- Taiwan

- /

- Tech Hardware

- /

- TWSE:2377

Asian Value Stocks Trading Below Estimated Worth In April 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by trade uncertainties and mixed performances across major indices, Asia's economic scene remains a focal point for investors seeking opportunities in undervalued stocks. In the context of ongoing tariff impacts and monetary policy shifts, identifying stocks trading below their estimated worth can be particularly appealing for those looking to capitalize on potential growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pegasus (TSE:6262) | ¥462.00 | ¥919.80 | 49.8% |

| Insource (TSE:6200) | ¥847.00 | ¥1673.19 | 49.4% |

| Micro-Star International (TWSE:2377) | NT$135.00 | NT$265.59 | 49.2% |

| Members (TSE:2130) | ¥1133.00 | ¥2245.98 | 49.6% |

| AeroEdge (TSE:7409) | ¥1884.00 | ¥3722.30 | 49.4% |

| Rakus (TSE:3923) | ¥2189.00 | ¥4351.79 | 49.7% |

| BIKE O (TSE:3377) | ¥388.00 | ¥769.71 | 49.6% |

| BalnibarbiLtd (TSE:3418) | ¥1120.00 | ¥2234.08 | 49.9% |

| Aozora Bank (TSE:8304) | ¥1861.00 | ¥3690.63 | 49.6% |

| CS BEARING (KOSDAQ:A297090) | ₩5340.00 | ₩10502.64 | 49.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

Rakus (TSE:3923)

Overview: Rakus Co., Ltd., along with its subsidiaries, offers cloud services in Japan and has a market cap of ¥396.59 billion.

Operations: Rakus Co., Ltd. and its subsidiaries generate revenue through the provision of cloud services in Japan.

Estimated Discount To Fair Value: 49.7%

Rakus Co., Ltd. appears significantly undervalued with its current trading price of ¥2,189, which is 49.7% below the estimated fair value of ¥4,351.79. Recent sales figures show steady growth with March 2025 sales reaching ¥4.57 billion from February's ¥4.43 billion. Despite revenue growth forecasts being slower than 20% annually, earnings are expected to grow at a robust rate of 26.7% per year, outpacing the broader Japanese market's anticipated growth rate.

- Our comprehensive growth report raises the possibility that Rakus is poised for substantial financial growth.

- Dive into the specifics of Rakus here with our thorough financial health report.

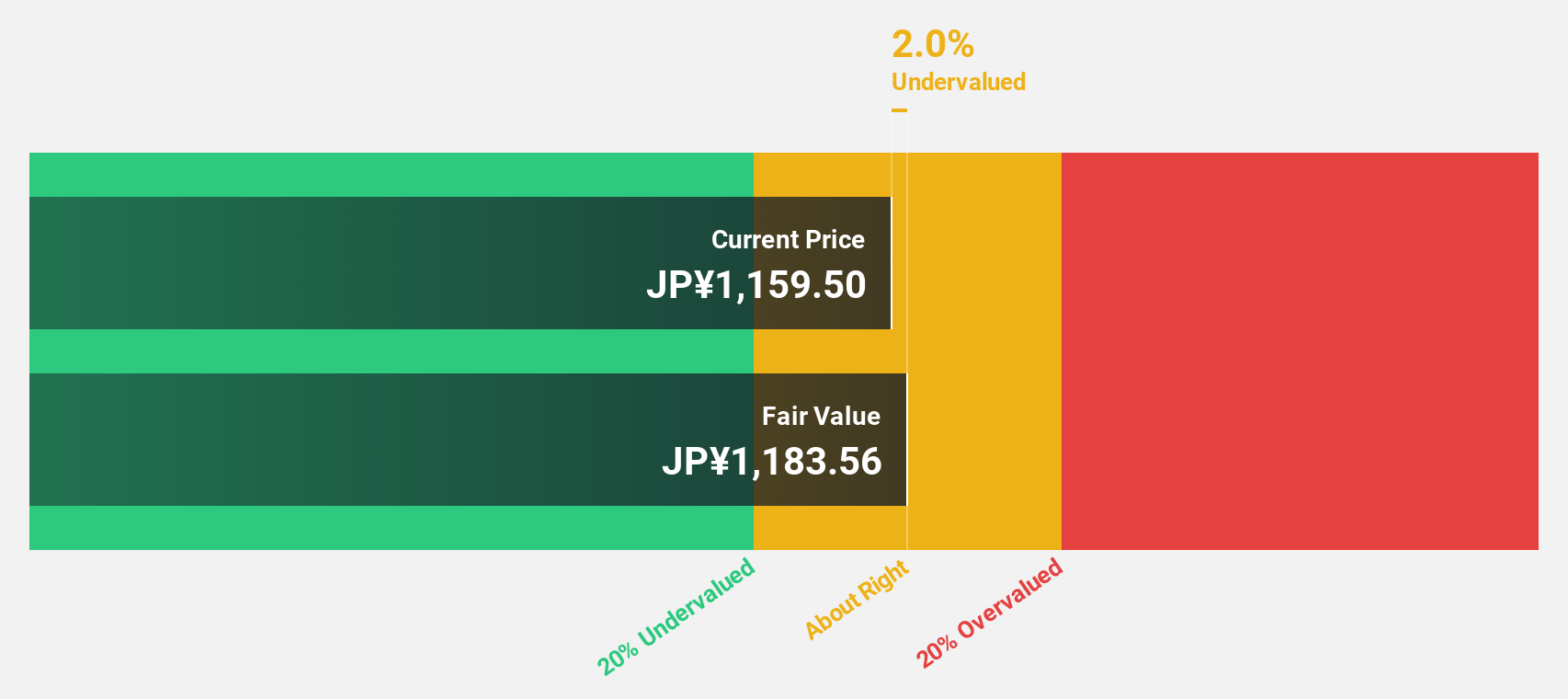

Gunma Bank (TSE:8334)

Overview: The Gunma Bank, Ltd. offers a range of banking and financial products and services in Japan with a market cap of ¥441.28 billion.

Operations: The company's revenue segments include ¥30.56 billion from leasing and ¥175.93 billion from banking services.

Estimated Discount To Fair Value: 26.6%

Gunma Bank is trading at ¥1,154, significantly below its estimated fair value of ¥1,572.93. Despite recent share price volatility, the bank's earnings and revenue are forecast to grow faster than the Japanese market at 8.8% and 26% per year respectively. The company recently increased its dividend guidance from ¥20 to ¥25 per share for fiscal year-end March 2025, reflecting a shift in shareholder return policy amidst a low allowance for bad loans (38%).

- Our growth report here indicates Gunma Bank may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Gunma Bank.

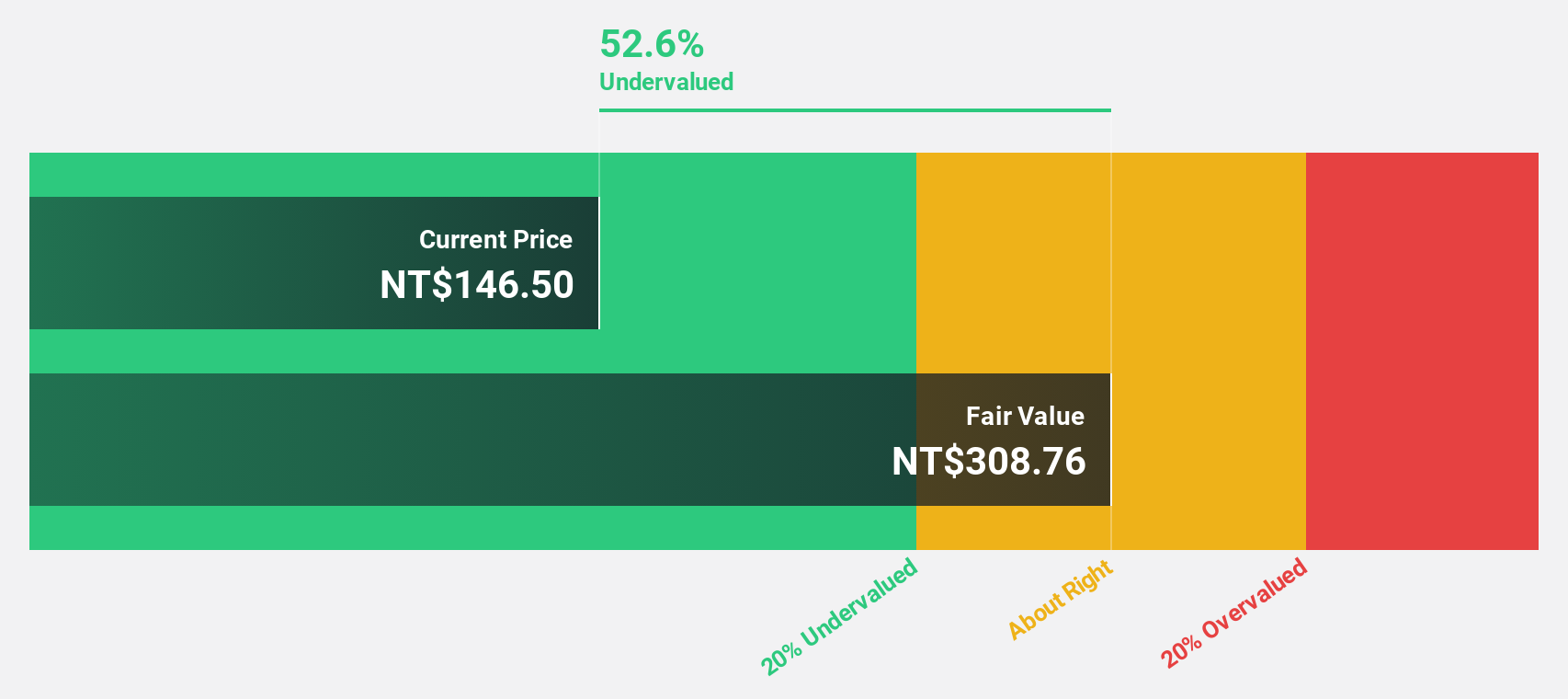

Micro-Star International (TWSE:2377)

Overview: Micro-Star International Co., Ltd. is a global manufacturer and seller of motherboards, interface cards, notebook computers, and other electronic products with a market cap of NT$114.06 billion.

Operations: The company's revenue primarily comes from its Computer and Peripherals segment, totaling NT$197.83 billion.

Estimated Discount To Fair Value: 49.2%

Micro-Star International is trading at NT$135, significantly below its estimated fair value of NT$265.59, offering potential for appreciation. Despite a decrease in net income to TWD 6.79 billion for 2024, earnings are expected to grow at 30.3% annually over the next three years, outpacing the Taiwanese market's growth rate of 14.8%. However, dividends remain unsustainable as they are not well covered by free cash flows. Recent AI platform innovations may bolster future performance.

- Upon reviewing our latest growth report, Micro-Star International's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Micro-Star International with our detailed financial health report.

Key Takeaways

- Embark on your investment journey to our 271 Undervalued Asian Stocks Based On Cash Flows selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2377

Micro-Star International

Engages in the manufacture and sale of motherboards, interface cards, notebook computers, and other electronic products in Asia, Europe, the United States, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion