The board of ROHM Co., Ltd. (TSE:6963) has announced that it will pay a dividend of ¥25.00 per share on the 27th of June. This means the annual payment is 3.2% of the current stock price, which is above the average for the industry.

See our latest analysis for ROHM

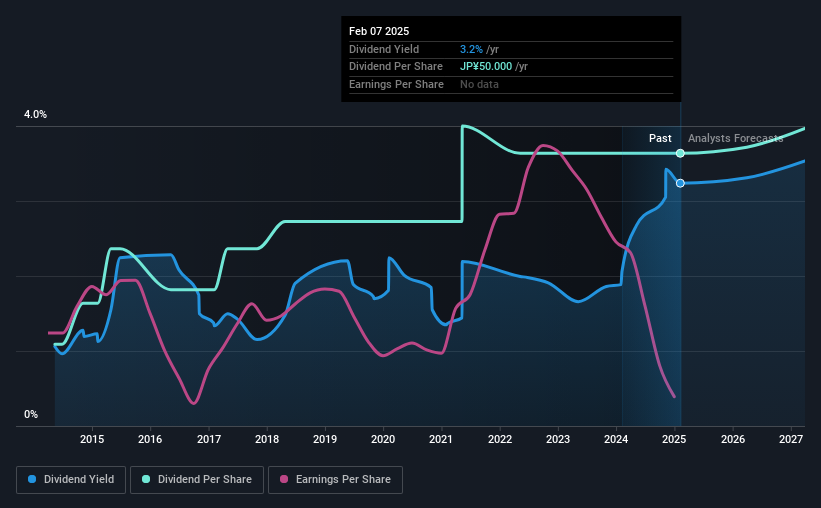

Estimates Indicate ROHM's Could Struggle to Maintain Dividend Payments In The Future

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Based on the last payment, earnings were actually smaller than the dividend, and the company was actually spending more cash than it was making. Paying out such a large dividend compared to earnings while also not generating any free cash flow would definitely be difficult to keep up.

Earnings per share is forecast to rise by 45.0% over the next year. However, if the dividend continues along recent trends, it could start putting pressure on the balance sheet with the payout ratio reaching 156% over the next year.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2015, the annual payment back then was ¥15.00, compared to the most recent full-year payment of ¥50.00. This works out to be a compound annual growth rate (CAGR) of approximately 13% a year over that time. ROHM has grown distributions at a rapid rate despite cutting the dividend at least once in the past. Companies that cut once often cut again, so we would be cautious about buying this stock solely for the dividend income.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. ROHM's earnings per share has shrunk at 16% a year over the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

We're Not Big Fans Of ROHM's Dividend

Overall, while some might be pleased that the dividend wasn't cut, we think this may help ROHM make more consistent payments in the future. The company isn't making enough to be paying as much as it is, and the other factors don't look particularly promising either. Overall, the dividend is not reliable enough to make this a good income stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Just as an example, we've come across 4 warning signs for ROHM you should be aware of, and 1 of them doesn't sit too well with us. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6963

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026