- Japan

- /

- Semiconductors

- /

- TSE:6966

Not Many Are Piling Into Mitsui High-tec, Inc. (TSE:6966) Stock Yet As It Plummets 27%

The Mitsui High-tec, Inc. (TSE:6966) share price has fared very poorly over the last month, falling by a substantial 27%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 62% loss during that time.

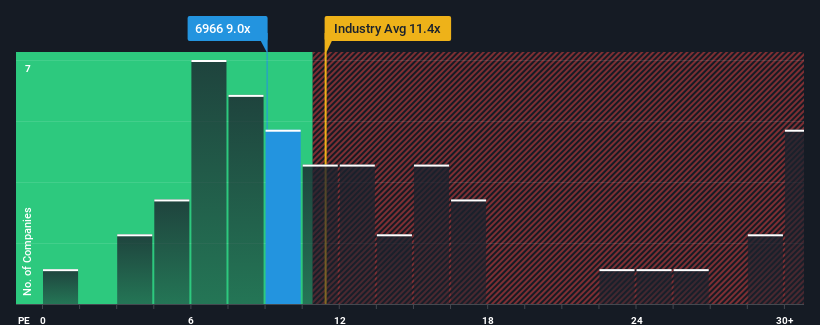

Since its price has dipped substantially, Mitsui High-tec's price-to-earnings (or "P/E") ratio of 9x might make it look like a buy right now compared to the market in Japan, where around half of the companies have P/E ratios above 13x and even P/E's above 20x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

While the market has experienced earnings growth lately, Mitsui High-tec's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Mitsui High-tec

Is There Any Growth For Mitsui High-tec?

In order to justify its P/E ratio, Mitsui High-tec would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 21% decrease to the company's bottom line. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 9.4% per year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the market is forecast to expand by 9.5% per year, which is not materially different.

With this information, we find it odd that Mitsui High-tec is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Mitsui High-tec's P/E

Mitsui High-tec's P/E has taken a tumble along with its share price. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Mitsui High-tec's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Mitsui High-tec (of which 1 doesn't sit too well with us!) you should know about.

If you're unsure about the strength of Mitsui High-tec's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6966

Mitsui High-tec

Produces and sells lead frames, precision tools, motor cores, and surface grinders for the electronics, automobile, and industrial machinery industries in Japan, China, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026