SHIFT (TSE:3697) Profit Margin Improvement Reinforces Bullish Narrative on Growth and Valuation

Reviewed by Simply Wall St

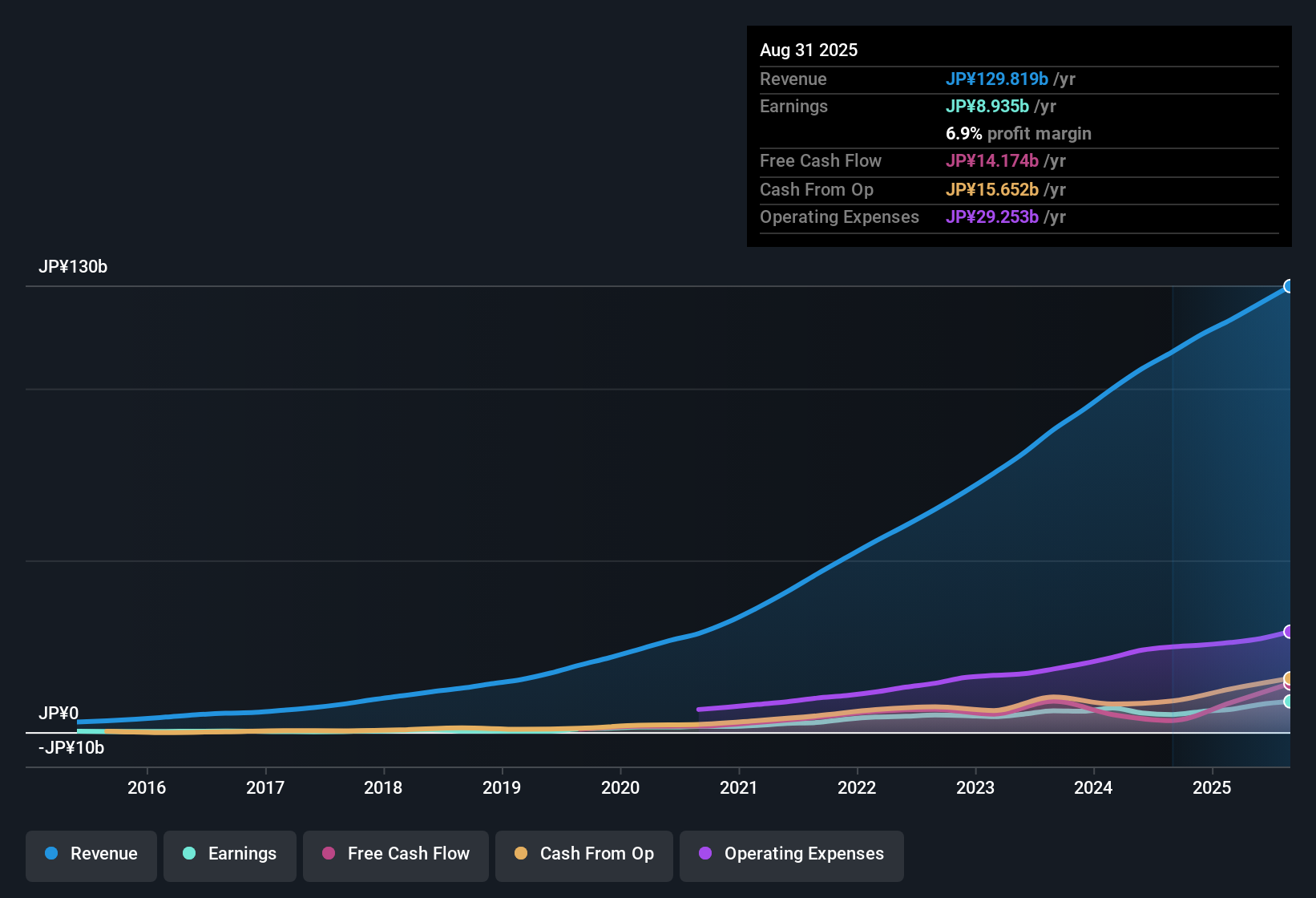

SHIFT (TSE:3697) posted a net profit margin of 6.9%, up from last year's 4.6%, with earnings leaping 74.3% over the past year and averaging 24.7% annual growth over five years. Revenue is expected to increase 15.7% per year, beating the broader Japanese market’s 4.4% forecast. Earnings are anticipated to grow at 20.5%, well ahead of the industry’s 8.1% target. With recent data showing improving profitability, robust growth momentum, and no significant risks flagged, investors are likely to focus on SHIFT’s rewards narrative as valuation and sector performance come into sharper view.

See our full analysis for SHIFT.Next, we’ll put these results in context by comparing the headline figures with prevailing narratives about SHIFT. This comparison will reveal where the numbers reinforce consensus opinion and where they may challenge common views.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Expansion Outpaces Industry Trend

- SHIFT reported a net profit margin of 6.9%, which is a significant improvement over last year's 4.6%. This marks a clear shift toward more efficient operations compared to peers in the Japanese IT sector.

- This development supports the case that SHIFT's profitability momentum might justify sustained optimism:

- Recent margin gains exceed both the sector average and the company's own historical trend, creating a foundation that some point to as a sign SHIFT can sustain elevated growth rates.

- The sharp rise in profit margin challenges those expecting growth to stall, as operating leverage has improved alongside headline earnings growth.

DCF Fair Value Gap Offers Upside

- With shares trading at ¥1,227.50 against a DCF fair value estimate of ¥1,356.07, SHIFT currently sits at a discount of roughly 9.5% to its fair value model.

- Some argue this gap demonstrates mispricing, where growth looks attractively priced:

- The combination of solid top-line expansion and better margins highlights why some expect a valuation re-rating, especially when the share price still trails DCF benchmarks.

- Despite carrying a high P/E, the discount to modeled fair value stands out as a possible catalyst for renewed buying if growth momentum continues.

P/E Premium Signals High Expectations

- SHIFT's P/E ratio of 36.2x remains well above both the peer average of 23.6x and the broader Japanese IT industry’s 17.4x, showing investors are willing to pay a premium for perceived growth leadership.

- This high premium, while a vote of confidence, leaves little room for underperformance. The prevailing market view emphasizes SHIFT must continue exceeding forecasts to justify its valuation:

- Any slip in growth rates or margins could drive a swift sentiment shift, as the stock is already priced at a substantial multiple to both peers and sector averages.

- The share price premium is sustained only while SHIFT continues to outpace both the IT sector and its closest competitors.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on SHIFT's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

SHIFT’s elevated P/E ratio and premium valuation mean that any slowdown in growth or profitability could quickly undermine its current share price momentum.

If you’d prefer companies where price better reflects potential, use these 877 undervalued stocks based on cash flows to uncover opportunities trading below fair value with less downside risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3697

SHIFT

Provides software quality assurance and testing solutions in Japan.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives