Japan's stock markets have seen a notable rise recently, with the Nikkei 225 Index gaining 2.45% and the broader TOPIX Index up 0.45%, supported by yen weakness which has enhanced profit prospects for exporters. In this environment of favorable currency conditions and rising indices, identifying high growth tech stocks involves looking for companies that are well-positioned to capitalize on technological advancements and global demand trends, potentially offering robust opportunities in Japan's dynamic market landscape.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| ExaWizards | 21.96% | 75.16% | ★★★★★★ |

| freee K.K | 18.18% | 74.08% | ★★★★★☆ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SHIFT Inc. is a company based in Japan that specializes in providing software quality assurance and testing solutions, with a market capitalization of ¥275.54 billion.

Operations: SHIFT Inc. generates revenue primarily from software testing-related services, accounting for ¥68.64 billion, and software development-related services, contributing ¥33.55 billion.

SHIFT Inc. demonstrates robust potential in Japan's tech landscape, with a notable 32.6% projected annual earnings growth outpacing the domestic market's 8.8%. This growth is supported by a strategic focus on R&D, which has consistently accounted for significant portions of revenue, aligning with industry trends toward innovation-driven expansion. Recent initiatives include a share repurchase program aimed at enhancing shareholder value, involving up to ¥1 billion to acquire 0.45% of its shares by late November 2024. These moves underscore SHIFT’s commitment to leveraging financial strategies and continuous innovation to sustain its competitive edge in high-tech sectors.

- Take a closer look at SHIFT's potential here in our health report.

Understand SHIFT's track record by examining our Past report.

Money Forward (TSE:3994)

Simply Wall St Growth Rating: ★★★★★★

Overview: Money Forward, Inc. offers financial solutions for individuals, financial institutions, and corporations mainly in Japan with a market capitalization of ¥340.35 billion.

Operations: The Platform Services Business is a key revenue segment for Money Forward, Inc., contributing ¥36.16 billion.

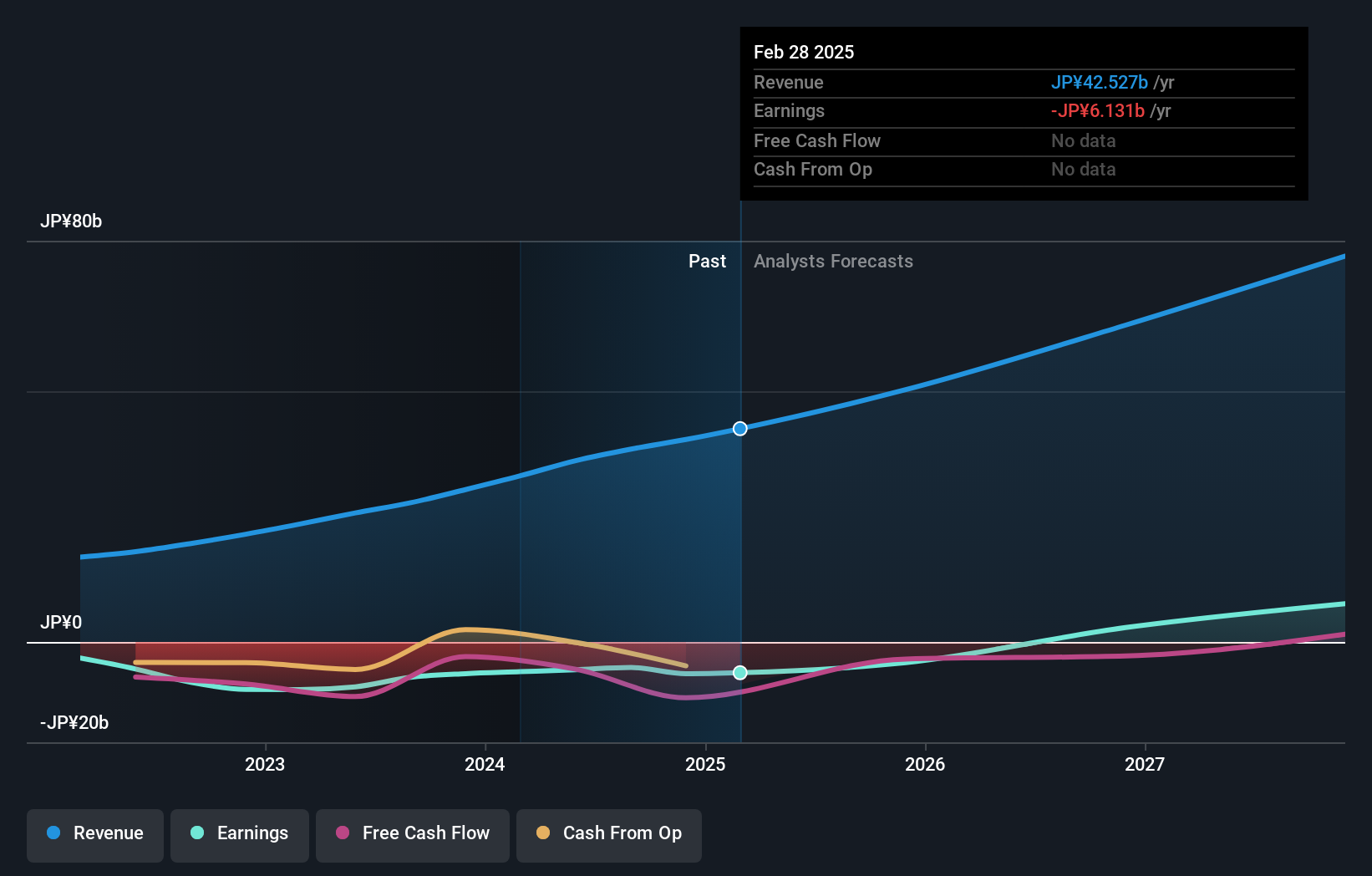

Money Forward, Inc., poised for significant growth with anticipated revenue increases of 20.7% annually, is strategically aligning itself within Japan's tech sector through focused R&D investments and recent corporate maneuvers. The company's R&D expenses are a testament to its commitment to innovation, crucial for staying competitive in the rapidly evolving fintech landscape. Recent board decisions, including partnerships and business restructuring like the split involving Money Forward Kessai, underscore efforts to optimize operations and expand service offerings. With an expected profitability turnaround in three years and a forecasted high return on equity of 20.6%, Money Forward is actively shaping its future trajectory amidst challenging market conditions.

- Get an in-depth perspective on Money Forward's performance by reading our health report here.

Explore historical data to track Money Forward's performance over time in our Past section.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★★☆

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market cap of ¥197.19 billion.

Operations: The company focuses on delivering cloud-based solutions for accounting and HR, targeting businesses in Japan. Its revenue primarily stems from subscription fees for its software services. Cost structure includes expenses related to product development, marketing, and customer support. Gross profit margin trends indicate a focus on optimizing operational efficiency.

Freee K.K., amidst a dynamic shift in leadership and strategic amendments, is setting the stage for accelerated growth within Japan's tech ecosystem. With an impressive projected revenue increase of 18.2% annually, the company's focus on enhancing its ERP systems through substantial R&D investments—constituting 74.1% of its earnings—is indicative of a robust commitment to innovation and market adaptability. The recent appointment of Yasuhiro Kimura as CPO, coupled with changes to corporate bylaws to expand business activities, underscores Freee K.K.'s proactive approach in fortifying its product offerings and operational framework in anticipation of future demands. These strategic moves are pivotal as the company navigates through unprofitability towards a promising horizon marked by potential profitability within three years and an ambitious revenue target set at JPY 33.06 billion for FY2025.

- Click here and access our complete health analysis report to understand the dynamics of freee K.K.

Examine freee K.K's past performance report to understand how it has performed in the past.

Key Takeaways

- Discover the full array of 119 Japanese High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if freee K.K might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4478

freee K.K

Engages in the provision of cloud-based accounting and HR software solutions in Japan.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives