- Japan

- /

- Semiconductors

- /

- TSE:6963

ROHM's New Automotive Switches Could Be a Game Changer for ROHM (TSE:6963)

Reviewed by Sasha Jovanovic

- In late September 2025, ROHM Semiconductor introduced six new high-side smart switches designed for automotive applications, featuring highly accurate current sensing, low ON resistance, and advanced diagnostic functions for improved load and subsystem protection.

- This product line directly addresses the evolving safety and efficiency requirements of modern automotive zonal controllers, positioning ROHM to support greater electrification and the transition away from mechanical fuses.

- We'll examine how ROHM's enhanced high-capacitance load driving capability strengthens its investment case in automotive semiconductors.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

ROHM Investment Narrative Recap

To own ROHM stock today, an investor must have conviction in the company’s ability to meet the rising global demand for advanced automotive semiconductors, even amid persistent profitability pressures and sector headwinds. The launch of ROHM’s new automotive smart switches marks incremental progress toward supporting electrification, but given ongoing challenges with net sales and margins, its effect on the near-term turnaround remains limited while execution risk and market weakness linger.

One recent announcement that complements this product launch is the April partnership with Schaeffler for mass production of SiC MOSFET-based EV inverters, reinforcing ROHM's push into next-generation automotive power solutions and innovation around EV electrification, one of the business’s clearest mid-term catalysts.

However, it’s crucial to recognize that, in contrast, the risk of slipping further behind profit targets remains, especially if inventory adjustments in core markets persist longer than expected...

Read the full narrative on ROHM (it's free!)

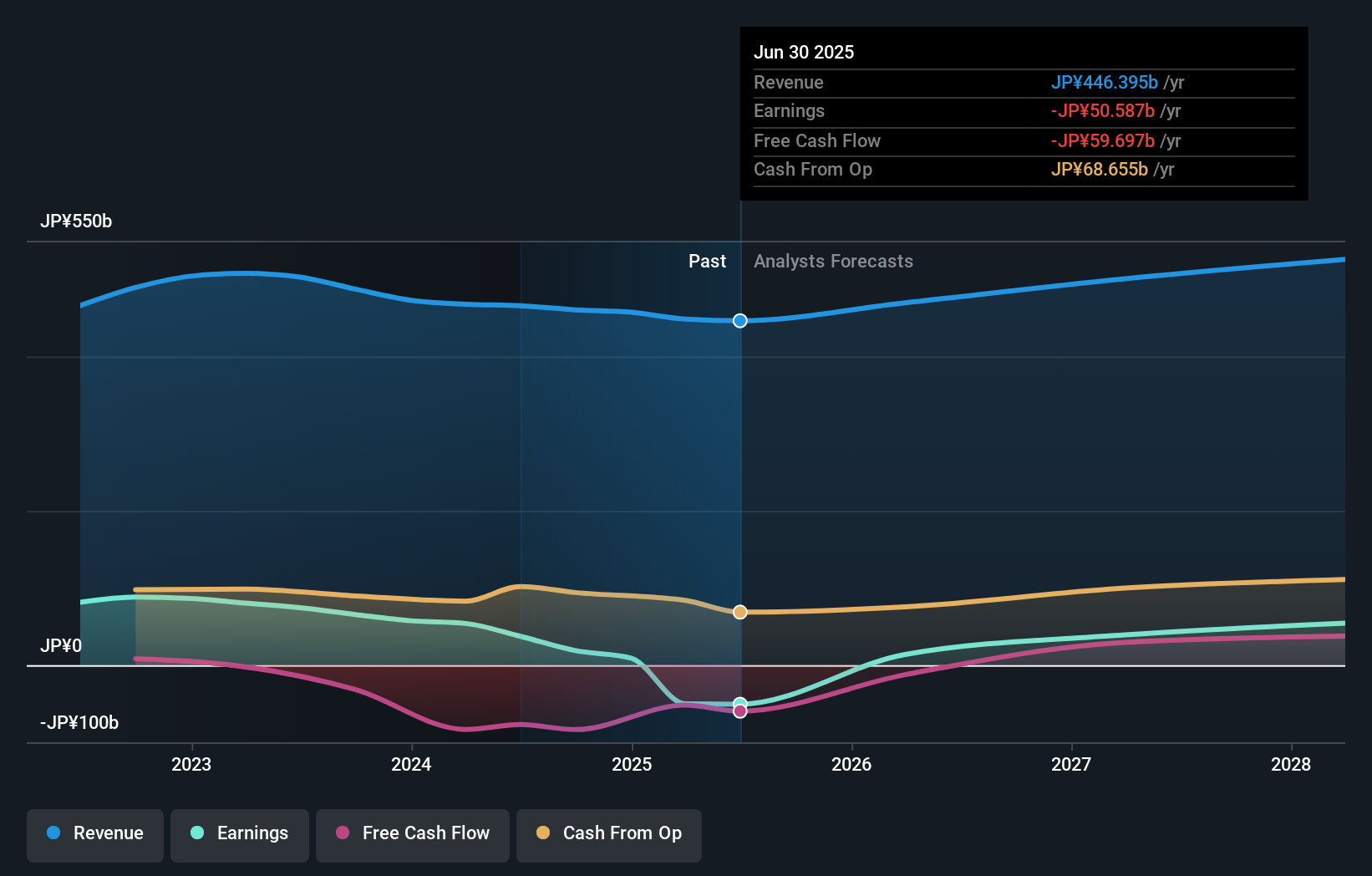

ROHM's narrative projects ¥543.4 billion revenue and ¥54.1 billion earnings by 2028. This requires 6.8% yearly revenue growth and an earnings increase of ¥104.7 billion from the current earnings of ¥-50.6 billion.

Uncover how ROHM's forecasts yield a ¥2149 fair value, a 6% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have produced three fair value estimates for ROHM ranging from ¥1,185 to ¥2,149. While the focus is on electrification and new automotive products, these diverse opinions highlight just how much expectations about earnings recovery and sector stability can shape your investment view, see how other investors interpret the risks and upside.

Explore 3 other fair value estimates on ROHM - why the stock might be worth 48% less than the current price!

Build Your Own ROHM Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ROHM research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free ROHM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ROHM's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6963

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives