- Japan

- /

- Trade Distributors

- /

- TSE:1514

3 Japanese Dividend Stocks Yielding Up To 4.1%

Reviewed by Simply Wall St

Japan’s stock markets rebounded strongly over a holiday-shortened week, with the Nikkei 225 Index gaining 8.7% and the broader TOPIX Index up 7.9%. Sentiment was boosted by better-than-expected U.S. economic data, which soothed concerns about a recession in the world’s largest economy. In this favorable market environment, dividend stocks can offer an appealing combination of income and potential capital appreciation. Here are three Japanese dividend stocks yielding up to 4.1%.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.19% | ★★★★★★ |

| Globeride (TSE:7990) | 4.11% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.75% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.89% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.50% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.49% | ★★★★★★ |

| Innotech (TSE:9880) | 4.64% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.07% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.90% | ★★★★★★ |

Click here to see the full list of 454 stocks from our Top Japanese Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Sumiseki HoldingsInc (TSE:1514)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumiseki Holdings Inc. (TSE:1514) imports, purchases, and sells coal in Japan with a market cap of ¥51.80 billion.

Operations: Sumiseki Holdings Inc. (TSE:1514) generates revenue primarily from its Coal Business, which accounts for ¥16.94 billion, followed by the Quarrying Business at ¥546 million and the New Material Business at ¥269 million.

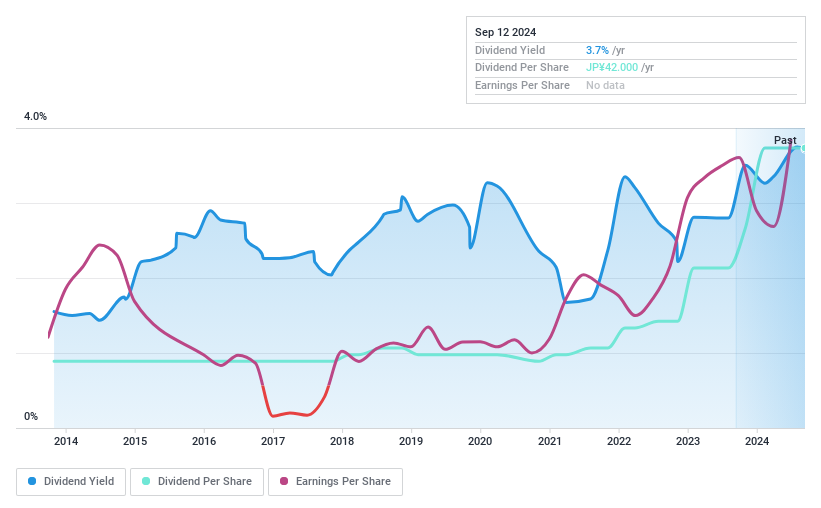

Dividend Yield: 4.2%

Sumiseki Holdings Inc. has a dividend yield of 4.17%, placing it in the top 25% of dividend payers in Japan, with dividends well-covered by earnings (payout ratio: 41.6%) and cash flows (cash payout ratio: 11.5%). Despite its stable payments, the company has only been paying dividends for nine years, indicating a relatively short track record. The stock's price-to-earnings ratio is favorable at 7x compared to the JP market average of 13.3x.

- Navigate through the intricacies of Sumiseki HoldingsInc with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Sumiseki HoldingsInc's share price might be too optimistic.

Systena (TSE:2317)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Systena Corporation operates in Japan, providing solution and framework design, IT services, business solutions, and cloud services with a market cap of ¥146.37 billion.

Operations: Systena Corporation's revenue segments include the Solution Design Business at ¥20.50 billion, Framework Design Business at ¥7.17 billion, and Business Solution Business at ¥28.44 billion.

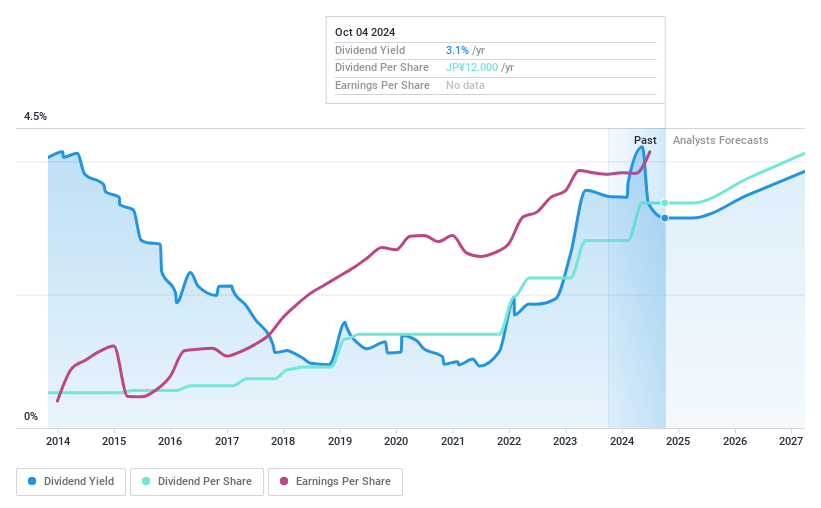

Dividend Yield: 3.1%

Systena Corporation's dividend payments have been stable and growing over the past 10 years, with a payout ratio of 49.4% covered by earnings and a cash payout ratio of 51.9%. The company offers a reliable dividend yield of 3.08%, though below the top tier in Japan. Recent buybacks, including ¥7.96 billion for 6.56% shares, enhance shareholder returns and signal confidence in future performance amidst revised earnings guidance for fiscal year ending March 2025.

- Delve into the full analysis dividend report here for a deeper understanding of Systena.

- According our valuation report, there's an indication that Systena's share price might be on the cheaper side.

Onamba (TSE:5816)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Onamba Co., Ltd. manufactures and distributes wires and components for household electronic appliances, business equipment, and industrial electronic appliances in Japan and internationally, with a market cap of ¥14.78 billion.

Operations: Onamba Co., Ltd. generates revenue through the production and distribution of wires and components for household electronic appliances, business equipment, and industrial electronic appliances in Japan and internationally.

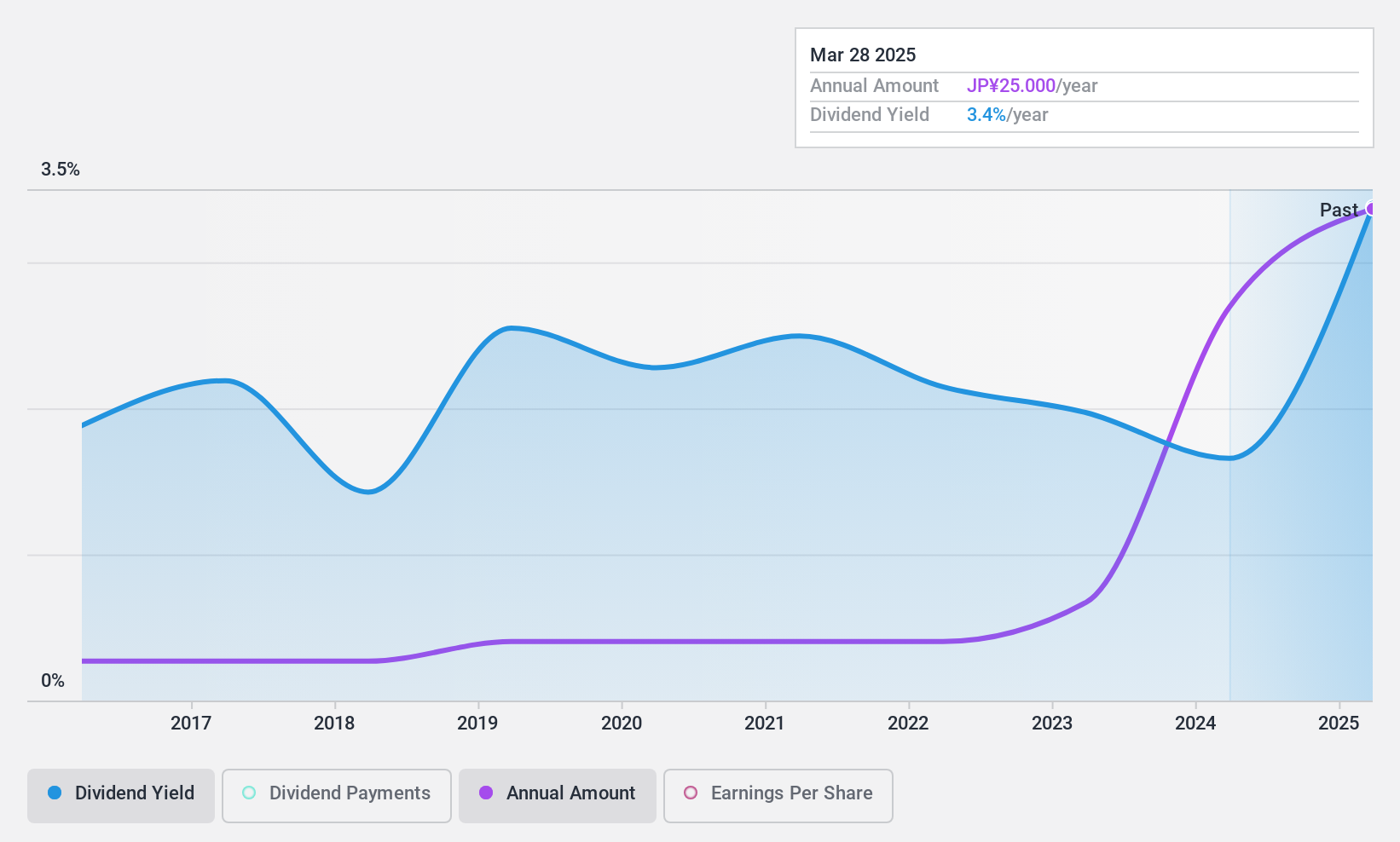

Dividend Yield: 3.5%

Onamba Co., Ltd. has a low payout ratio of 11.8% and a cash payout ratio of 50.3%, indicating dividends are well-covered by earnings and cash flows, despite an unreliable dividend history over the past decade. Earnings have grown at 36.7% annually over five years, but large one-off items impact financial results. The price-to-earnings ratio is favorable at 5.3x compared to the JP market's 13.3x, though its dividend yield of 3.46% lags behind Japan's top tier payers (3.74%).

- Click here to discover the nuances of Onamba with our detailed analytical dividend report.

- The analysis detailed in our Onamba valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Delve into our full catalog of 454 Top Japanese Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1514

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives