- Japan

- /

- Semiconductors

- /

- TSE:6857

Will Advantest's (TSE:6857) Focus on Energy Efficiency Reshape Its Long-Term Competitive Edge?

Reviewed by Sasha Jovanovic

- Advantest Corporation recently launched its Power Optimization Solution (APOS) for the V93000 system-on-chip test platform, aiming to enhance energy efficiency and support sustainability objectives for semiconductor manufacturers and test providers.

- This release introduces real-time power management and centralized reporting features, with early customer deployments indicating both reduced test costs and meaningful progress toward environmental targets.

- We'll explore how Advantest's focus on energy-efficient semiconductor testing solutions could influence its investment outlook and future growth narrative.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Advantest Investment Narrative Recap

To be a shareholder in Advantest, you need to believe that the company's leadership in innovative, energy-efficient semiconductor testing solutions captures ongoing AI and chip complexity trends, while managing cyclical industry swings. The recent launch of the APOS platform adds substance to its sustainability narrative but is unlikely to immediately change the principal short-term catalyst: the timing and scale of next-generation chip testing demand as device transitions play out, nor the key risk of near-term margin and earnings volatility during a projected "digestion" period.

Among recent announcements, the completed share buyback program, totaling 6,643,900 shares for ¥69,999.94 million, stands out; while it reflects ongoing shareholder returns, it doesn't directly alter the short-term outlook shaped by product cycle timing and operational risks. The sustainability-focused product launch delivers another proof-point but does not insulate the company from profit swings tied tightly to demand normalization and the potential for lumpy revenue in the coming quarters.

By contrast, investors should be aware that even the most innovative releases won't shield earnings if the anticipated digestion period...

Read the full narrative on Advantest (it's free!)

Advantest's outlook anticipates ¥1,030.0 billion in revenue and ¥274.7 billion in earnings by 2028. This is based on a 4.4% annual revenue growth rate and an increase of ¥47.2 billion in earnings from the current ¥227.5 billion.

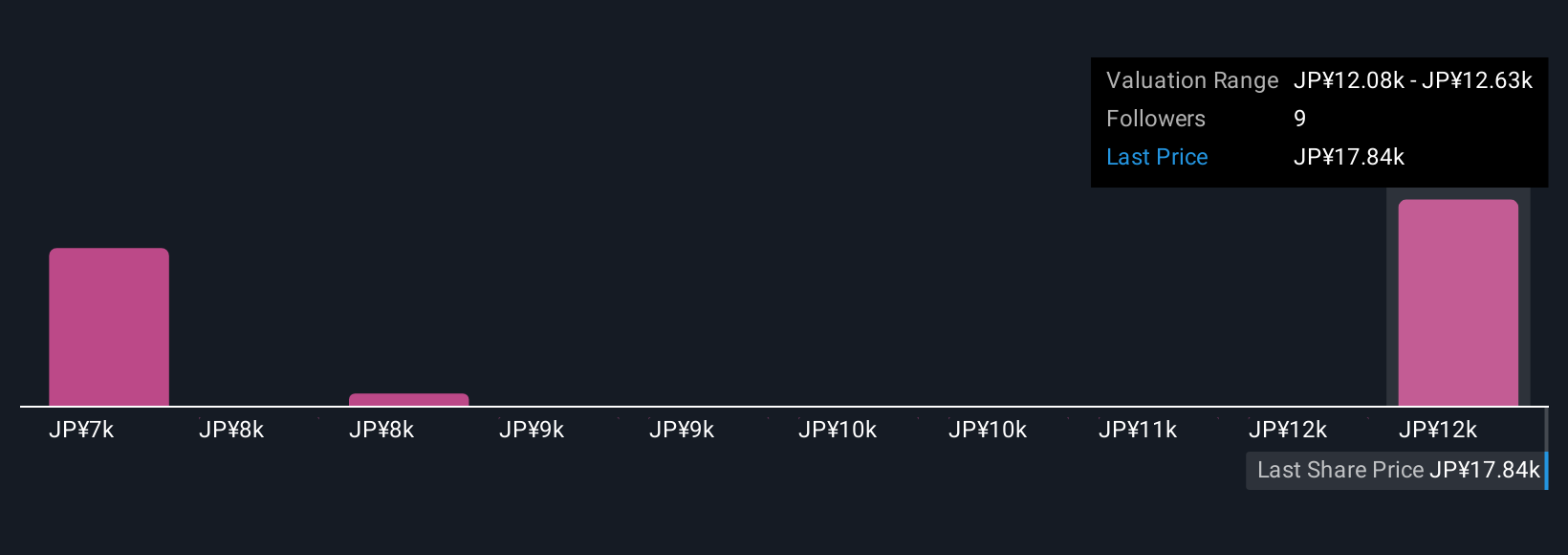

Uncover how Advantest's forecasts yield a ¥12625 fair value, a 20% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Advantest’s fair value from ¥7,157 to ¥12,625 across three viewpoints. Some anticipate cyclical earnings volatility driven by device transition timing, so explore these differing outlooks for a fuller picture.

Explore 3 other fair value estimates on Advantest - why the stock might be worth as much as ¥12625!

Build Your Own Advantest Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Advantest research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Advantest research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Advantest's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6857

Advantest

Manufactures and sells semiconductors, component test systems, and mechatronics-related products in Japan, the Americas, Europe, and Asia.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives