Amidst a backdrop of geopolitical tensions and consumer spending concerns, U.S. stock indices experienced a volatile week in February 2025, with the S&P 500 initially reaching record highs before ending lower due to tariff fears and economic uncertainties. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate resilience through innovative solutions and strong fundamentals despite broader market challenges.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| Travere Therapeutics | 27.14% | 66.43% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.83% | 59.08% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1196 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★★☆

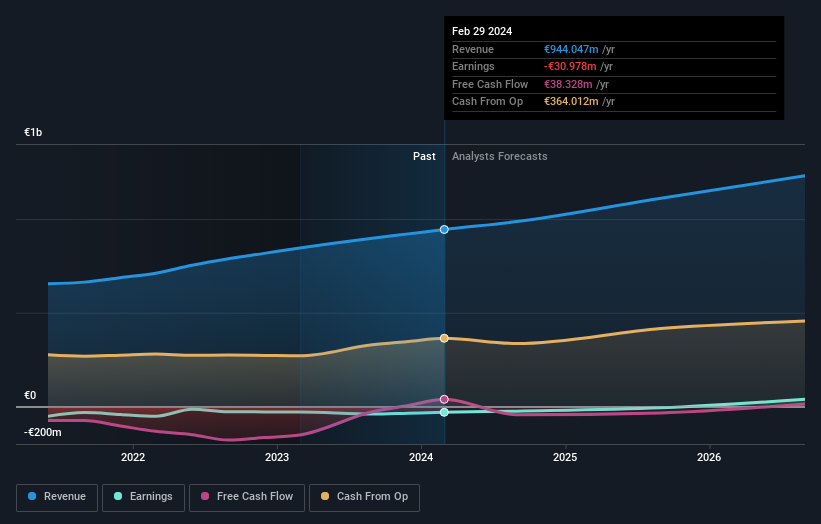

Overview: OVH Groupe S.A. is a global provider of public and private cloud services, shared hosting, and dedicated server solutions with a market capitalization of approximately €1.15 billion.

Operations: OVH Groupe generates revenue primarily from its Private Cloud segment, contributing €638.33 million, followed by Public Cloud and Web Cloud services at €189.67 million and €188.80 million, respectively.

OVHcloud's recent strategic moves underscore its commitment to growth in the tech sector, particularly through partnerships and enhanced product offerings. The collaboration with HYCU to resell R-Cloud Hybrid Cloud Edition licenses, starting at £140 monthly for 25 VMs, expands its service range, catering to diverse business needs from small to resource-intensive environments. Additionally, the introduction of Nutanix-qualified Scale servers offers more choices for partners, enhancing OVHcloud’s competitive position in cloud infrastructure services. With a revenue forecast growing at 10% annually—double the French market rate—and an anticipated shift into profitability within three years, OVHcloud is positioning itself strongly against industry norms. This growth trajectory is supported by a robust R&D focus and strategic partnerships aimed at broadening its market reach and service capabilities.

HYBE (KOSE:A352820)

Simply Wall St Growth Rating: ★★★★☆☆

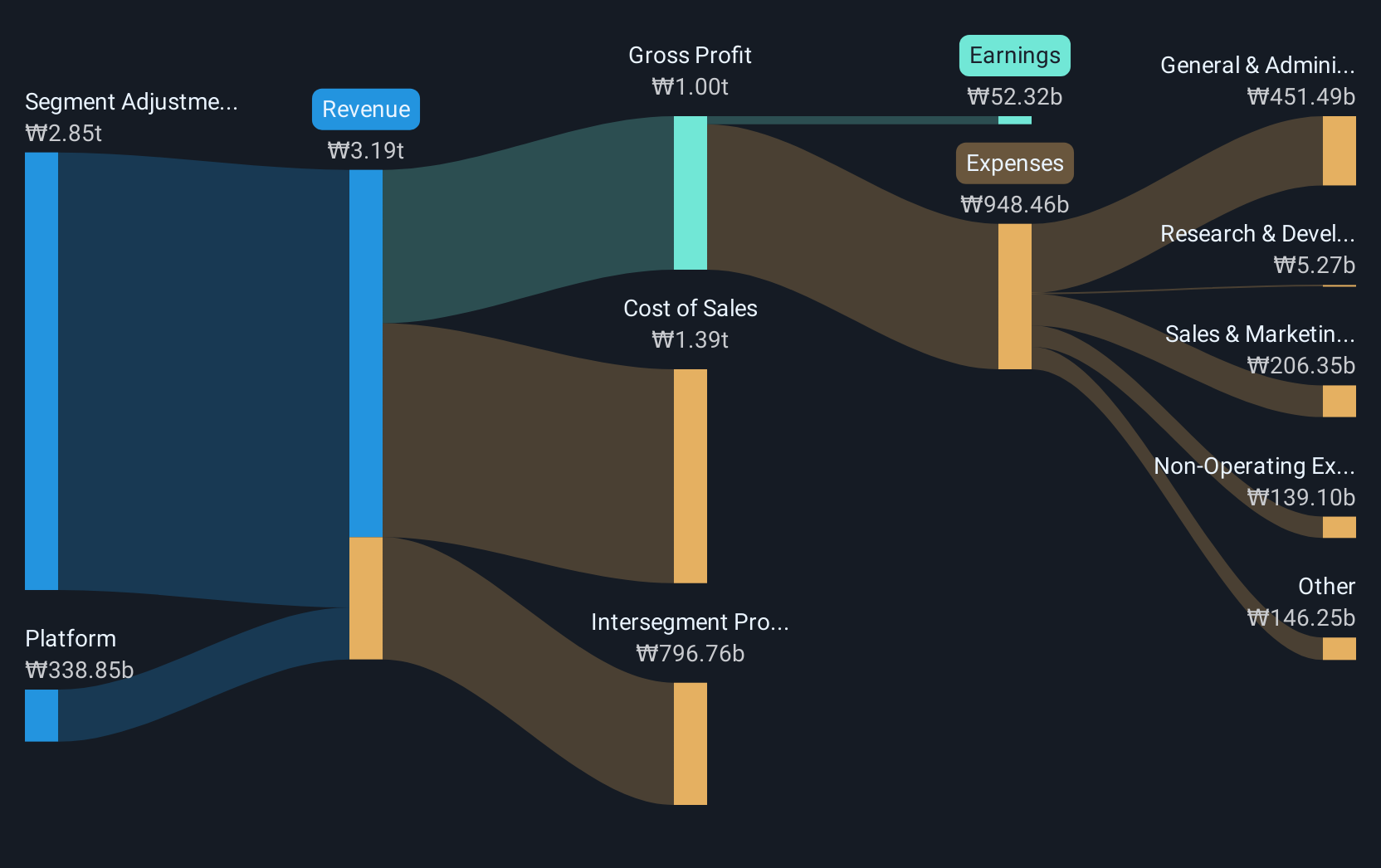

Overview: HYBE Co., Ltd. is involved in music production, publishing, and artist development and management, with a market cap of ₩10.23 trillion.

Operations: HYBE Co., Ltd. generates revenue primarily through its Label and Solution segments, with the Label segment contributing ₩1.29 trillion and the Solution segment adding ₩1.21 trillion. The Platform segment also plays a significant role, bringing in ₩337.18 billion in revenue.

HYBE's trajectory in the high-growth tech landscape is marked by a robust 17.1% annual revenue increase, outpacing the Korean market's 9.2% growth. Despite current unprofitability, it is set to shift towards profitability within three years, with earnings projected to surge by 50.8% annually. This growth is underpinned by strategic leadership changes and a clear focus on enhancing global competitiveness, as evidenced by recent executive reshuffles aimed at reinforcing innovation and market adaptability in its music segment. HYBE continues to invest significantly in R&D, aligning with its ambitious revenue targets and future profitability projections, positioning it as a dynamic player in the entertainment technology sphere.

- Click here and access our complete health analysis report to understand the dynamics of HYBE.

Explore historical data to track HYBE's performance over time in our Past section.

SAKURA Internet (TSE:3778)

Simply Wall St Growth Rating: ★★★★★☆

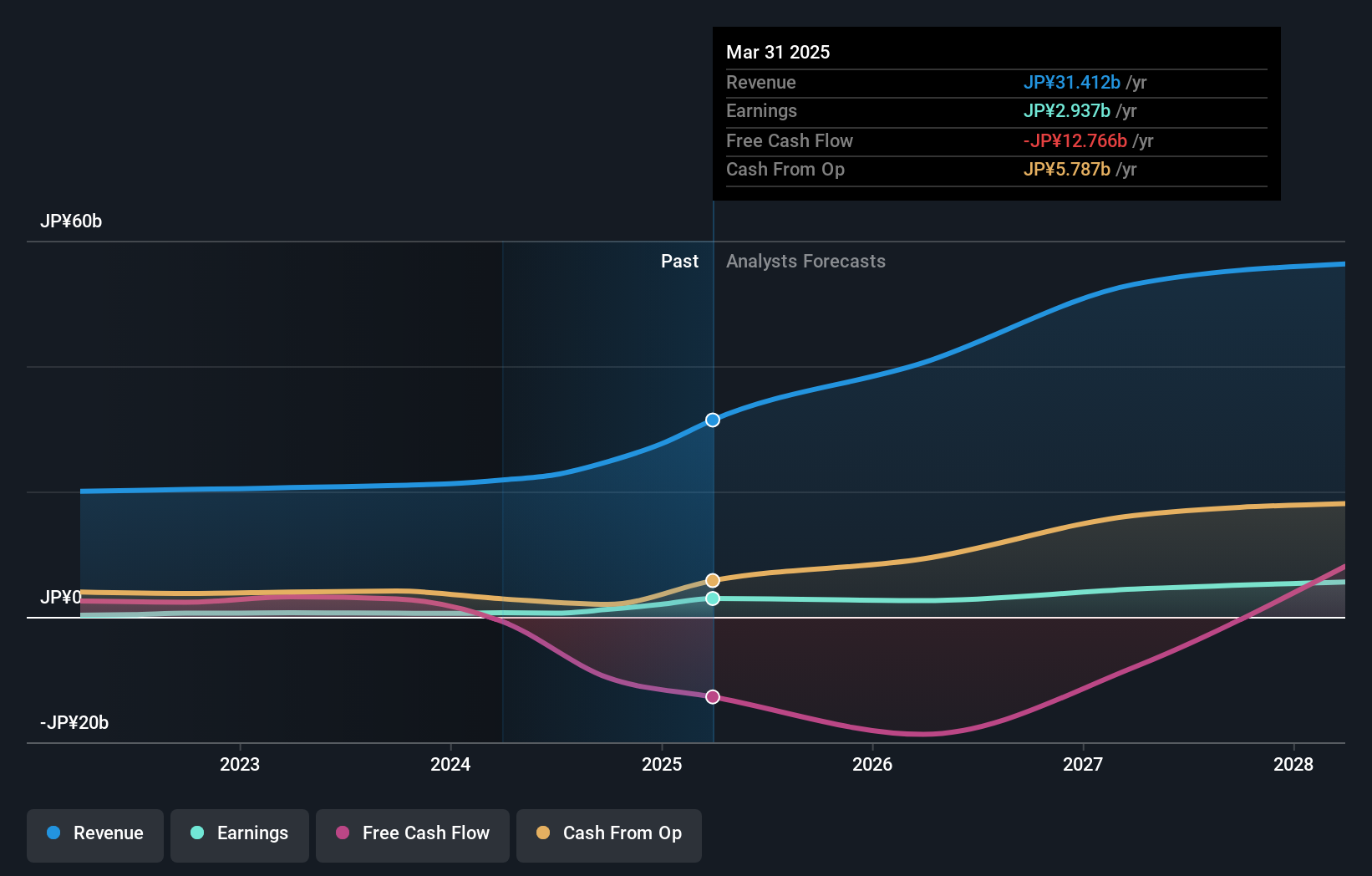

Overview: SAKURA Internet Inc. offers cloud computing services in Japan and has a market capitalization of ¥173 billion.

Operations: SAKURA Internet Inc. generates revenue primarily from its Internet Infrastructure Business, amounting to ¥27.56 billion. The company's operations focus on providing cloud computing services within Japan's market.

SAKURA Internet's strategic investments in AI and cloud services are propelling its rapid growth, with a revised earnings forecast showing a notable increase in net sales to JPY 31 billion, up from JPY 29 billion. This uptick is fueled by the deployment of 800 NVIDIA H100 Tensor Core GPUs, enhancing their GPU infrastructure to meet surging demand for AI development. The company's recent board meetings underscore a commitment to scaling operations and boosting profitability, expecting an operating profit of JPY 3.4 billion, significantly higher than previous estimates. These moves highlight SAKURA's agility in capitalizing on high-value tech trends and government contracts, positioning it well for sustained growth amidst competitive pressures.

- Get an in-depth perspective on SAKURA Internet's performance by reading our health report here.

Examine SAKURA Internet's past performance report to understand how it has performed in the past.

Taking Advantage

- Navigate through the entire inventory of 1196 High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OVH

OVH Groupe

Provides public and private cloud, shared hosting, and dedicated server products and solutions worldwide.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives