- Japan

- /

- Specialty Stores

- /

- TSE:8282

K's Holdings (TSE:8282): Exploring Valuation Following Completion of Major Share Buyback Program

Reviewed by Kshitija Bhandaru

K's Holdings (TSE:8282) has wrapped up its previously announced share repurchase, buying back 5,437,100 shares, or about 3.4% of the company. This move often catches investor attention because of its impact on value and future earnings.

See our latest analysis for K's Holdings.

The recent completion of K's Holdings' buyback program comes with the share price now at ¥1,547.5, capping off a year in which short-term momentum has softened. The company’s total return over three years sits at an impressive 43.4%. This combination of steady long-term value and a proactive management move may shift how investors see K’s Holdings in the months ahead.

If you’re curious where else management conviction and growth intersect, now’s a great time to broaden your search and uncover fast growing stocks with high insider ownership

With recent buybacks and solid long-term returns, is K’s Holdings now trading at an attractive value for investors? Or has the market already factored in all its future growth prospects?

Price-to-Earnings of 21.5x: Is it justified?

On a price-to-earnings (P/E) basis, K's Holdings is trading at 21.5x, a clear premium compared to both its industry and peer groups. With its last close at ¥1,547.5, this valuation signals a higher market expectation, or perhaps a willingness to pay up for its recent performance.

The price-to-earnings ratio compares a company’s share price to its earnings per share. For specialty retail, it serves as a signal of how much investors are paying for current earnings and their outlook on future profit growth. A higher P/E can sometimes reflect optimism about sustainable growth or unique business strengths, but it can also point to over-enthusiasm.

In K's Holdings' case, the P/E of 21.5x stands out against the Specialty Retail industry average (13.6x) and the peer average (12.9x). The current ratio is also above the estimated Fair P/E Ratio of 16.9x, suggesting that the market is pricing in more growth or resilience than what would usually be justified. Investors should consider whether company fundamentals can support this premium, or if sentiment and buybacks are inflating expectations higher than averages suggest.

Explore the SWS fair ratio for K's Holdings

Result: Price-to-Earnings of 21.5x (OVERVALUED)

However, growth in revenue remains modest and near-term returns have softened. This may temper enthusiasm for continued outperformance in the stock.

Find out about the key risks to this K's Holdings narrative.

Another View: What Does the SWS DCF Model Reveal?

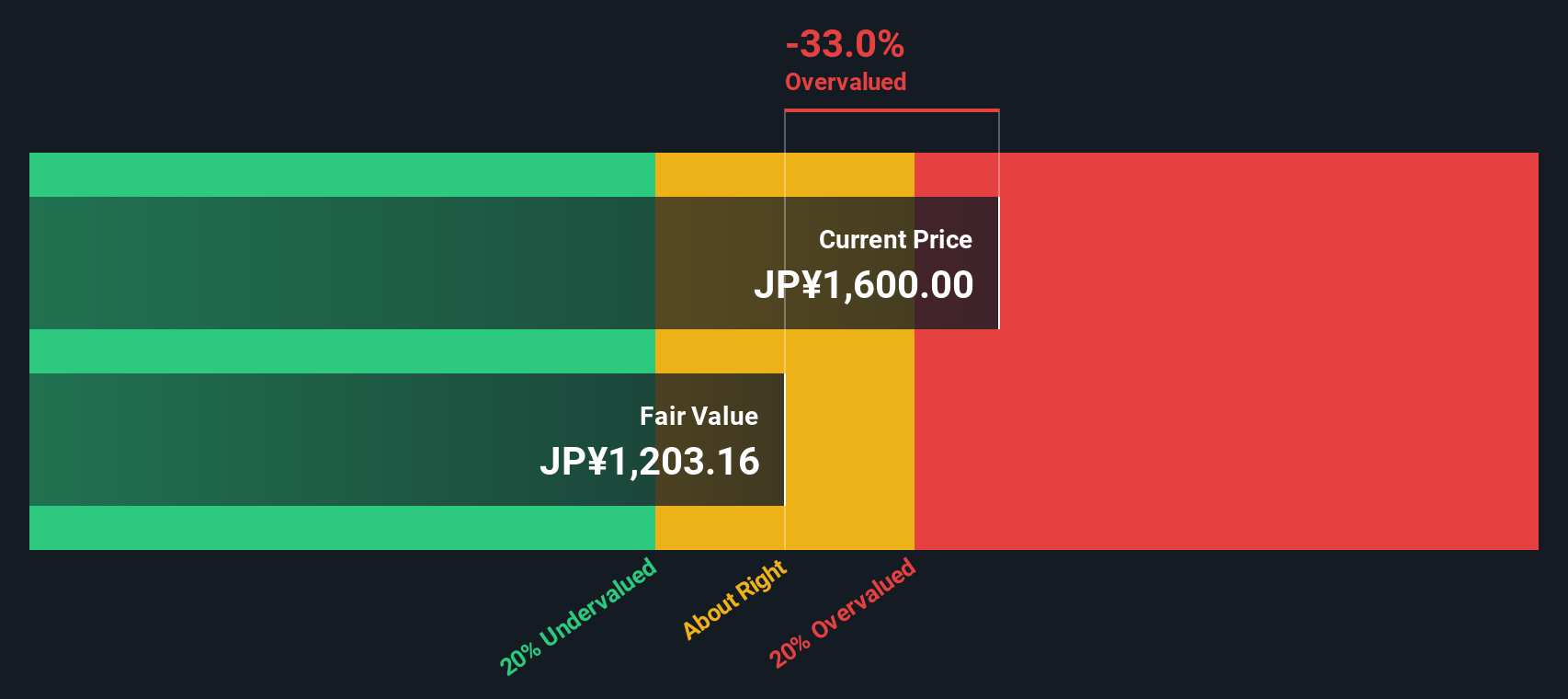

Switching perspectives, the SWS DCF model pegs K’s Holdings’ fair value at ¥1,218.39, which is notably below its current trading price of ¥1,547.5. This approach, which focuses on projected future cash flows, currently sees the stock as overvalued by about 27%.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out K's Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own K's Holdings Narrative

If you want to dig deeper or see things differently, you can explore the data and shape your own perspective in just a few minutes with Do it your way.

A great starting point for your K's Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let a single opportunity pass you by. Unlock the potential of your portfolio by searching for stocks that match your investment style and goals right now.

- Tap into future breakthroughs when you navigate these 26 quantum computing stocks and find innovators advancing quantum computing and reshaping entire industries.

- Boost your income with peace of mind as you select from these 19 dividend stocks with yields > 3% featuring companies that consistently deliver yields greater than 3%.

- Stay ahead of the curve by acting on these 24 AI penny stocks driving AI adoption and trailblazing advancements across tech, health, and finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K's Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8282

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives