- Japan

- /

- Semiconductors

- /

- TSE:6146

A Look at Disco (TSE:6146) Valuation Following Strong Earnings and Positive Investor Reaction

Reviewed by Kshitija Bhandaru

Disco (TSE:6146) saw its stock reach a new high after announcing Q2 and first-half financial results that outperformed internal forecasts. Investors responded positively, especially as sales were lifted by generative AI demand and favorable currency movements.

See our latest analysis for Disco.

Disco's impressive first-half performance, fueled by strong generative AI demand and favorable currency trends, has sent its share price to all-time highs. After a robust 29.3% share price return over the past month, momentum appears to be building. Long-term investors have also enjoyed a hefty 44.5% total shareholder return over the past year and a staggering 432% three-year total return. The upbeat reaction to results and a flurry of recent investor interest suggest confidence is riding high for now.

If this kind of momentum has you curious about what else is rising fast, it might be a great time to broaden your perspective and discover fast growing stocks with high insider ownership

With such a strong run behind it and robust fundamentals in play, the key question now is whether Disco’s impressive growth is already reflected in its soaring share price or if there is still room for upside.

Price-to-Earnings of 47x: Is it justified?

Disco currently trades at a price-to-earnings (P/E) ratio of 47x, which places its valuation well above both its peer group and the broader Japanese semiconductor sector. At a last close price of ¥53,690, the market appears to be demanding a steep premium for Disco's recent growth and profitability.

The price-to-earnings multiple gives investors a quick sense of how much they are paying for every yen of current earnings. In sectors like semiconductors, a high P/E can often reflect expectations for future innovation or strong profits. For Disco, this high ratio suggests that the market is pricing in robust future performance and continued sector tailwinds.

Highlighting its premium, Disco’s P/E ratio far exceeds the industry average of just 16.5x and is well above the estimated fair P/E ratio of 27.6x. This divergence signals that investors are paying a substantial mark-up relative to both peers and a regression-based fair value benchmark. If the market shifts toward fundamentals, there could be significant repricing ahead.

Explore the SWS fair ratio for Disco

Result: Price-to-Earnings of 47x (OVERVALUED)

However, a sharp market focus on valuation and any downturn in sector momentum could quickly challenge the optimistic outlook for Disco’s shares.

Find out about the key risks to this Disco narrative.

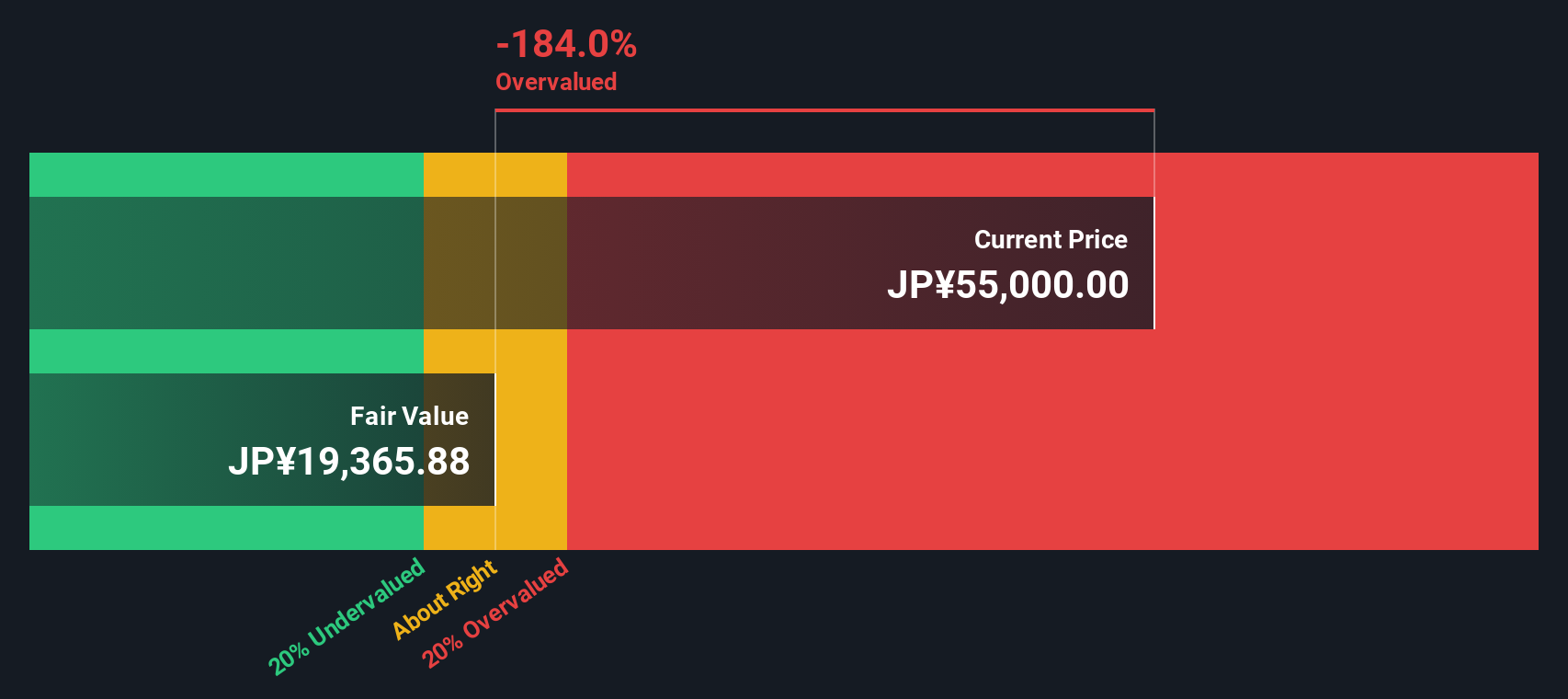

Another View: SWS DCF Model Suggests Big Downside

Taking a different approach, our DCF model estimates Disco's fair value at around ¥19,683, which is far below its current market price of ¥53,690. This suggests shares could be significantly overvalued if you rely on discounted future cash flows. However, does this calculation miss something the market sees?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Disco for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Disco Narrative

If you want to see the numbers from a fresh perspective or chart your own conclusions, it’s easy to create your own view in minutes. Just Do it your way.

A great starting point for your Disco research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stand still, and Simply Wall Street’s screeners put the most exciting opportunities right at your fingertips. Don’t let these potential winners pass you by. Refresh your portfolio and stay ahead of the market.

- Boost your income potential when you evaluate these 19 dividend stocks with yields > 3% featuring companies with yields above 3% and a record of rewarding shareholders.

- Catalyze your exposure to next-gen technology by tracking these 24 AI penny stocks, companies driving the artificial intelligence revolution across industries.

- Tap into groundbreaking innovation and stay at the frontier of computing with these 26 quantum computing stocks, shaping tomorrow’s tech landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6146

Disco

Manufactures and sells precision cutting, grinding, and polishing machines in Japan and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives