- China

- /

- Metals and Mining

- /

- SHSE:603995

Three Undiscovered Gems And Their Potential To Enhance Your Portfolio

Reviewed by Simply Wall St

In a week where major stock indexes like the S&P 500 and Nasdaq Composite reached record highs, small-cap stocks, as represented by the Russell 2000 Index, faced a decline after previous strong performances. Amid this mixed market environment and with economic indicators such as job growth rebounding in November, investors might find opportunities in lesser-known stocks that have the potential to strengthen their portfolios. Identifying these "undiscovered gems" involves looking for companies with solid fundamentals and growth prospects that align well with current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Ingersoll-Rand (India) | NA | 15.75% | 28.28% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Master Trust | 33.35% | 28.01% | 41.50% | ★★★★★☆ |

| Abans Holdings | 94.08% | 16.32% | 18.24% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

JiangXi Tianxin Pharmaceutical (SHSE:603235)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangxi Tianxin Pharmaceutical Co., Ltd. is engaged in the production and sale of vitamins in China, with a market capitalization of CN¥11.72 billion.

Operations: The company generates revenue primarily through the production and sale of vitamins.

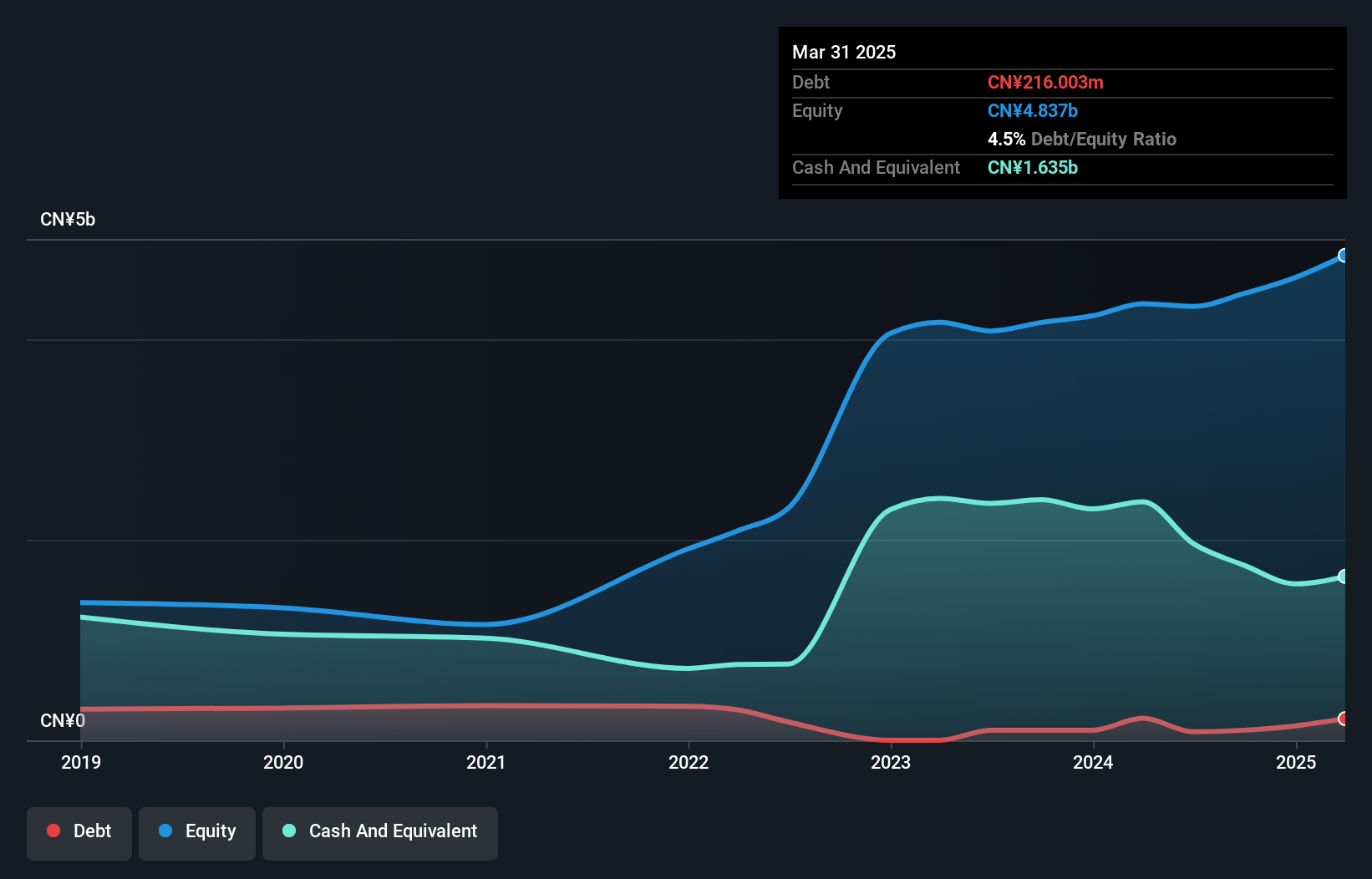

JiangXi Tianxin Pharmaceutical has been making waves with its impressive earnings growth of 15.2% over the past year, outpacing the Personal Products industry, which saw a decrease of 10.1%. The company boasts a reduced debt to equity ratio from 23.9% to 2.3% over five years, indicating strengthened financial health. Despite not being free cash flow positive recently, it holds more cash than total debt, suggesting stability in operations. Recent buybacks included repurchasing shares worth CNY 60 million this year alone, reflecting confidence in its market position and future prospects amidst competitive pricing with a P/E ratio of 21.2x against the CN market's average of 37.6x.

- Take a closer look at JiangXi Tianxin Pharmaceutical's potential here in our health report.

Learn about JiangXi Tianxin Pharmaceutical's historical performance.

Yongjin Technology Group (SHSE:603995)

Simply Wall St Value Rating: ★★★★★☆

Overview: Yongjin Technology Group Co., Ltd. specializes in the research, development, production, and sale of cold-rolled stainless steel sheets and strips with a market capitalization of CN¥7.11 billion.

Operations: Yongjin Technology Group generates revenue primarily from the sale of cold-rolled stainless steel sheets and strips. The company's financial performance is influenced by its ability to manage production costs and optimize its net profit margin, which has shown variability in recent periods.

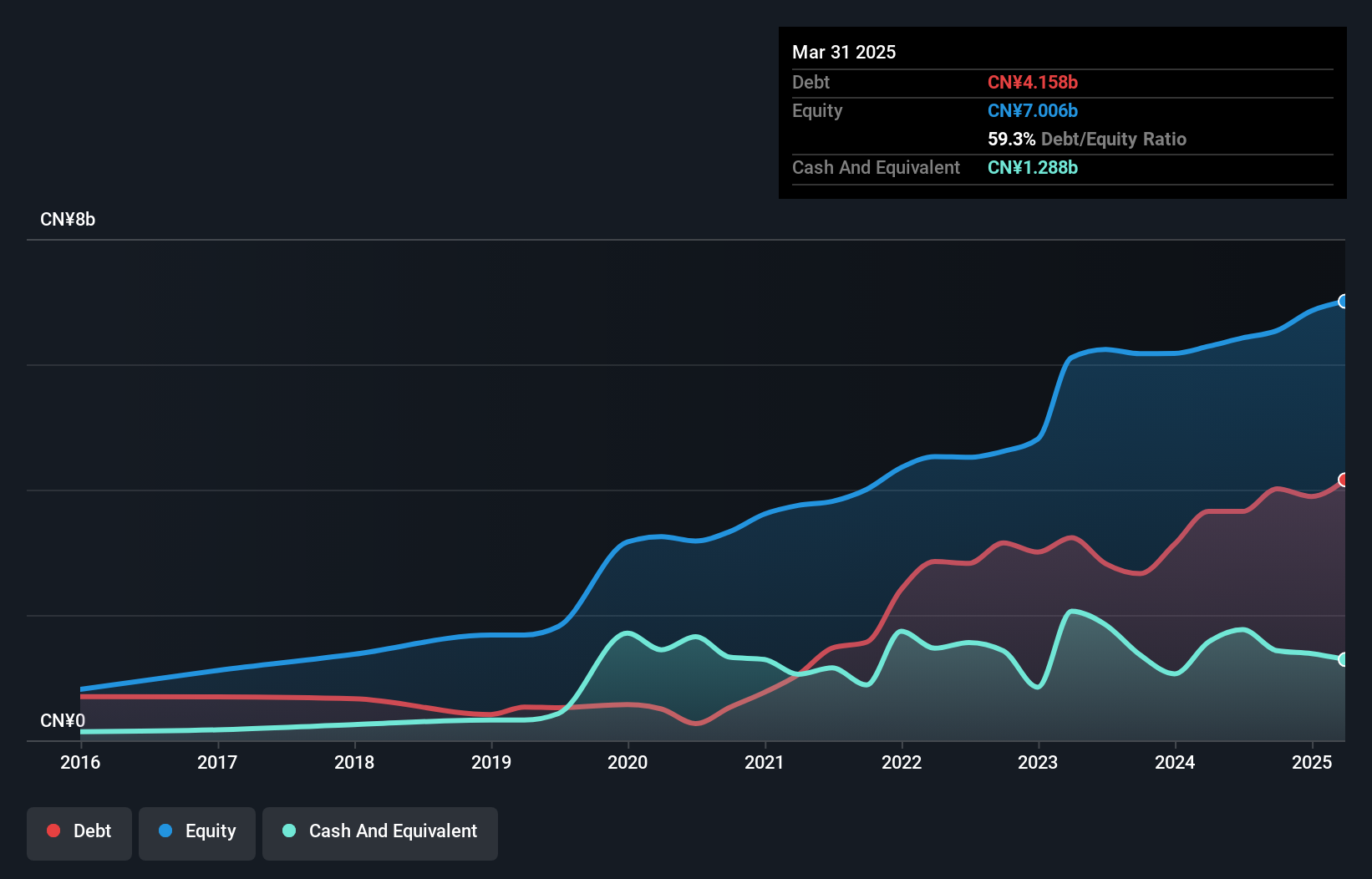

Yongjin Tech, a promising player in its industry, reported impressive growth with sales reaching CNY 30.94 billion for the first nine months of 2024, up from CNY 27.58 billion last year. The net income surged to CNY 583.91 million from CNY 315.43 million, reflecting strong operational performance and strategic positioning in the market. Its price-to-earnings ratio stands attractively at 10.3x compared to the broader CN market's 37.6x, suggesting good relative value for investors seeking opportunities in smaller companies with high-quality earnings and robust growth potential within their sector.

Changsha Tongcheng HoldingsLtd (SZSE:000419)

Simply Wall St Value Rating: ★★★★★★

Overview: Changsha Tongcheng Holdings Co. Ltd operates in commercial retail, comprehensive investment, and tourism hotels sectors in China with a market capitalization of CN¥3.42 billion.

Operations: The company generates revenue primarily from its commercial retail, comprehensive investment, and tourism hotels sectors. It has a market capitalization of CN¥3.42 billion.

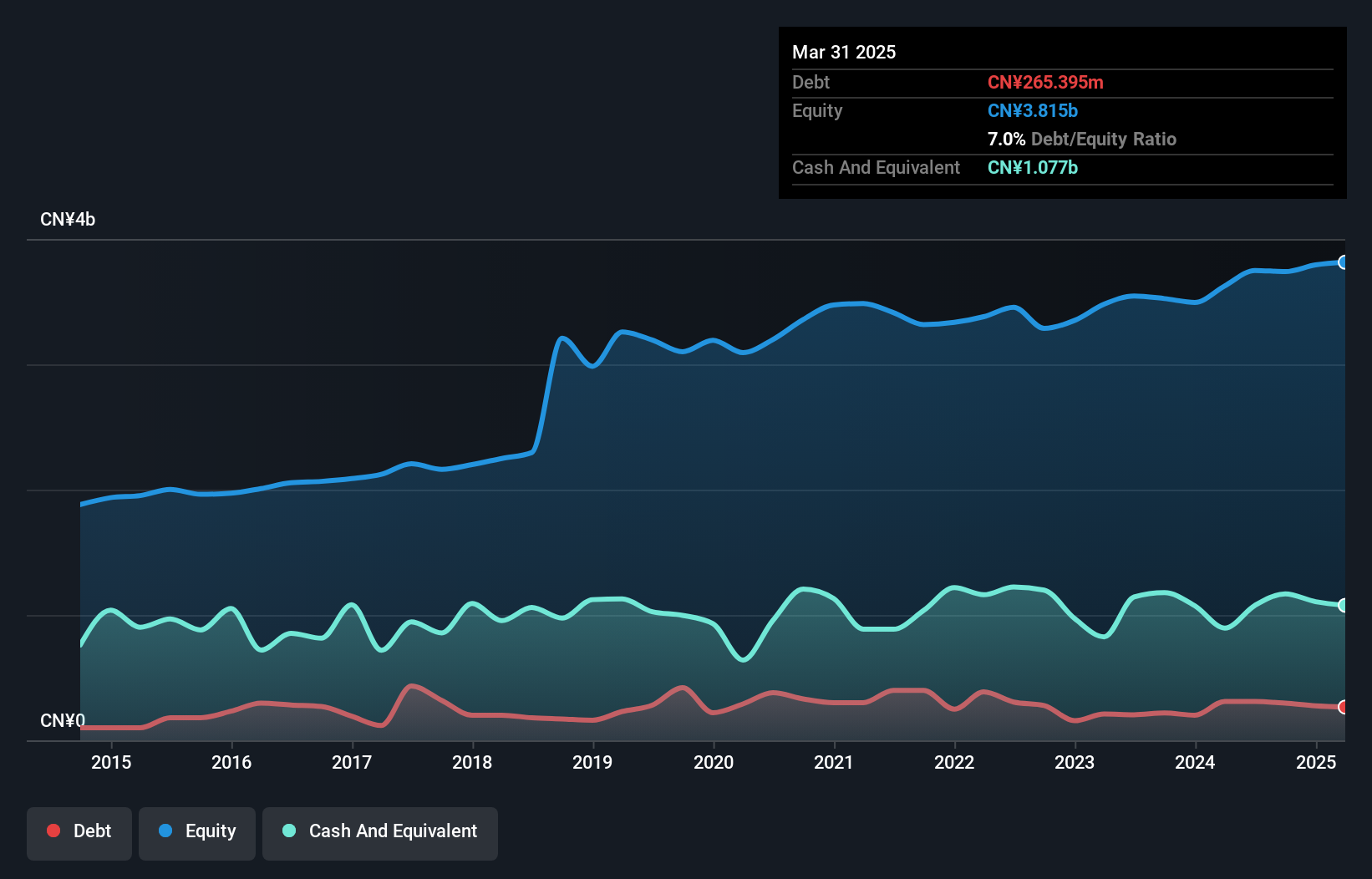

Changsha Tongcheng Holdings, a smaller player in the market, has shown notable financial resilience. Over the past year, earnings surged by 49%, outpacing the Multiline Retail industry which saw a -6.7% change. The company's debt-to-equity ratio improved significantly from 13.5% to 7.9% over five years, indicating better leverage management. Despite a CN¥60 million one-off gain affecting recent results, its price-to-earnings ratio of 22.9x remains attractive compared to the broader CN market at 37.6x. Recent reports reveal net income rose to CN¥146 million for nine months ending September 2024, up from CN¥118 million previously.

Turning Ideas Into Actions

- Gain an insight into the universe of 4629 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603995

Yongjin Technology Group

Engages in the research, development, production, and sale of cold-rolled stainless steel strips.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives