- China

- /

- Medical Equipment

- /

- SHSE:688389

3 Stocks With Estimated Discounts Ranging From 30% To 46.9%

Reviewed by Simply Wall St

In a week marked by mixed performances across major U.S. stock indexes, growth stocks outpaced value stocks significantly, highlighting the ongoing divergence in market trends. While geopolitical events and economic data continue to shape investor sentiment, opportunities may arise in identifying undervalued stocks that could offer potential value amidst these fluctuating conditions. In this context, understanding what constitutes a good stock—such as strong fundamentals and attractive valuations—becomes crucial for investors seeking to capitalize on estimated discounts ranging from 30% to 46.9%.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hunan Jiudian Pharmaceutical (SZSE:300705) | CN¥26.16 | CN¥52.08 | 49.8% |

| Tibet Rhodiola Pharmaceutical Holding (SHSE:600211) | CN¥38.61 | CN¥76.93 | 49.8% |

| Aguas Andinas (SNSE:AGUAS-A) | CLP289.00 | CLP576.34 | 49.9% |

| Befesa (XTRA:BFSA) | €22.32 | €44.53 | 49.9% |

| Visional (TSE:4194) | ¥8394.00 | ¥16975.49 | 50.6% |

| First Advantage (NasdaqGS:FA) | US$19.81 | US$39.49 | 49.8% |

| DoubleVerify Holdings (NYSE:DV) | US$20.77 | US$41.28 | 49.7% |

| QD Laser (TSE:6613) | ¥295.00 | ¥585.61 | 49.6% |

| Carter Bankshares (NasdaqGS:CARE) | US$19.30 | US$38.28 | 49.6% |

| Ryman Healthcare (NZSE:RYM) | NZ$4.20 | NZ$8.35 | 49.7% |

Let's explore several standout options from the results in the screener.

Shenzhen Lifotronic Technology (SHSE:688389)

Overview: Shenzhen Lifotronic Technology Co., Ltd. is involved in the research, development, manufacturing, and marketing of medical devices for diagnostics and clinical medicine in China, with a market cap of CN¥6.94 billion.

Operations: The company generates revenue through its activities in the development, production, and distribution of medical devices focused on diagnostics, clinical applications, skin care, and human health within China.

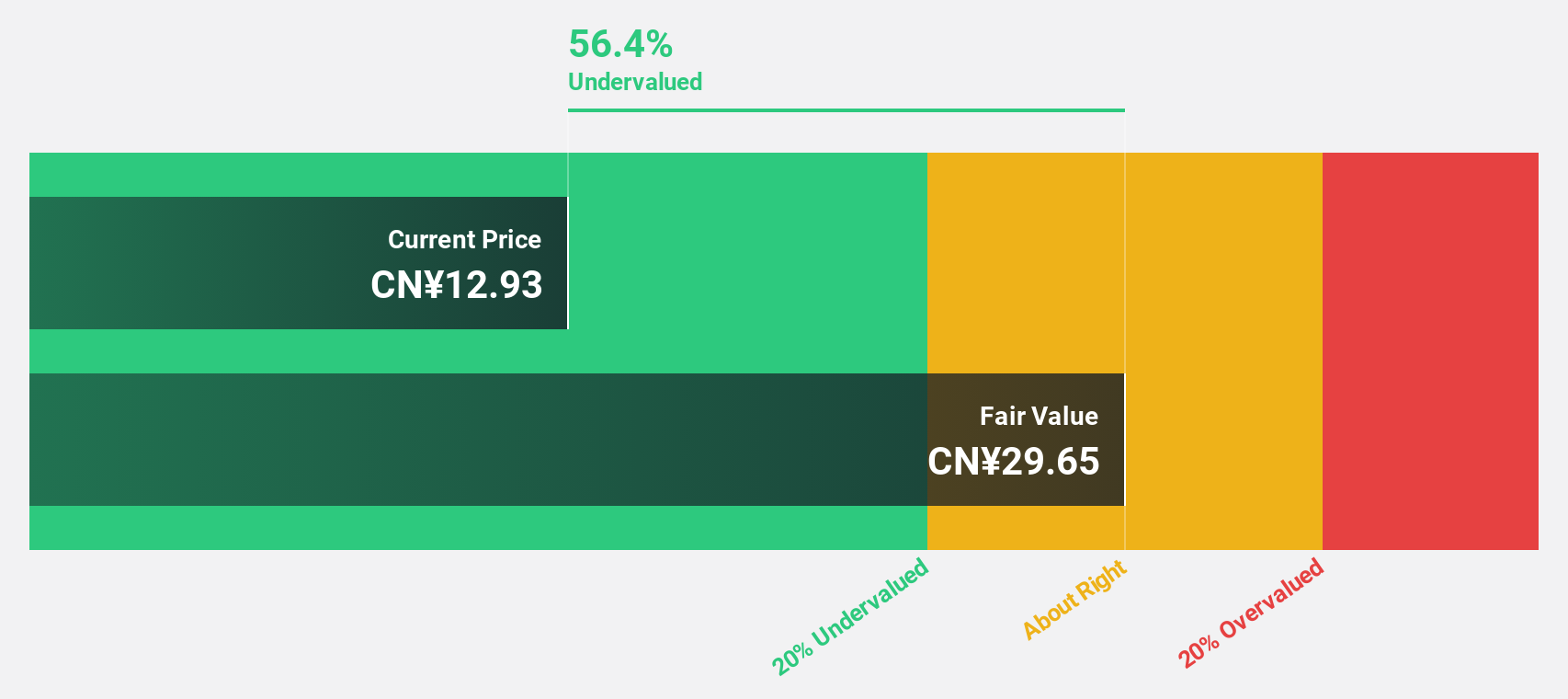

Estimated Discount To Fair Value: 46.9%

Shenzhen Lifotronic Technology is trading at approximately 46.9% below its estimated fair value of CN¥30.89, highlighting potential undervaluation based on cash flows. Recent earnings for the nine months ended September 2024 show sales of CN¥856.79 million and net income of CN¥257.41 million, reflecting solid performance compared to the previous year. Despite revenue growth forecasts being slower than 20% annually, its projected earnings growth remains significant at over 20% per year, offering promising prospects for investors focused on cash flow valuation metrics.

- Our growth report here indicates Shenzhen Lifotronic Technology may be poised for an improving outlook.

- Dive into the specifics of Shenzhen Lifotronic Technology here with our thorough financial health report.

Suwen Electric Energy TechnologyLtd (SZSE:300982)

Overview: Suwen Electric Energy Technology Co., Ltd. operates in the electric energy technology sector and has a market cap of CN¥3.94 billion.

Operations: Suwen Electric Energy Technology Co., Ltd.'s revenue segments are not specified in the provided text.

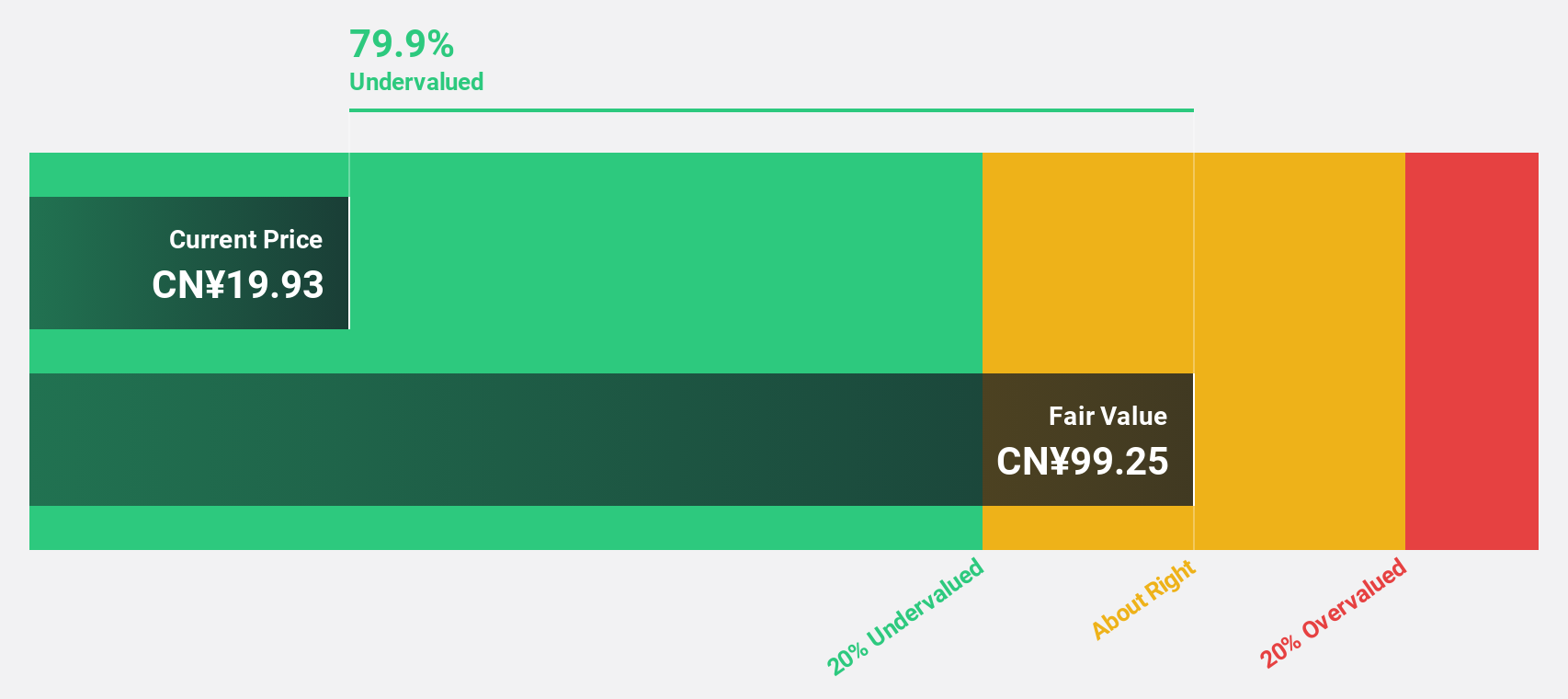

Estimated Discount To Fair Value: 30%

Suwen Electric Energy Technology is trading over 20% below its estimated fair value of CNY 28.66, suggesting undervaluation based on cash flows. Despite a decline in recent earnings, with net income dropping to CNY 53.98 million for the nine months ended September 2024, revenue growth is projected at a robust 34.8% annually. The company has completed significant share buybacks worth CNY 100.07 million, potentially enhancing shareholder value amidst expected profitability improvements over the next three years.

- Our comprehensive growth report raises the possibility that Suwen Electric Energy TechnologyLtd is poised for substantial financial growth.

- Get an in-depth perspective on Suwen Electric Energy TechnologyLtd's balance sheet by reading our health report here.

91APP (TPEX:6741)

Overview: 91APP, Inc. is a Software-as-a-Service company offering retail software cloud and e-commerce value-added services in Taiwan, Hong Kong, and Malaysia with a market cap of NT$10.98 billion.

Operations: The company generates revenue of NT$1.49 billion from its operations in Taiwan, excluding other and intersegment amounts.

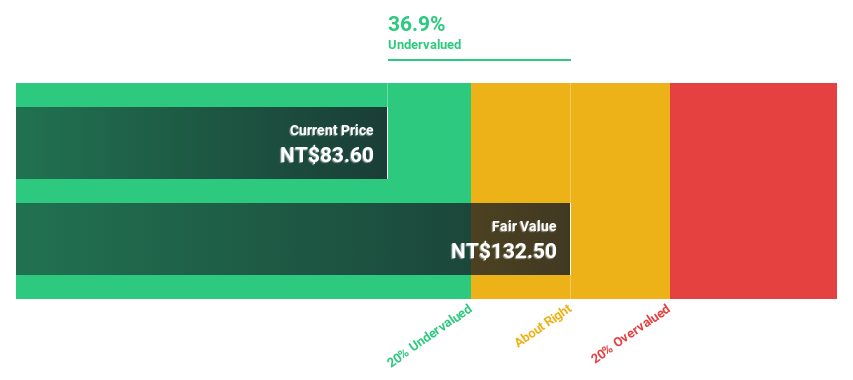

Estimated Discount To Fair Value: 30.4%

91APP is trading over 20% below its estimated fair value of NT$133.12, highlighting potential undervaluation based on cash flows. Despite a slight decline in third-quarter net income to NT$104.27 million, the company has shown strong sales growth and earnings expansion over the past five years. With revenue projected to grow at 18.8% annually and earnings expected to increase by 24.9% per year, it presents significant growth prospects compared to the TW market averages.

- Insights from our recent growth report point to a promising forecast for 91APP's business outlook.

- Unlock comprehensive insights into our analysis of 91APP stock in this financial health report.

Turning Ideas Into Actions

- Access the full spectrum of 903 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688389

Shenzhen Lifotronic Technology

Research, develops, manufactures, and markets medical devices for diagnostics, clinical medicine, skin, and human health related purposes in China.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives