- Taiwan

- /

- Electrical

- /

- TWSE:1519

3 Stocks That May Be Undervalued By Up To 10.3%

Reviewed by Simply Wall St

As global markets continue to reach record highs, driven by strong performances from major indices like the S&P 500 and Dow Jones Industrial Average, investors are keenly observing the impact of geopolitical developments and domestic policies. Amidst this environment, identifying stocks that may be undervalued can present unique opportunities for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Türkiye Sise Ve Cam Fabrikalari (IBSE:SISE) | TRY41.22 | TRY82.15 | 49.8% |

| Giant Biogene Holding (SEHK:2367) | HK$48.30 | HK$96.27 | 49.8% |

| PharmaResearch (KOSDAQ:A214450) | ₩219500.00 | ₩419471.41 | 47.7% |

| DAEDUCK ELECTRONICS (KOSE:A353200) | ₩14670.00 | ₩28008.09 | 47.6% |

| Power Root Berhad (KLSE:PWROOT) | MYR1.46 | MYR2.92 | 50% |

| Enento Group Oyj (HLSE:ENENTO) | €18.02 | €35.91 | 49.8% |

| EuroGroup Laminations (BIT:EGLA) | €2.726 | €5.42 | 49.7% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €7.84 | €15.60 | 49.7% |

| First Advantage (NasdaqGS:FA) | US$19.37 | US$38.63 | 49.9% |

| AeroVironment (NasdaqGS:AVAV) | US$203.19 | US$404.34 | 49.7% |

We're going to check out a few of the best picks from our screener tool.

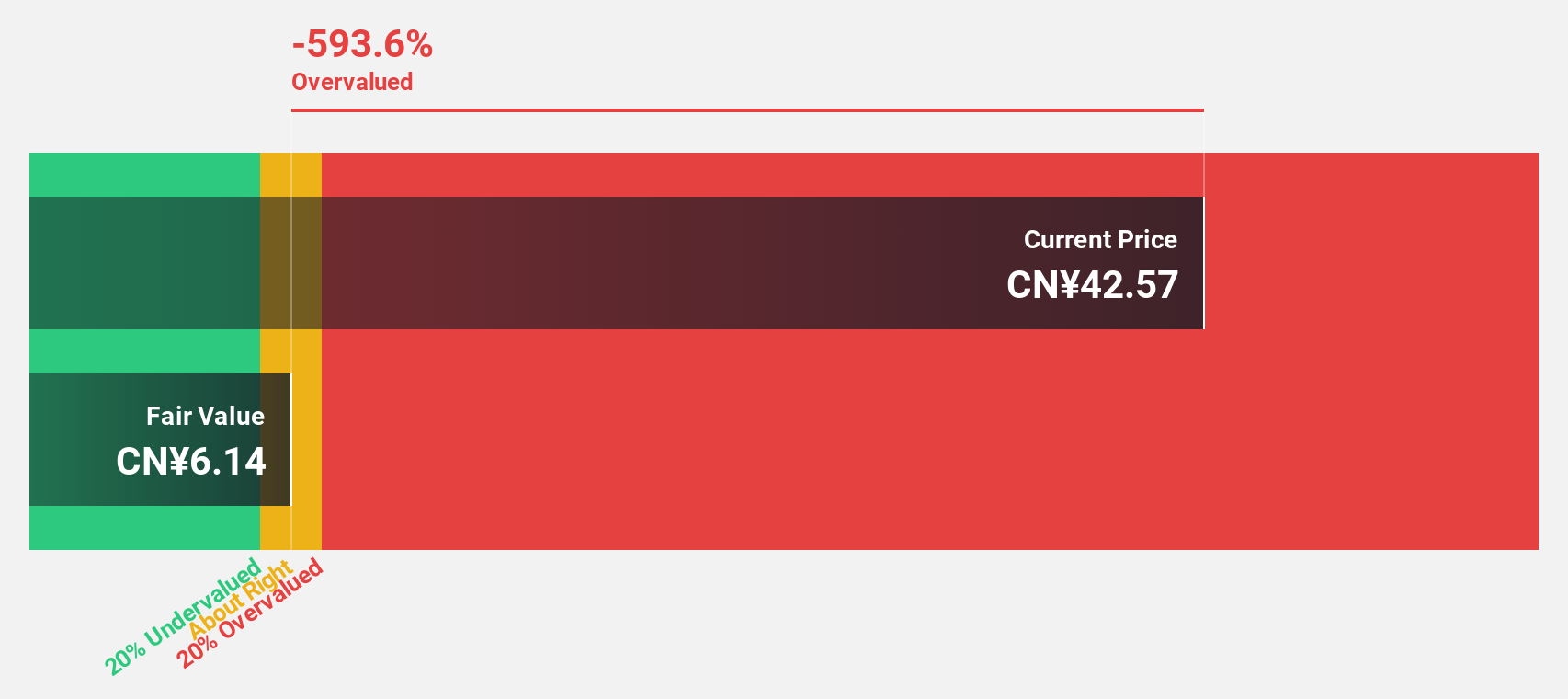

Beijing Easpring Material TechnologyLTD (SZSE:300073)

Overview: Beijing Easpring Material Technology Co., Ltd. operates in the materials technology sector and has a market cap of CN¥23.53 billion.

Operations: Revenue segments for SZSE:300073 are not provided in the given text.

Estimated Discount To Fair Value: 25.4%

Beijing Easpring Material Technology appears undervalued, trading at CN¥45.79, below its fair value of CN¥61.36. Despite a volatile share price and recent revenue decline to CN¥5.53 billion from CN¥12.54 billion last year, earnings are forecast to grow significantly by 25.45% annually, with revenue growth outpacing the market at 28.5%. However, the dividend yield of 1.64% is not well covered by free cash flows, indicating potential cash flow challenges despite good relative value compared to peers.

- According our earnings growth report, there's an indication that Beijing Easpring Material TechnologyLTD might be ready to expand.

- Navigate through the intricacies of Beijing Easpring Material TechnologyLTD with our comprehensive financial health report here.

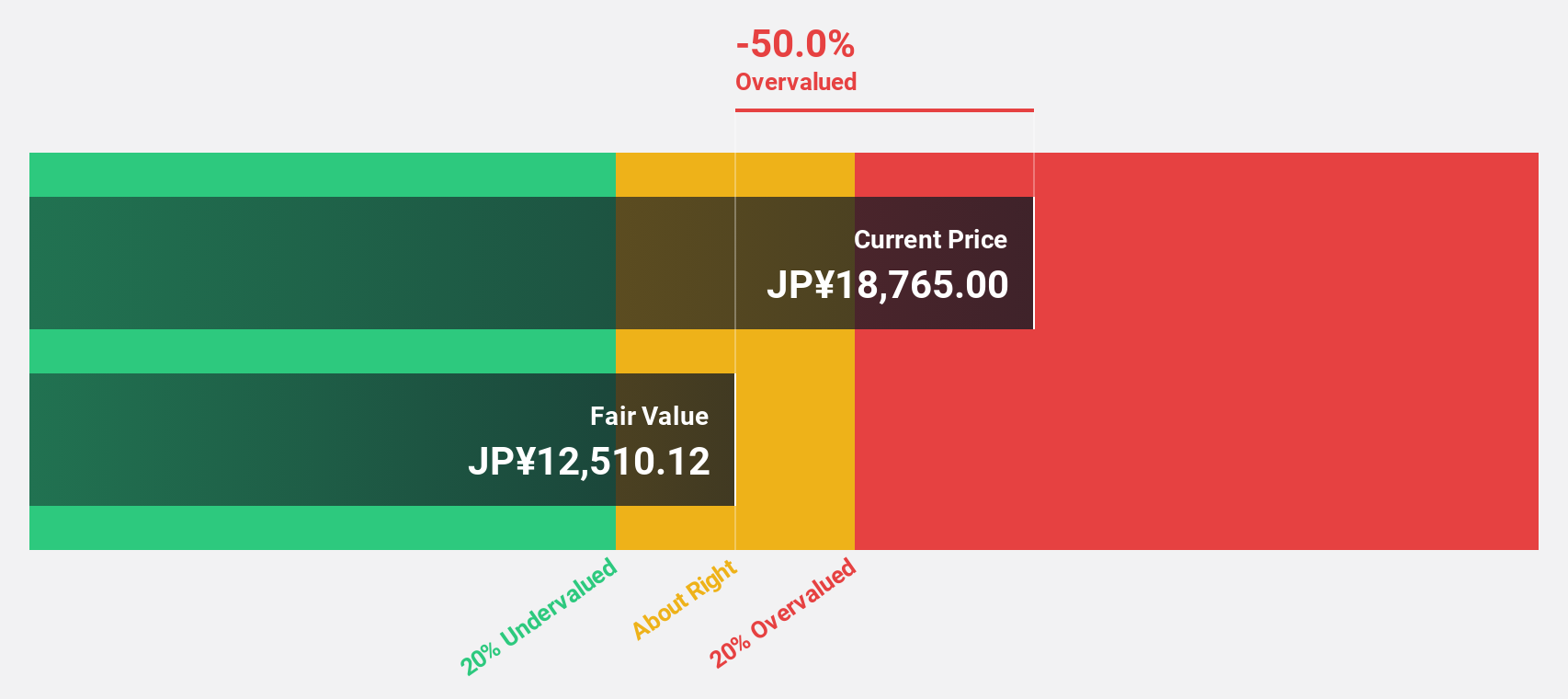

Lasertec (TSE:6920)

Overview: Lasertec Corporation designs, manufactures, and sells inspection and measurement equipment both in Japan and internationally, with a market cap of approximately ¥1.47 trillion.

Operations: The company generates revenue of ¥202.94 billion from its inspection and measurement equipment segment.

Estimated Discount To Fair Value: 10.3%

Lasertec is trading at ¥17,035, below its estimated fair value of ¥18,997.1, suggesting it may be undervalued based on cash flows. Earnings grew by 27.9% last year and are forecast to increase by 14.9% annually, outpacing the Japanese market's growth rate of 7.9%. Despite recent share price volatility, Lasertec's high-quality earnings and innovative product developments like SICA108 enhance its competitive position in the semiconductor inspection sector.

- Our expertly prepared growth report on Lasertec implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Lasertec with our detailed financial health report.

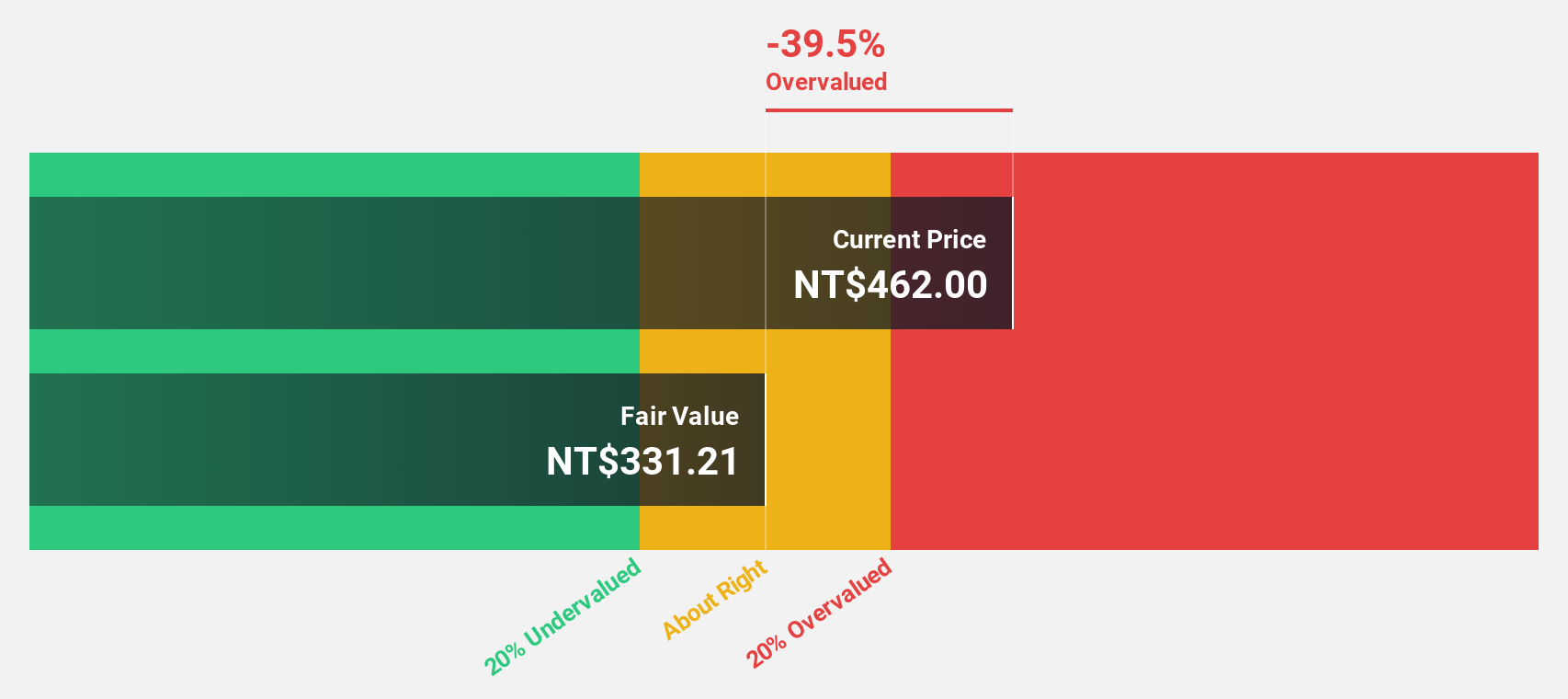

Fortune Electric (TWSE:1519)

Overview: Fortune Electric Co., Ltd. manufactures, processes, and sells transformers, inverters, power distribution boards, and high-low voltage switches both in Taiwan and internationally with a market cap of NT$162.54 billion.

Operations: The company's revenue is primarily derived from its Mechanical and Electrical segment, contributing NT$16.96 billion, followed by the General Contracting segment at NT$1.69 billion.

Estimated Discount To Fair Value: 7.0%

Fortune Electric's recent earnings report shows robust growth, with net income rising to TWD 1.23 billion for Q3 2024 from TWD 713 million a year prior. The company's revenue is forecast to grow at an impressive rate of 24.3% annually, surpassing the Taiwan market average. Trading at NT$589, it's slightly undervalued compared to its fair value estimate of NT$633.32 based on discounted cash flow analysis, reflecting strong potential despite share price volatility.

- Upon reviewing our latest growth report, Fortune Electric's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Fortune Electric.

Where To Now?

- Investigate our full lineup of 900 Undervalued Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1519

Fortune Electric

Manufactures, processes, and sells transformers, power distribution boards, and high-low voltage switches in Taiwan and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives