- Japan

- /

- Semiconductors

- /

- TSE:6890

Ferrotec Corporation (TSE:6890) Soars 34% But It's A Story Of Risk Vs Reward

Despite an already strong run, Ferrotec Corporation (TSE:6890) shares have been powering on, with a gain of 34% in the last thirty days. The last 30 days bring the annual gain to a very sharp 43%.

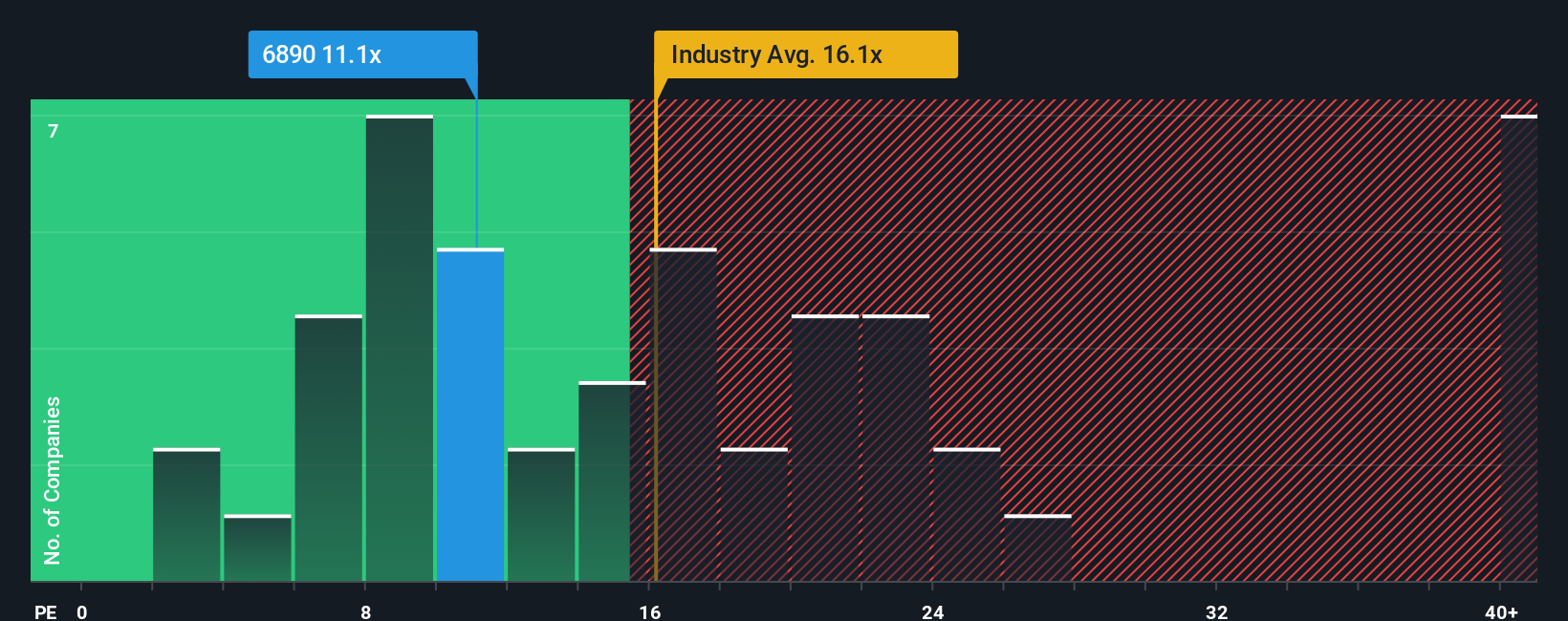

Even after such a large jump in price, Ferrotec may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 11.1x, since almost half of all companies in Japan have P/E ratios greater than 14x and even P/E's higher than 22x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times haven't been advantageous for Ferrotec as its earnings have been rising slower than most other companies. It seems that many are expecting the uninspiring earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

See our latest analysis for Ferrotec

How Is Ferrotec's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Ferrotec's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a decent 3.6% gain to the company's bottom line. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 50% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 19% each year as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 8.9% per year growth forecast for the broader market.

In light of this, it's peculiar that Ferrotec's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Ferrotec's P/E?

The latest share price surge wasn't enough to lift Ferrotec's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Ferrotec's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you settle on your opinion, we've discovered 2 warning signs for Ferrotec that you should be aware of.

You might be able to find a better investment than Ferrotec. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6890

Ferrotec

Engages in semiconductor equipment-related, electronic device, and other businesses in Japan and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives