SCAT Inc. (TSE:3974) has announced that it will pay a dividend of ¥7.00 per share on the 11th of July. This takes the dividend yield to 3.2%, which shareholders will be pleased with.

SCAT's Future Dividend Projections Appear Well Covered By Earnings

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. The last dividend was quite easily covered by SCAT's earnings. This means that a large portion of its earnings are being retained to grow the business.

Unless the company can turn things around, EPS could fall by 6.9% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could be 52%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

View our latest analysis for SCAT

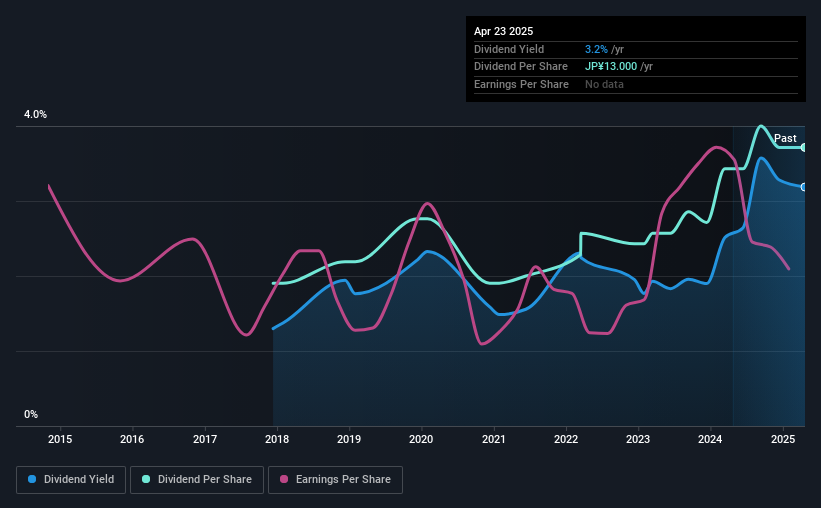

SCAT's Dividend Has Lacked Consistency

It's comforting to see that SCAT has been paying a dividend for a number of years now, however it has been cut at least once in that time. Due to this, we are a little bit cautious about the dividend consistency over a full economic cycle. The annual payment during the last 7 years was ¥6.67 in 2018, and the most recent fiscal year payment was ¥13.00. This means that it has been growing its distributions at 10% per annum over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

Dividend Growth May Be Hard To Come By

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. It's not great to see that SCAT's earnings per share has fallen at approximately 6.9% per year over the past five years. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits.

In Summary

In summary, while it's always good to see the dividend being raised, we don't think SCAT's payments are rock solid. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We don't think SCAT is a great stock to add to your portfolio if income is your focus.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For example, we've identified 4 warning signs for SCAT (2 can't be ignored!) that you should be aware of before investing. Is SCAT not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3974

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)