- Japan

- /

- Semiconductors

- /

- TSE:6855

Take Care Before Jumping Onto Japan Electronic Materials Corporation (TSE:6855) Even Though It's 26% Cheaper

The Japan Electronic Materials Corporation (TSE:6855) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Looking at the bigger picture, even after this poor month the stock is up 54% in the last year.

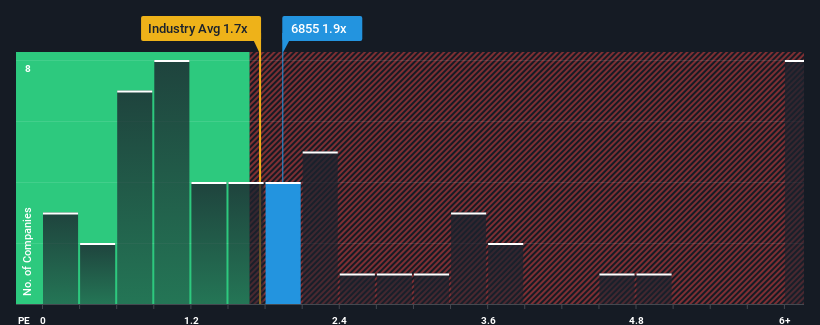

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Japan Electronic Materials' P/S ratio of 1.9x, since the median price-to-sales (or "P/S") ratio for the Semiconductor industry in Japan is also close to 1.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Japan Electronic Materials

What Does Japan Electronic Materials' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Japan Electronic Materials' revenue has gone into reverse gear, which is not great. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Japan Electronic Materials will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Japan Electronic Materials would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 16%. As a result, revenue from three years ago have also fallen 5.7% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 17% each year over the next three years. That's shaping up to be materially higher than the 15% per annum growth forecast for the broader industry.

With this information, we find it interesting that Japan Electronic Materials is trading at a fairly similar P/S compared to the industry. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Japan Electronic Materials' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Japan Electronic Materials' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Japan Electronic Materials (1 is potentially serious) you should be aware of.

If you're unsure about the strength of Japan Electronic Materials' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6855

Japan Electronic Materials

Engages in the manufacture and sale of probe cards and electron tube parts in Japan and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives