's health report.

Explore historical data to track Kuaishou Technology's performance over time in our Past section.

Plus Alpha ConsultingLtd (TSE:4071)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plus Alpha Consulting Ltd. specializes in providing marketing solutions and has a market capitalization of ¥95.56 billion.

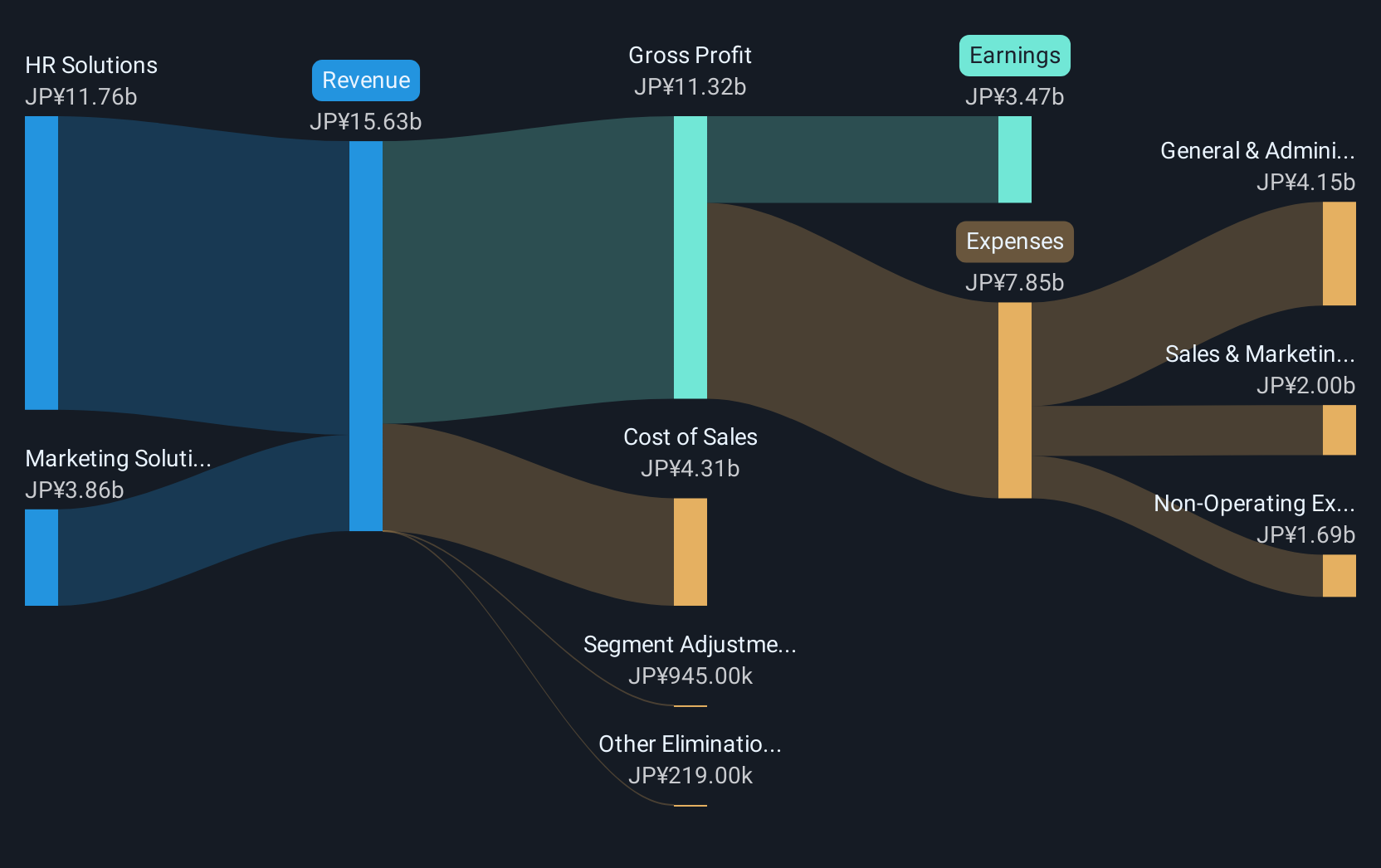

Operations: The company generates revenue primarily through its HR Solutions segment, contributing ¥11.76 billion, and Marketing Solutions segment, adding ¥3.86 billion.

Plus Alpha ConsultingLtd. is distinguishing itself in the Asian tech sector with a notable 13.5% annual revenue growth and a higher-than-market earnings growth forecast at 17.7% per year, outpacing Japan's market average of 8%. Recent strategic mergers and acquisitions, including the purchase of stakes by Plus Energy LLC, underscore confidence in its expansion strategy and market position. The firm's investment in R&D is robust, aligning with its revenue growth to fuel innovation and competitive edge in a rapidly evolving industry landscape. This approach not only enhances its service offerings but also solidifies its standing among high-profile clients, positioning it well for future technological advancements and market demands.

COVER (TSE:5253)

Simply Wall St Growth Rating: ★★★★★☆

Overview: COVER Corporation operates in the virtual platform, VTuber production, and media mix sectors with a market capitalization of ¥143.71 billion.

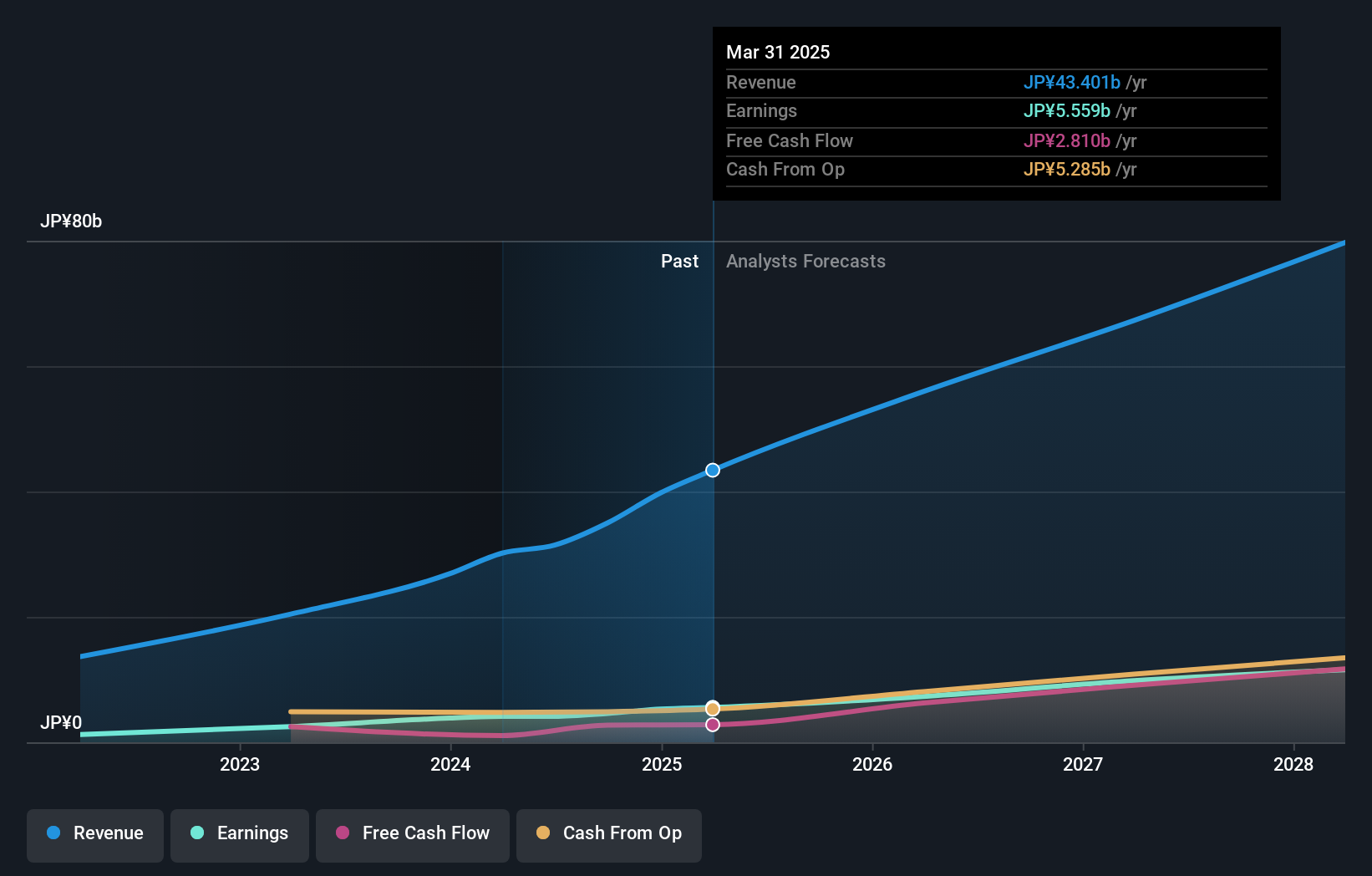

Operations: The company generates revenue through its virtual platform, VTuber production, and media mix activities. With a market capitalization of ¥143.71 billion, COVER Corporation engages in diverse digital entertainment ventures.

With an annual revenue growth of 15.1% and earnings expected to surge by 20.6% per year, COVER is carving a niche in the high-growth tech landscape of Asia. This performance notably outstrips the broader Japanese market's growth rates of 4.3% and 8% in revenue and earnings respectively. The company's commitment to innovation is evident from its R&D spending, crucial for maintaining its competitive edge in a dynamic industry. At the recent Annual General Meeting, strategies were likely discussed that could further influence COVER's trajectory amidst a volatile market environment, ensuring it remains at the forefront of technological advancements and client needs.

- Delve into the full analysis health report here for a deeper understanding of COVER.

Evaluate COVER's historical performance by accessing our past performance report.

Make It Happen

- Click here to access our complete index of 166 Asian High Growth Tech and AI Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5253

COVER

Engages in the virtual platform, VTuber production, and media mix businesses.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives