- China

- /

- Electronic Equipment and Components

- /

- SZSE:300782

3 Asian Stocks Estimated To Be Priced Below Intrinsic Value By Up To 19.6%

Reviewed by Simply Wall St

Amid escalating trade tensions and fluctuating consumer sentiment, Asian markets have experienced a period of volatility that has captured the attention of global investors. In such an environment, identifying stocks that are potentially undervalued can provide opportunities for investors seeking to capitalize on discrepancies between market prices and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥26.72 | CN¥53.26 | 49.8% |

| Future (TSE:4722) | ¥1697.00 | ¥3344.97 | 49.3% |

| Alexander Marine (TWSE:8478) | NT$141.00 | NT$279.61 | 49.6% |

| People & Technology (KOSDAQ:A137400) | ₩38500.00 | ₩76934.19 | 50% |

| Rorze (TSE:6323) | ¥1219.50 | ¥2430.32 | 49.8% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.15 | CN¥41.59 | 49.1% |

| Kokusai Electric (TSE:6525) | ¥2103.00 | ¥4145.64 | 49.3% |

| GMO internet group (TSE:9449) | ¥3058.00 | ¥5988.45 | 48.9% |

| World Fitness Services (TWSE:2762) | NT$80.00 | NT$156.97 | 49% |

| Innovent Biologics (SEHK:1801) | HK$47.75 | HK$94.14 | 49.3% |

Let's review some notable picks from our screened stocks.

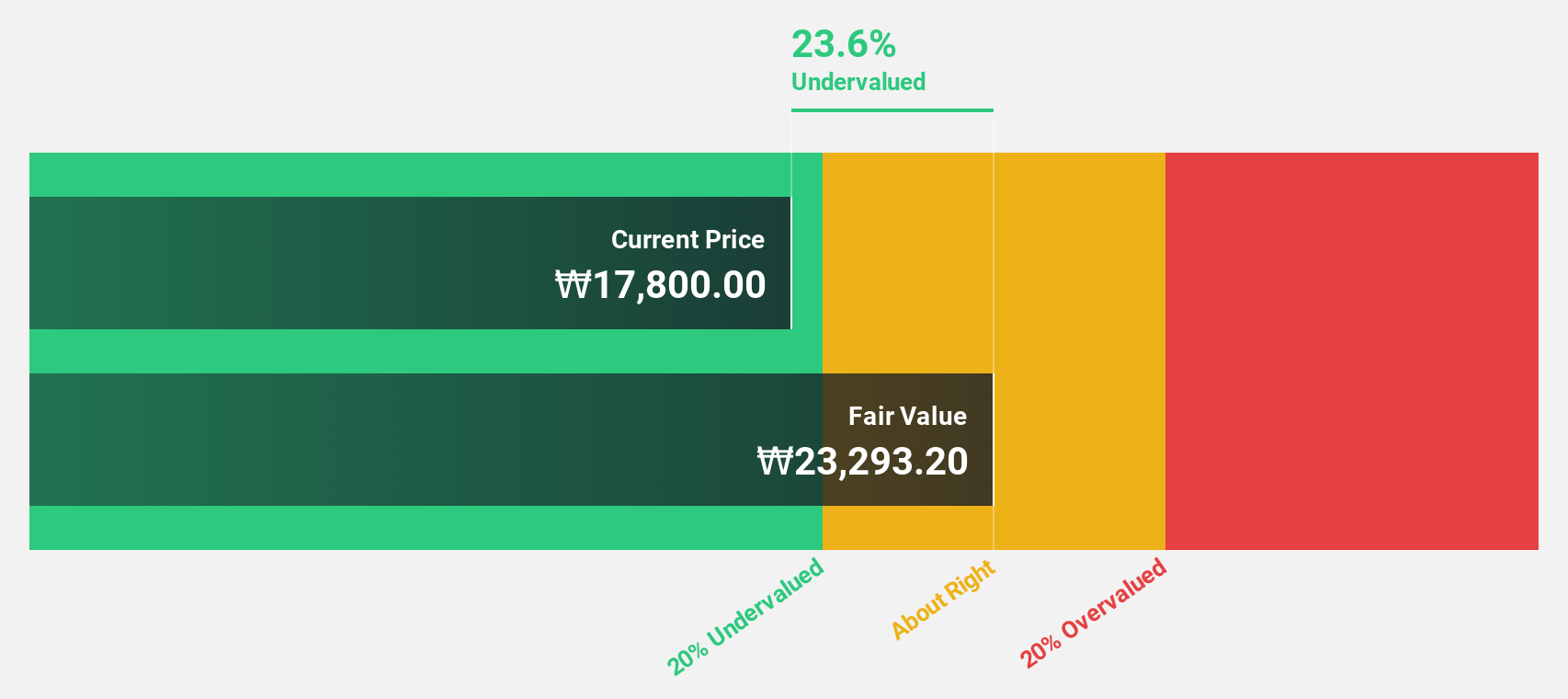

Samsung Heavy Industries (KOSE:A010140)

Overview: Samsung Heavy Industries Co., Ltd. operates globally in shipbuilding, offshore, and energy and infrastructure sectors with a market cap of approximately ₩12.39 trillion.

Operations: The company's revenue segments consist of Joseon Maritime at ₩9.31 trillion and Construction at ₩791.65 billion.

Estimated Discount To Fair Value: 17%

Samsung Heavy Industries is trading at ₩14,500, approximately 17% below its estimated fair value of ₩17,463.21. The company recently became profitable, reporting a net income of KRW 63.88 billion for 2024 compared to a loss the previous year. Earnings are forecast to grow significantly at over 50% annually for the next three years, although revenue growth is slower than 20%. Interest payments remain poorly covered by earnings despite these improvements.

- Our expertly prepared growth report on Samsung Heavy Industries implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Samsung Heavy Industries' balance sheet by reading our health report here.

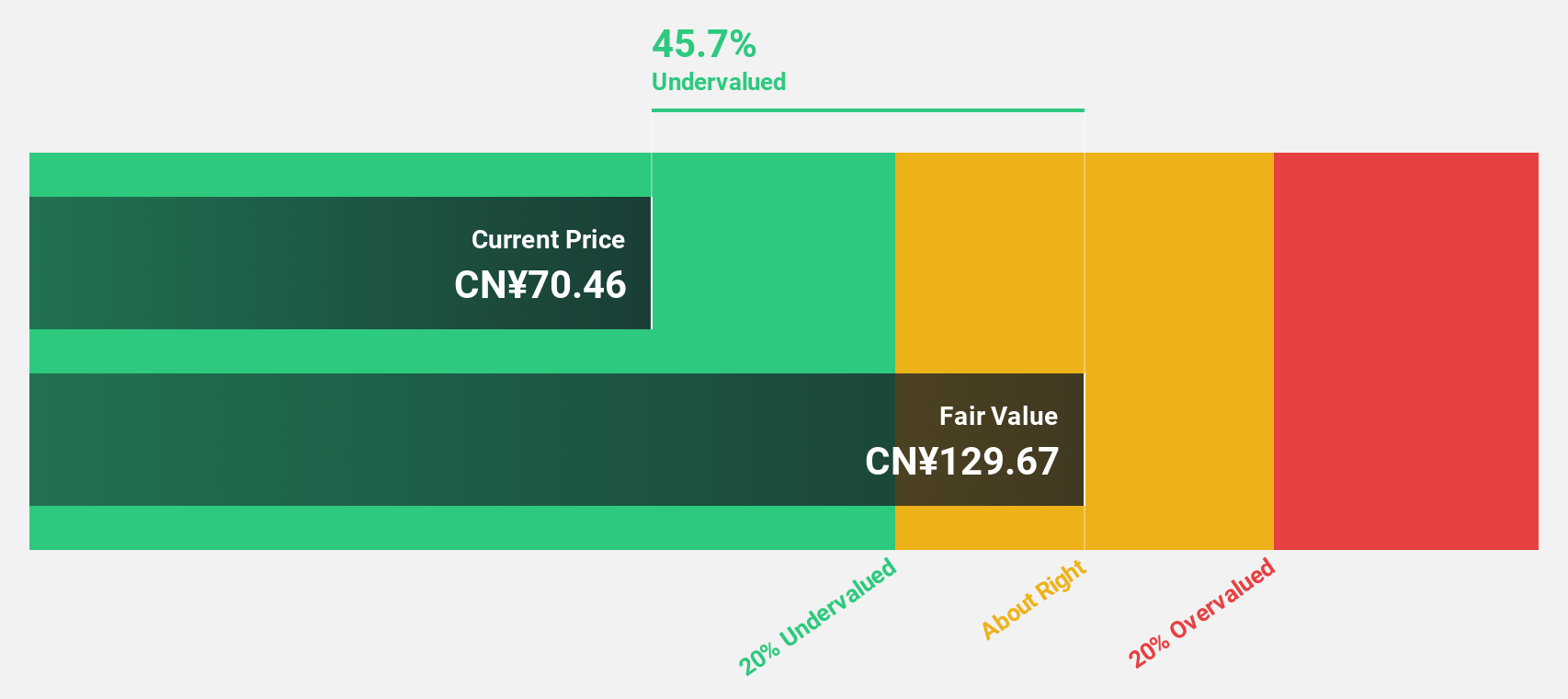

Maxscend Microelectronics (SZSE:300782)

Overview: Maxscend Microelectronics Company Limited is involved in the research, development, production, and sale of radio frequency integrated circuits in China with a market cap of CN¥45.66 billion.

Operations: The company's revenue is primarily derived from merchandise sales, which amount to CN¥4.47 billion, with additional income from premium services at CN¥1.55 million and IP authorization and services totaling CN¥6.79 million.

Estimated Discount To Fair Value: 19%

Maxscend Microelectronics is trading at CNY 85.42, below its estimated fair value of CNY 105.43, suggesting undervaluation based on cash flows. Despite a sharp decline in net income to CNY 401.83 million from the previous year, earnings are projected to grow significantly at 28.91% annually over the next three years, outpacing the broader Chinese market's growth rate of 24%. However, profit margins have decreased and return on equity is forecasted to be low at 11.7%.

- Our earnings growth report unveils the potential for significant increases in Maxscend Microelectronics' future results.

- Take a closer look at Maxscend Microelectronics' balance sheet health here in our report.

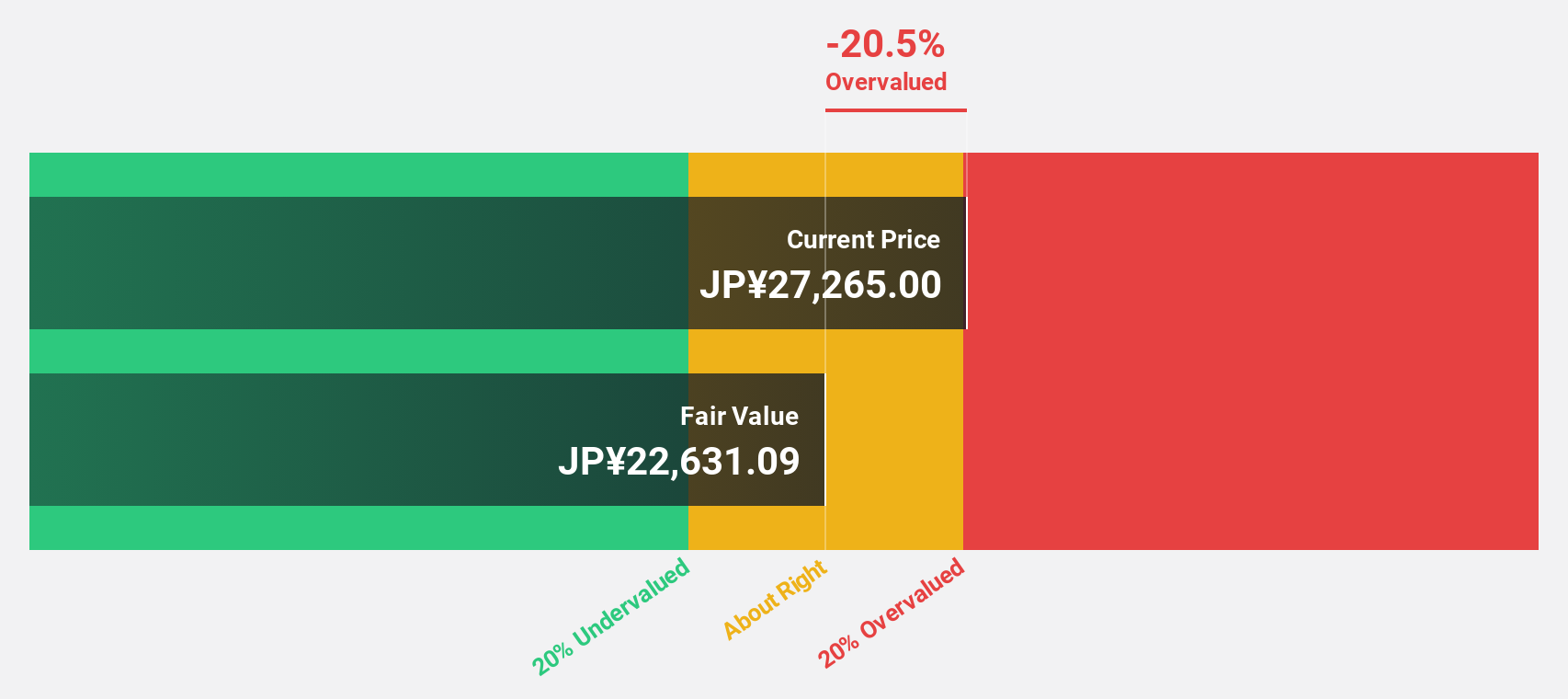

Tokyo Electron (TSE:8035)

Overview: Tokyo Electron Limited, with a market cap of ¥8.99 trillion, develops, manufactures, and sells semiconductor and flat panel display production equipment globally through its subsidiaries.

Operations: The company's revenue primarily comes from its semiconductor production equipment segment, which generated ¥2.32 trillion.

Estimated Discount To Fair Value: 19.6%

Tokyo Electron's stock, priced at ¥19,640, is trading below its estimated fair value of ¥24,432.69. Despite a volatile share price recently and a dividend not fully covered by free cash flows, earnings are projected to grow faster than the Japanese market at 9.1% annually. The recent strategic alliance with IBM to advance semiconductor technologies for generative AI highlights potential for future growth and innovation in the sector.

- In light of our recent growth report, it seems possible that Tokyo Electron's financial performance will exceed current levels.

- Dive into the specifics of Tokyo Electron here with our thorough financial health report.

Seize The Opportunity

- Get an in-depth perspective on all 273 Undervalued Asian Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300782

Maxscend Microelectronics

Engages in the research, development, production, and sale of radio frequency integrated circuits in the People’s Republic of China.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives