- Japan

- /

- Semiconductors

- /

- TSE:6855

Subdued Growth No Barrier To Japan Electronic Materials Corporation (TSE:6855) With Shares Advancing 54%

Despite an already strong run, Japan Electronic Materials Corporation (TSE:6855) shares have been powering on, with a gain of 54% in the last thirty days. The annual gain comes to 152% following the latest surge, making investors sit up and take notice.

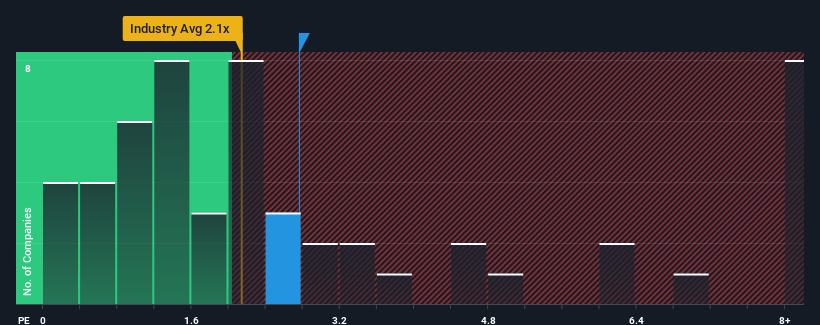

Since its price has surged higher, you could be forgiven for thinking Japan Electronic Materials is a stock not worth researching with a price-to-sales ratios (or "P/S") of 2.8x, considering almost half the companies in Japan's Semiconductor industry have P/S ratios below 2.1x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

See our latest analysis for Japan Electronic Materials

What Does Japan Electronic Materials' Recent Performance Look Like?

Japan Electronic Materials hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Japan Electronic Materials will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Japan Electronic Materials' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 16% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 5.7% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 0.2% over the next year. Meanwhile, the rest of the industry is forecast to expand by 16%, which is noticeably more attractive.

In light of this, it's alarming that Japan Electronic Materials' P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Japan Electronic Materials' P/S

The large bounce in Japan Electronic Materials' shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It comes as a surprise to see Japan Electronic Materials trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 2 warning signs for Japan Electronic Materials (1 is significant!) that you should be aware of.

If these risks are making you reconsider your opinion on Japan Electronic Materials, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:6855

Japan Electronic Materials

Engages in the manufacture and sale of probe cards and electron tube parts in Japan and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives