- China

- /

- Medical Equipment

- /

- SZSE:300832

China Jushi And 2 Other Stocks That Might Be Priced Below Estimated Value

Reviewed by Simply Wall St

As global markets show signs of resilience with U.S. indexes nearing record highs and broad-based gains, investors are navigating a landscape marked by geopolitical tensions and economic policy shifts. Amidst this environment, identifying stocks that may be undervalued can provide strategic opportunities for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victory Capital Holdings (NasdaqGS:VCTR) | US$72.24 | US$144.03 | 49.8% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.12 | US$99.93 | 49.8% |

| CS Wind (KOSE:A112610) | ₩41550.00 | ₩83428.63 | 50.2% |

| Synovus Financial (NYSE:SNV) | US$57.97 | US$115.67 | 49.9% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.95 | CN¥43.13 | 49.1% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.85 | 49.8% |

| EuroGroup Laminations (BIT:EGLA) | €2.728 | €5.42 | 49.7% |

| Nidaros Sparebank (OB:NISB) | NOK100.00 | NOK198.62 | 49.7% |

| Nutanix (NasdaqGS:NTNX) | US$72.35 | US$143.99 | 49.8% |

| VerticalScope Holdings (TSX:FORA) | CA$9.01 | CA$18.01 | 50% |

Below we spotlight a couple of our favorites from our exclusive screener.

China Jushi (SHSE:600176)

Overview: China Jushi Co., Ltd. manufactures and sells fiberglass both in China and internationally, with a market cap of CN¥42.71 billion.

Operations: The company generates revenue of CN¥15.08 billion from its production and sales of glass fiber and related products.

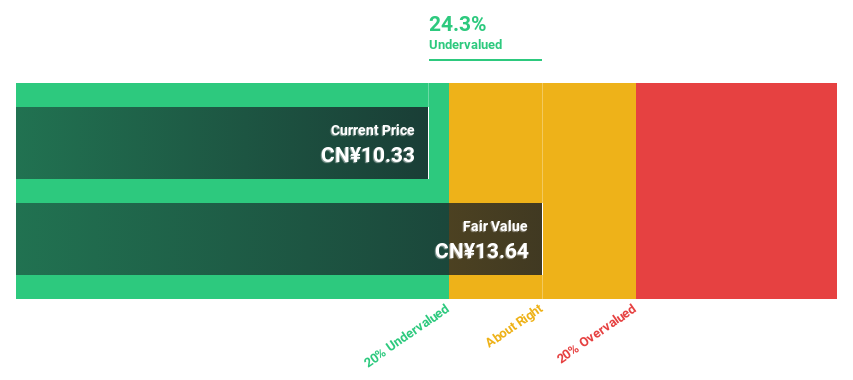

Estimated Discount To Fair Value: 21.2%

China Jushi is trading at CN¥11.07, 21.2% below its estimated fair value of CN¥14.05, suggesting it may be undervalued based on cash flows despite recent challenges. The company's net income fell significantly over the past year, impacting profit margins and earnings per share. However, earnings are forecast to grow significantly at 29.1% annually over the next three years, outpacing market expectations and indicating potential for future value realization despite current low dividend coverage by free cash flows.

- Upon reviewing our latest growth report, China Jushi's projected financial performance appears quite optimistic.

- Take a closer look at China Jushi's balance sheet health here in our report.

Shenzhen New Industries Biomedical Engineering (SZSE:300832)

Overview: Shenzhen New Industries Biomedical Engineering Co., Ltd. is a bio-medical company involved in the research, development, production, and sale of clinical laboratory instruments and in vitro diagnostic reagents to hospitals both within China and internationally, with a market cap of CN¥50.04 billion.

Operations: The company generates revenue of CN¥4.44 billion from its in vitro diagnostic segment, supplying clinical laboratory instruments and reagents to hospitals domestically and abroad.

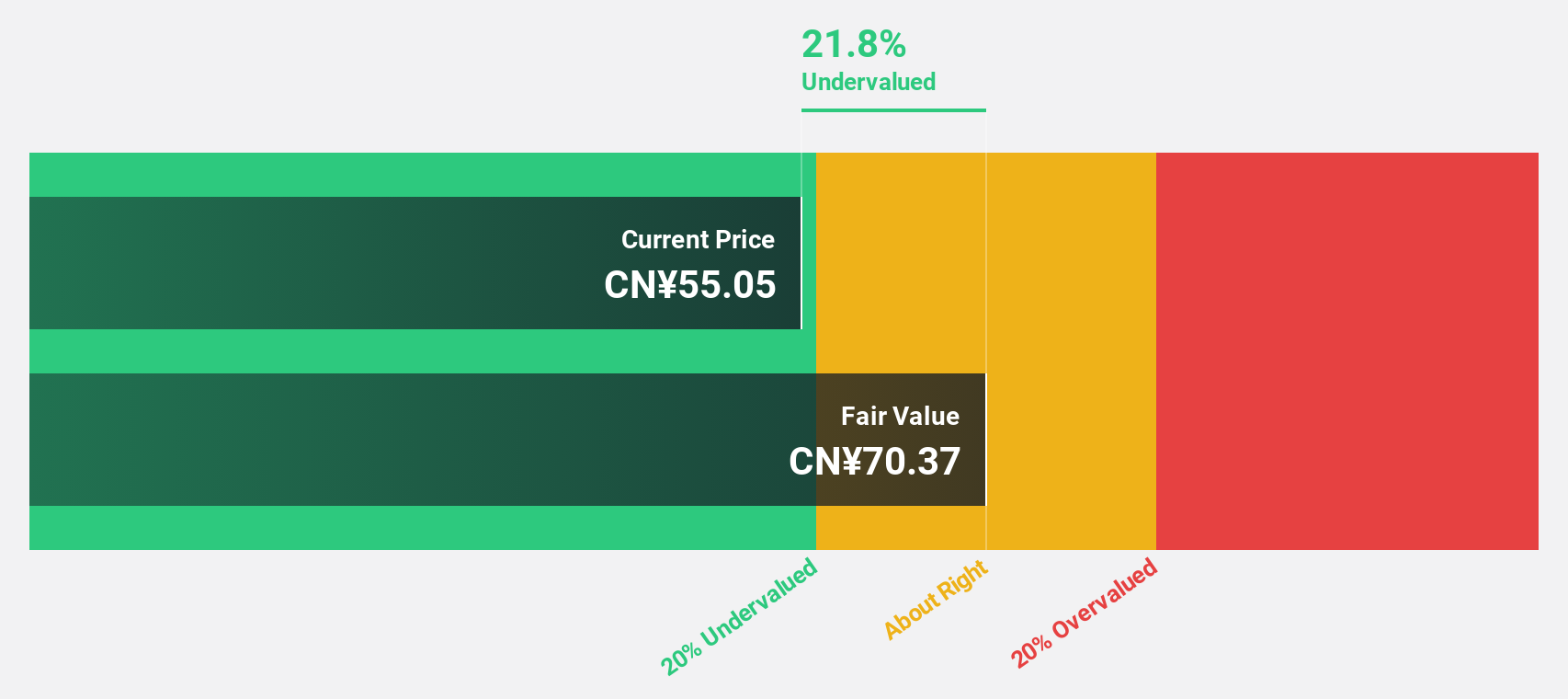

Estimated Discount To Fair Value: 23.4%

Shenzhen New Industries Biomedical Engineering is trading at CN¥64.86, over 20% below its estimated fair value of CN¥84.71, indicating potential undervaluation based on cash flows. Recent earnings show robust growth with sales reaching CN¥3.41 billion and net income rising to CN¥1.38 billion for the nine months ending September 2024. The company’s revenue is forecast to grow faster than the market at 21.5% annually, although earnings growth may lag slightly behind market expectations.

- Insights from our recent growth report point to a promising forecast for Shenzhen New Industries Biomedical Engineering's business outlook.

- Get an in-depth perspective on Shenzhen New Industries Biomedical Engineering's balance sheet by reading our health report here.

SHIFT (TSE:3697)

Overview: SHIFT Inc. offers software quality assurance and testing solutions in Japan, with a market cap of ¥264.97 billion.

Operations: The company's revenue segments include Software Testing Related Services generating ¥71.34 billion and Software Development Related Services contributing ¥35.01 billion.

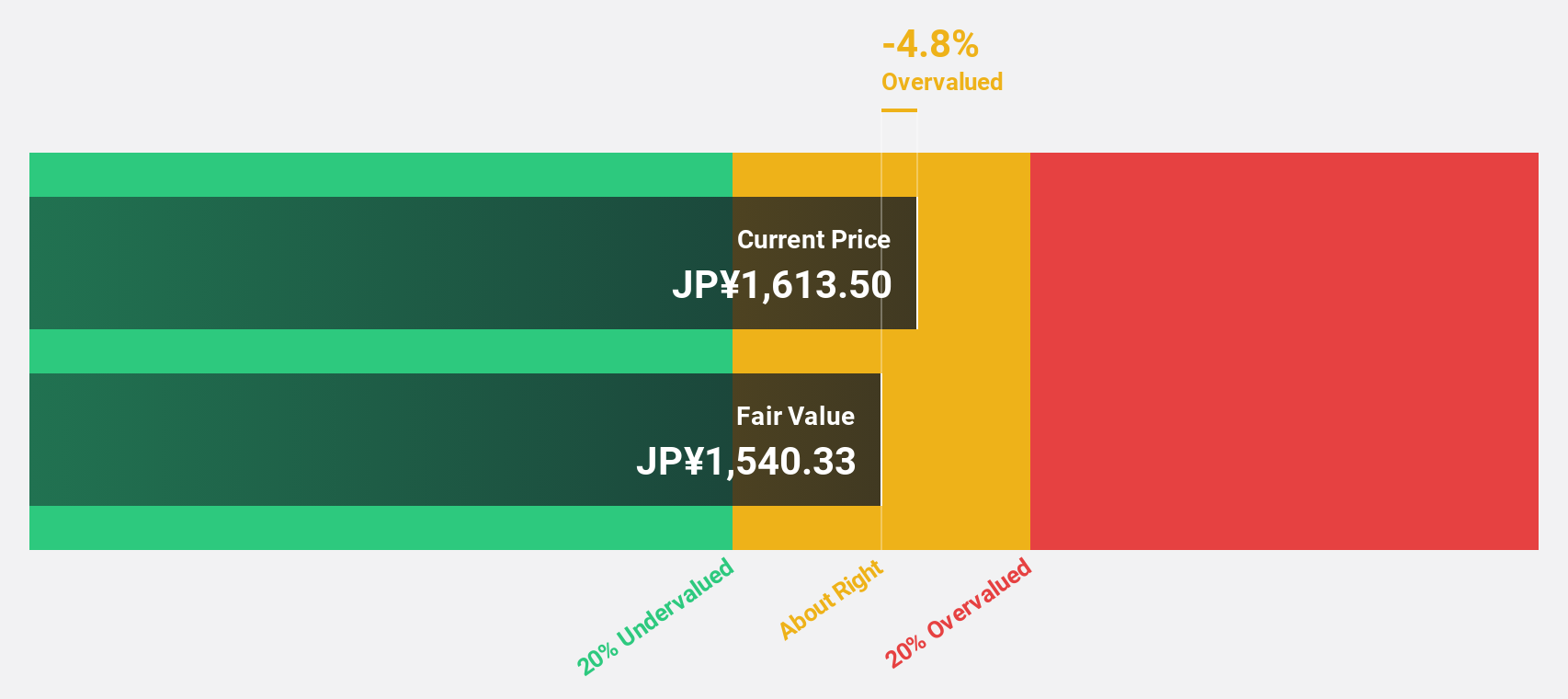

Estimated Discount To Fair Value: 28.1%

SHIFT is trading at ¥16,245, significantly below its fair value estimate of ¥22,606. Despite a recent share buyback program aimed at enhancing shareholder returns and corporate value, the company's profit margins have decreased from 7.1% to 4.6% over the past year. Nonetheless, earnings are projected to grow significantly by 33.45% annually over the next three years, outpacing both revenue growth and market averages in Japan.

- Our comprehensive growth report raises the possibility that SHIFT is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of SHIFT.

Seize The Opportunity

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 910 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300832

Shenzhen New Industries Biomedical Engineering

A bio-medical company, engages in the research, development, production, and sale of clinical laboratory instruments and in vitro diagnostic reagents to hospitals in the People's Republic of China and internationally.

Flawless balance sheet with high growth potential.