Undiscovered Gems And Two Other Potential Small Caps With Strong Prospects

Reviewed by Simply Wall St

As global markets navigate the complexities of political shifts and economic indicators, small-cap stocks have remained in the spotlight, with indices like the S&P MidCap 400 and Russell 2000 showing notable gains. In this dynamic environment, identifying promising small-cap companies requires a keen eye for those with strong fundamentals and potential to thrive amidst evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nippon Denko | 20.08% | 5.07% | 47.43% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Toyo Kanetsu K.K | 32.74% | 2.71% | 17.49% | ★★★★★☆ |

| Alembic | 0.72% | 21.20% | -6.80% | ★★★★★☆ |

| Piccadily Agro Industries | 34.60% | 14.20% | 46.61% | ★★★★★☆ |

| Sichuan Haite High-techLtd | 49.88% | 6.40% | -10.22% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 136.00% | 2.73% | 2.17% | ★★★★☆☆ |

| Chongqing Gas Group | 17.09% | 9.78% | 0.53% | ★★★★☆☆ |

| Toho Bank | 74.70% | 1.80% | 25.54% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

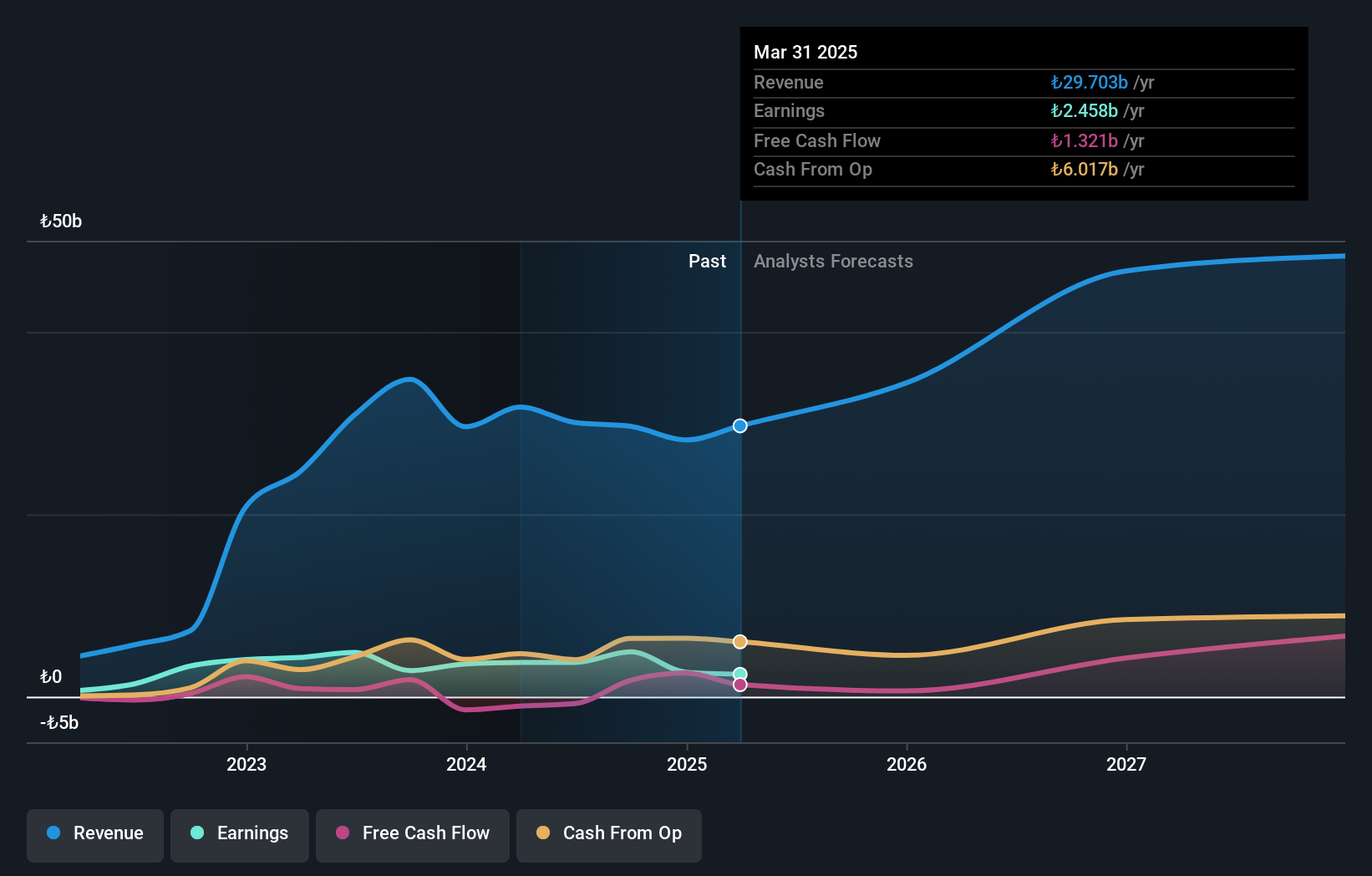

Çimsa Çimento Sanayi ve Ticaret (IBSE:CIMSA)

Simply Wall St Value Rating: ★★★★★★

Overview: Çimsa Çimento Sanayi ve Ticaret A.S. is a Turkish company involved in the production and sale of cement and building materials, with a market capitalization of TRY52.48 billion.

Operations: Çimsa generates revenue primarily from its cement segment, amounting to TRY14.78 billion, and its ready-mixed concrete segment, contributing TRY4.20 billion.

Çimsa, a notable player in the cement industry, has demonstrated robust financial health with earnings growth of 29.6% over the past year, surpassing the Basic Materials industry's 19.4%. The company's net debt to equity ratio stands at a satisfactory 10.9%, showcasing effective debt management as it decreased from 109.9% to 73.7% over five years. With interest payments well covered by EBIT at a multiple of 33.7x, Çimsa's high-quality earnings and favorable price-to-earnings ratio of 14.1x compared to the TR market's 16x suggest potential for continued value appreciation in its sector.

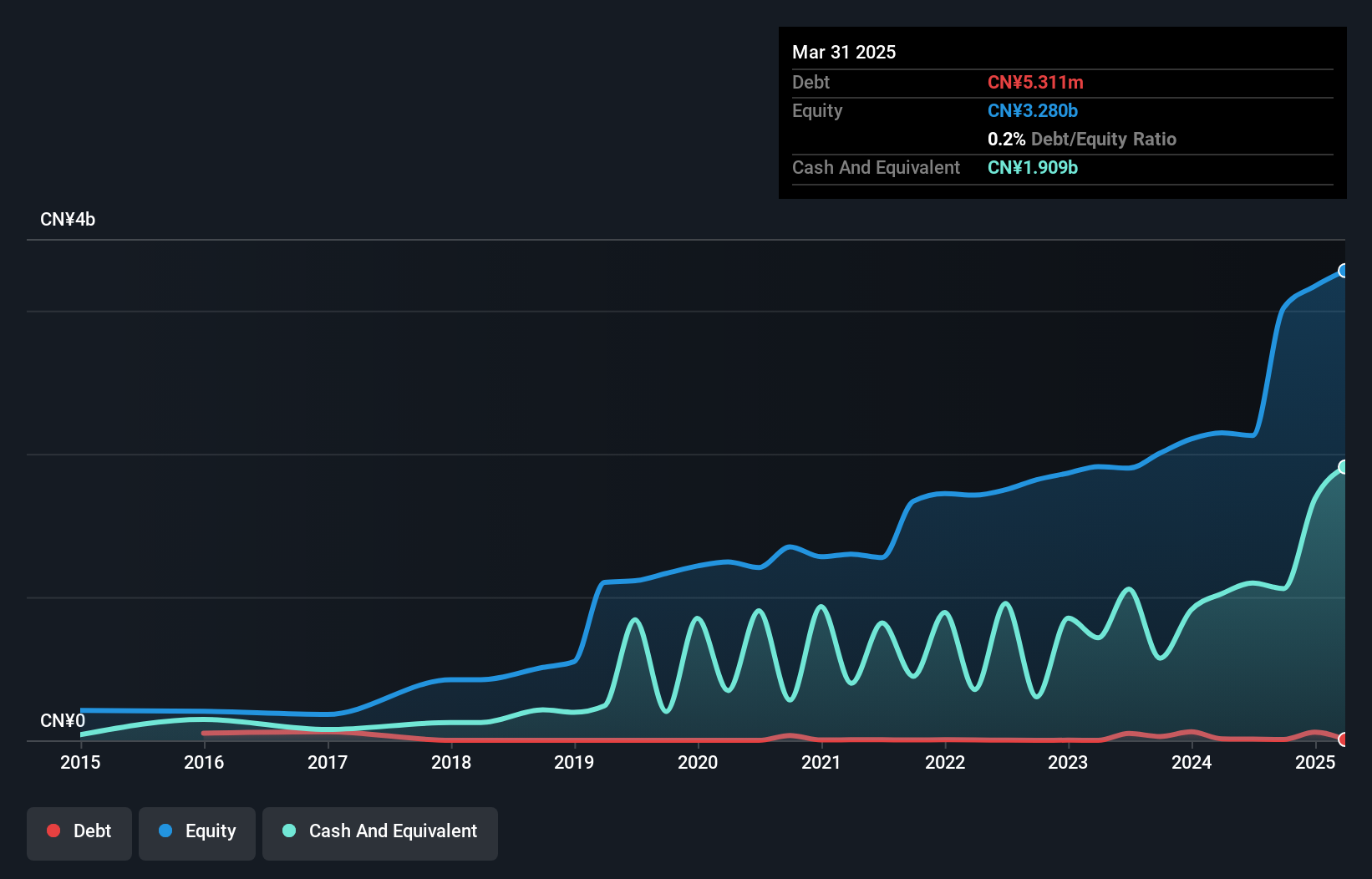

Suzhou Hengmingda Electronic Technology (SZSE:002947)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Hengmingda Electronic Technology Co., Ltd. specializes in the development and manufacturing of electronic components, with a market cap of CN¥9.05 billion.

Operations: Suzhou Hengmingda Electronic Technology Co., Ltd. generates revenue through the development and manufacturing of electronic components. The company's financial performance is reflected in its market capitalization of CN¥9.05 billion, with a focus on optimizing its cost structure to enhance profitability.

Suzhou Hengmingda Electronic Technology, a small player in the electronics sector, has shown impressive earnings growth of 68% over the past year, outpacing the industry's 2.3%. Its price-to-earnings ratio of 22.8x suggests it is undervalued compared to the broader CN market's average of 35.1x. The company boasts more cash than total debt, indicating a solid financial footing and no concerns over interest coverage with profits exceeding interest expenses. A recent shareholder meeting discussed potential stock repurchases and amendments to corporate governance, signaling proactive management strategies for future growth and stability in their operations.

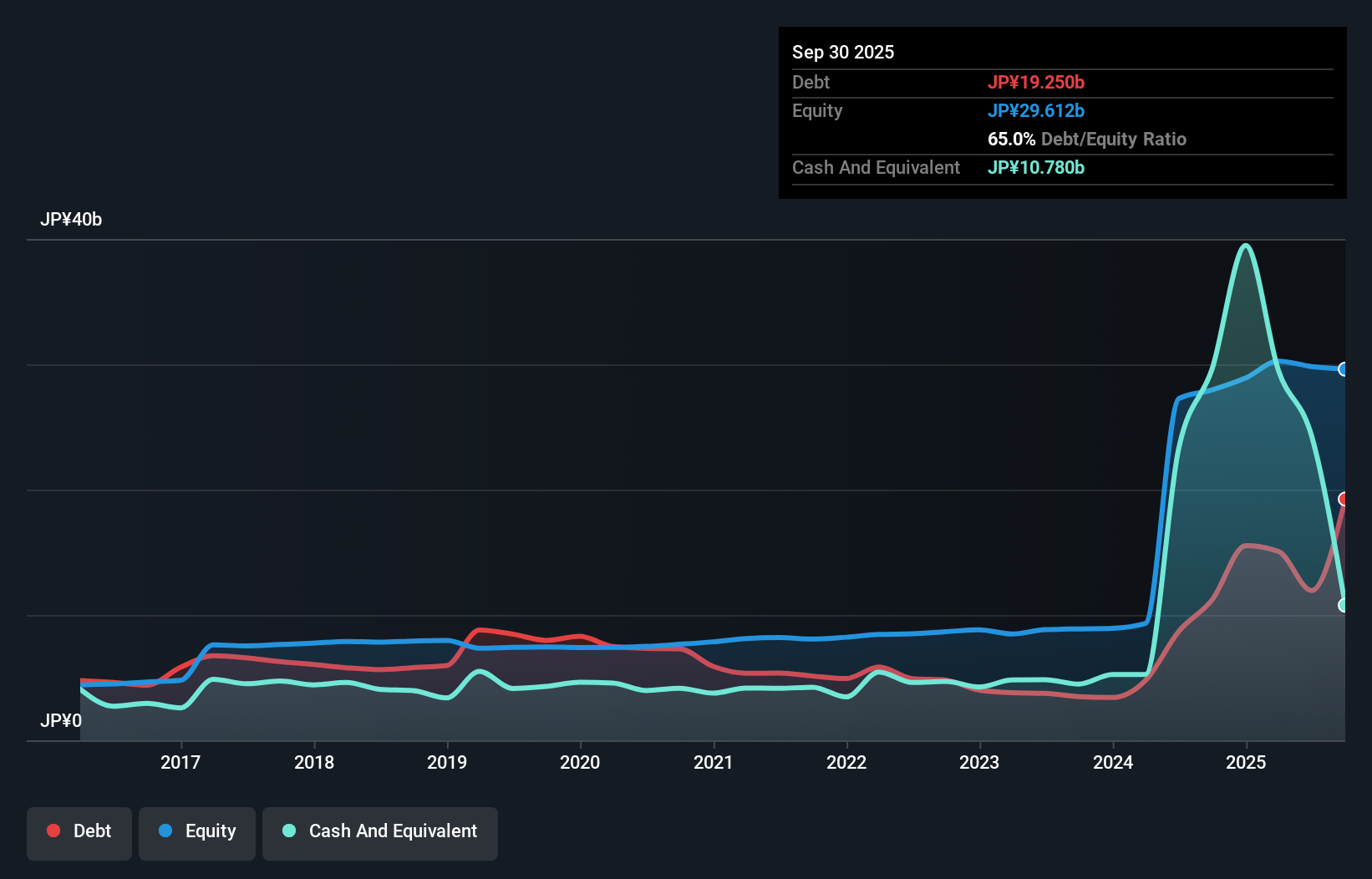

SAKURA Internet (TSE:3778)

Simply Wall St Value Rating: ★★★★★☆

Overview: SAKURA Internet Inc. offers cloud computing services in Japan and has a market capitalization of ¥179.99 billion.

Operations: The primary revenue stream for SAKURA Internet comes from its Internet Infrastructure Business, generating ¥24.75 billion.

SAKURA Internet, a nimble player in the tech space, has seen its earnings soar by 99.7% over the past year, outpacing the IT industry's growth of 11.4%. With a debt-to-equity ratio now at 40.1%, down from 107% over five years, it appears to be managing its financial obligations effectively. The company anticipates net sales of ¥29 billion and an operating profit of ¥2.6 billion for the fiscal year ending March 2025. Despite recent share price volatility, SAKURA Internet's high level of non-cash earnings suggests strong underlying performance that could attract investors' interest.

- Delve into the full analysis health report here for a deeper understanding of SAKURA Internet.

Understand SAKURA Internet's track record by examining our Past report.

Summing It All Up

- Navigate through the entire inventory of 4666 Undiscovered Gems With Strong Fundamentals here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade SAKURA Internet, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3778

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives