Last Update 22 Dec 25

6963: New Product Pipeline And Guidance Revision Will Support Balanced Profit Outlook

Analysts have modestly raised their price target on ROHM, reflecting slightly higher long term growth and profitability expectations. They are maintaining a fair value estimate of ¥2,204.55 per share, as incremental improvements in revenue growth and profit margins offset a marginally higher discount rate and a slightly lower assumed future P E multiple.

What's in the News

- Launched two new brushed DC motor driver ICs, BD60210FV and BD64950EFJ, targeting energy efficient home appliances and compact industrial equipment. These devices feature ultra low standby current and versatile packaging for design reuse (Key Developments).

- Began mass production of the SCT40xxDLL series of SiC MOSFETs in compact TOLL packages. This series is designed to improve thermal performance and power density for AI servers, ESS, and slim industrial power supplies (Key Developments).

- Released the RPR 0730 compact analog optical sensor capable of detecting fast moving, fine objects for printers and conveyor systems. The sensor is intended to support higher speed and precision in industrial automation (Key Developments).

- Developed the RS7P200BM 100V power MOSFET optimized for 48V hot swap circuits in AI servers. It combines low on resistance with a wide safe operating area to support efficiency and reliability (Key Developments).

- Revised fiscal year 2026 guidance upward, projecting higher net sales and profit despite macroeconomic and input cost headwinds. The revision is described as being supported by strong first half performance (Key Developments).

Valuation Changes

- Fair value estimate remains unchanged at ¥2,204.55 per share, indicating that modest fundamental improvements are viewed as broadly offsetting a higher required return.

- The discount rate has risen slightly from 10.83 percent to 10.98 percent, reflecting a marginally higher perceived risk or cost of capital.

- Revenue growth has edged up from 7.03 percent to 7.10 percent annually, signaling slightly stronger long term top line expectations.

- The net profit margin has increased modestly from 8.95 percent to 8.99 percent, pointing to a small improvement in expected profitability.

- The future P/E multiple has eased slightly from 22.92x to 22.85x, suggesting a marginally more conservative valuation multiple despite stable fair value.

Key Takeaways

- Expansion in SiC power devices and optimized investment aims to boost revenue, align with market demand, and improve returns.

- Strategic partnerships and organizational restructuring target enhanced sales, better customer alignment, and increased profitability through cost reductions and improved efficiencies.

- The company faces revenue challenges due to declines in industrial and automotive segments, inventory issues, and unachieved cost reductions impacting profitability.

Catalysts

About ROHM- Manufactures and sells electronic components worldwide.

- ROHM is planning to increase its production capacity and efficiency for SiC (silicon carbide) power devices, correlating with expected battery EV market growth, which should enhance revenue and earnings as demand eventually picks up.

- The company is implementing a new organizational structure to better cater to customer needs and market applications, which aims to improve sales and potentially increase net margins by offering more integrated, solution-based proposals.

- Significant cost reduction measures are being implemented, including a plan to decrease annual fixed costs by ¥20 to 30 billion over the next three years and increased outsourcing, which is expected to improve net margins and profitability.

- ROHM is deferring certain capital expenditures and optimizing investment efficiency, aiming to align investments with demand trends, which should stabilize earnings and improve return on investment as market conditions improve.

- Strategic partnerships, such as with DENSO and potential alliances with Toshiba, are poised to enhance collaborative opportunities and could lead to steady revenue increases and strengthen competitive positioning in the semiconductor market.

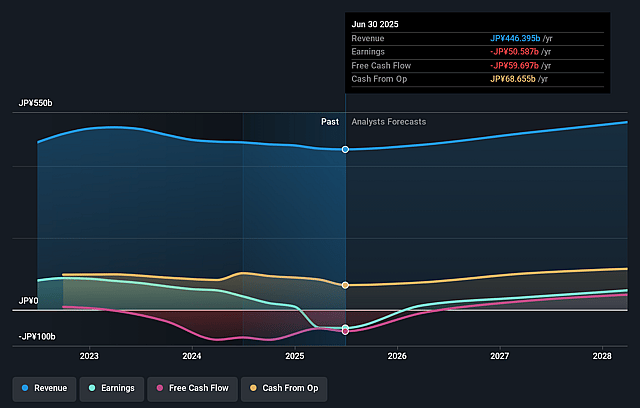

ROHM Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ROHM's revenue will grow by 6.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -11.3% today to 10.0% in 3 years time.

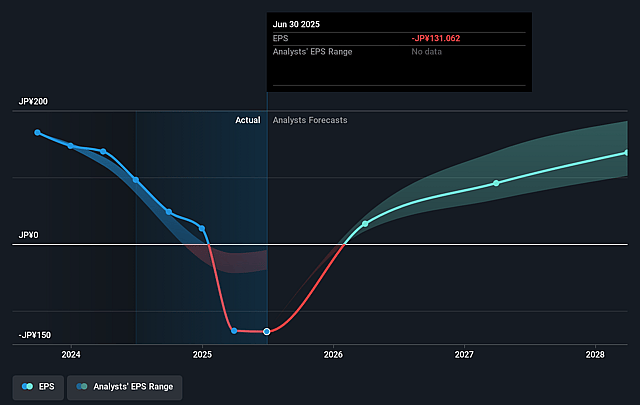

- Analysts expect earnings to reach ¥54.1 billion (and earnings per share of ¥137.9) by about September 2028, up from ¥-50.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting ¥72.0 billion in earnings, and the most bearish expecting ¥39.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.9x on those 2028 earnings, up from -16.3x today. This future PE is greater than the current PE for the JP Semiconductor industry at 14.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.52%, as per the Simply Wall St company report.

ROHM Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A significant decline in the industrial market segment, with a year-on-year drop of 28.1%, continues due to ongoing inventory adjustments, impacting overall revenue prospects.

- The operating profit turned negative due to a combination of inventory impacts and increased fixed expenses, which are not being offset by the expected cost reduction measures, affecting net margins and earnings.

- The downward revision of net sales and operating profit forecasts, with an operating loss expected, underscores challenges in meeting initial financial targets and managing expenses effectively, impacting earnings and profitability.

- A slowdown in the battery EV market, particularly in China, limits the growth potential for SiC power devices, which are critical for future revenue growth in the automotive sector.

- The continued dependency and exposure to declines in the Japanese automotive and industrial market segments, coupled with a weak sales forecast, could lead to lower revenue stability and financial stress.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of ¥1966.364 for ROHM based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ¥2550.0, and the most bearish reporting a price target of just ¥1300.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be ¥543.4 billion, earnings will come to ¥54.1 billion, and it would be trading on a PE ratio of 18.9x, assuming you use a discount rate of 10.5%.

- Given the current share price of ¥2142.5, the analyst price target of ¥1966.36 is 9.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on ROHM?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.