- Japan

- /

- Semiconductors

- /

- TSE:6723

Renesas (TSE:6723) Valuation Check After Launching New Wi‑Fi 6 Wireless Microcontrollers for IoT Growth

Reviewed by Simply Wall St

Renesas Electronics (TSE:6723) just rolled out its first Wi-Fi 6 microcontrollers, the RA6W1 and RA6W2, aiming squarely at always connected, low power IoT gear across smart homes, factories and healthcare.

See our latest analysis for Renesas Electronics.

The new Wi-Fi 6 MCUs land at a time when Renesas’ 1 month share price return of 18.38 percent and 3 month share price return of 26.66 percent signal strengthening momentum, while its 5 year total shareholder return of 118.19 percent underlines a solid longer term record.

If this kind of connected device story interests you, it is also worth exploring other opportunities in high growth tech and AI stocks that may be riding similar digital transformation trends.

With shares up strongly over the past quarter but still trading at a modest discount to analyst targets and intrinsic value estimates, is Renesas quietly undervalued today, or is the market already pricing in its next wave of growth?

Most Popular Narrative: 9.4% Undervalued

With Renesas Electronics last closing at ¥2190 against a narrative fair value near ¥2417, the storyline leans toward upside driven by ambitious growth and margin recovery.

The increasing adoption of electric vehicles and autonomous driving features is set to drive higher demand for advanced automotive MCUs and ADAS SoCs, particularly as Renesas ramps production of its new 28 nm MCU platform beyond China into Japan and Europe, this is likely to meaningfully support automotive segment revenue growth and help Renesas outpace the addressable market over the next 2 to 3 years.

Want to see the math behind this optimism, including rapid earnings swings, faster than market revenue growth and a richer future profit multiple? Dig into the full narrative to uncover the specific forecasts powering that upside case.

Result: Fair Value of ¥2417.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trade uncertainty and slower than expected adoption of key automotive chips could limit margins and delay the earnings recovery reflected in forecasts.

Find out about the key risks to this Renesas Electronics narrative.

Another View: Rich Sales Multiple, Room To Normalize

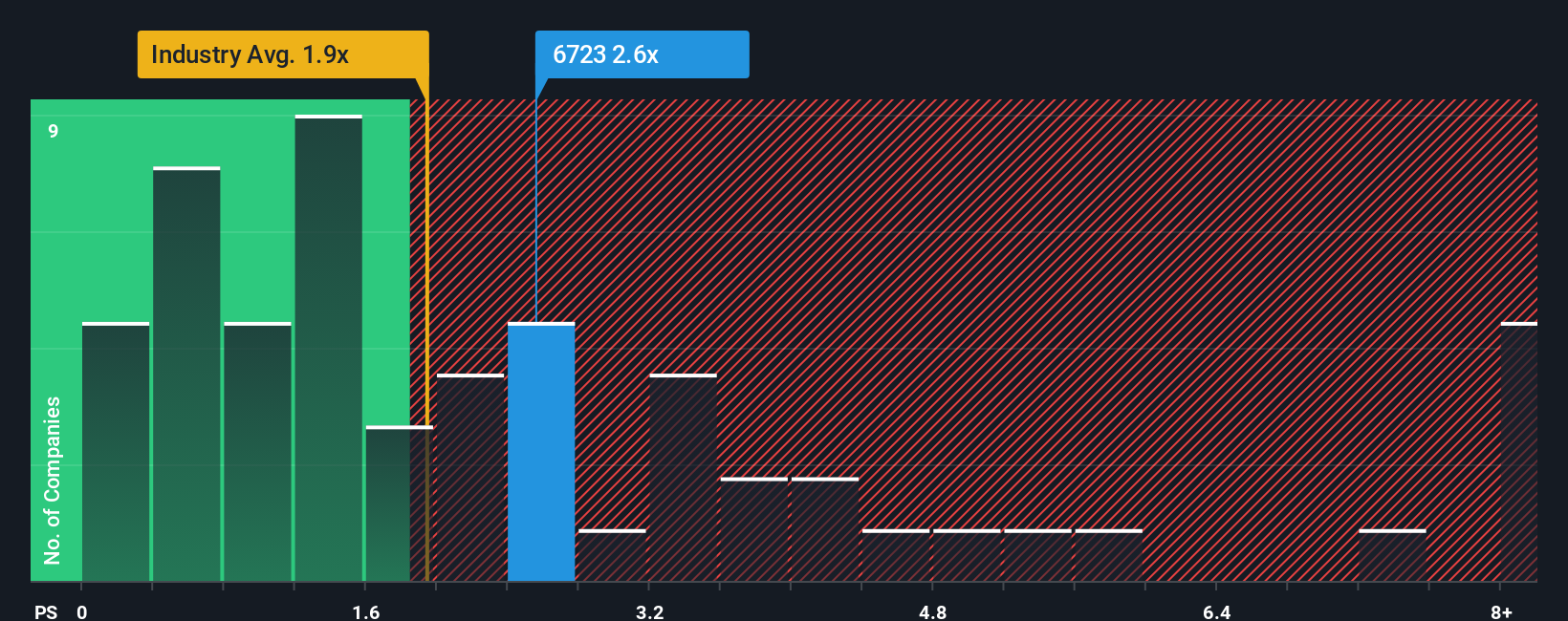

While the narrative fair value points to upside, the market is already paying 3.1x sales for Renesas, compared with about 2x for both peers and the wider JP semiconductor space. This is the case even though our fair ratio suggests the stock could justify nearer 7.7x. Is this a safety margin or valuation risk if growth stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Renesas Electronics Narrative

If you see things differently or want to dig into the numbers yourself, you can build a personalized Renesas view in just minutes: Do it your way.

A great starting point for your Renesas Electronics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one compelling story. Put the Simply Wall Street Screener to work and uncover fresh opportunities that could reshape your portfolio sooner than you expect.

- Capture potential mispricings by targeting companies that look statistically cheap on future cash flows using these 906 undervalued stocks based on cash flows before the market wakes up.

- Ride structural trends in automation and intelligent software by zeroing in on fast moving innovators through these 26 AI penny stocks that may be poised to scale.

- Seek more stable income streams while rates and markets shift by focusing on businesses with robust cash generation and steady payouts via these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6723

Renesas Electronics

Researches, develops, designs, manufactures, sells, and services semiconductors in Japan, China, rest of Asia, Europe, North America, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026