Discovering Rheon Automatic Machinery And 2 Other Hidden Japanese Small Caps

Reviewed by Simply Wall St

Japan's stock markets have recently experienced significant declines, with the Nikkei 225 Index down 5.8% and the broader TOPIX Index registering a 4.2% loss. This downturn has been influenced by a U.S.-led sell-off in semiconductor stocks and yen strength affecting Japan’s export-oriented companies. In such volatile market conditions, identifying resilient small-cap stocks with strong fundamentals can offer unique opportunities for investors. In this article, we will explore three hidden Japanese small caps that show potential despite current market challenges: Rheon Automatic Machinery, along with two other promising companies.

Top 10 Undiscovered Gems With Strong Fundamentals In Japan

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ryoyu Systems | NA | 1.08% | 8.08% | ★★★★★★ |

| Nice | 71.69% | -1.98% | 36.48% | ★★★★★★ |

| Techno Smart | NA | 6.07% | -0.57% | ★★★★★★ |

| Otec | 9.81% | 2.32% | -1.39% | ★★★★★★ |

| Soliton Systems K.K | 0.58% | 5.04% | 16.76% | ★★★★★★ |

| AJIS | 0.69% | 0.07% | -12.44% | ★★★★★☆ |

| Imuraya Group | 26.21% | 2.37% | 32.09% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 139.93% | 2.20% | -0.27% | ★★★★☆☆ |

| Toho Bank | 98.27% | 0.43% | 22.80% | ★★★★☆☆ |

| FDK | 89.57% | -0.88% | 25.34% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Rheon Automatic Machinery (TSE:6272)

Simply Wall St Value Rating: ★★★★★★

Overview: Rheon Automatic Machinery Co., Ltd. develops, manufactures, and supplies a range of food processing machines and factory systems in Japan and internationally, with a market cap of ¥36.38 billion.

Operations: Rheon generates revenue primarily from its Food Processing Machine Manufacturing and Sales Business across various regions, including Japan (¥17.80 billion), North America/South America (¥4.65 billion), Asia (¥2.35 billion), and Europe (¥5.01 billion). Additionally, it has a significant presence in the Food Manufacturing and Sales sector in North America/South America with ¥15.10 billion in revenue and a smaller segment in Japan contributing ¥0.49 billion.

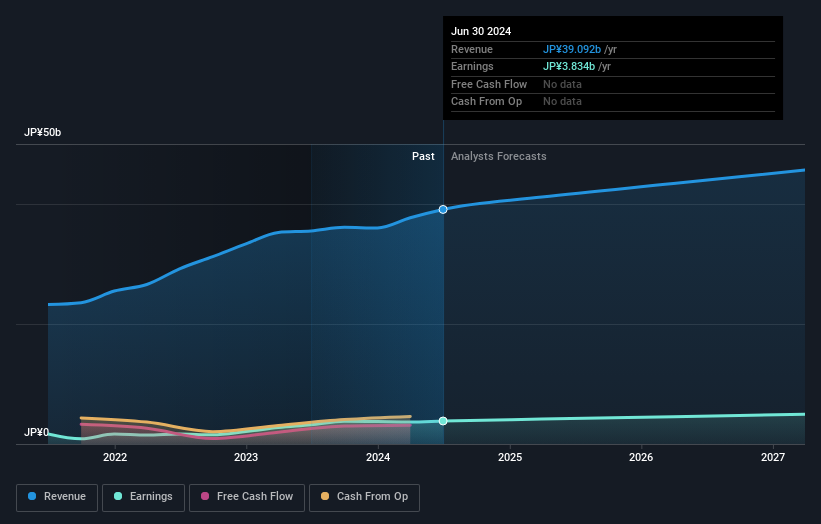

Rheon Automatic Machinery, a small-cap Japanese firm, is trading at 50.4% below its estimated fair value and shows strong relative value compared to peers. Over the past five years, its debt-to-equity ratio has improved from 4.9 to 3.7, reflecting prudent financial management. The company's earnings grew by 19.7% last year, outpacing the machinery industry's 13.1%, and are forecasted to grow at an annual rate of 9.27%.

- Navigate through the intricacies of Rheon Automatic Machinery with our comprehensive health report here.

Gain insights into Rheon Automatic Machinery's past trends and performance with our Past report.

Kintetsu Department Store (TSE:8244)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kintetsu Department Store Co., Ltd. operates department stores in Japan and has a market cap of ¥82.82 billion.

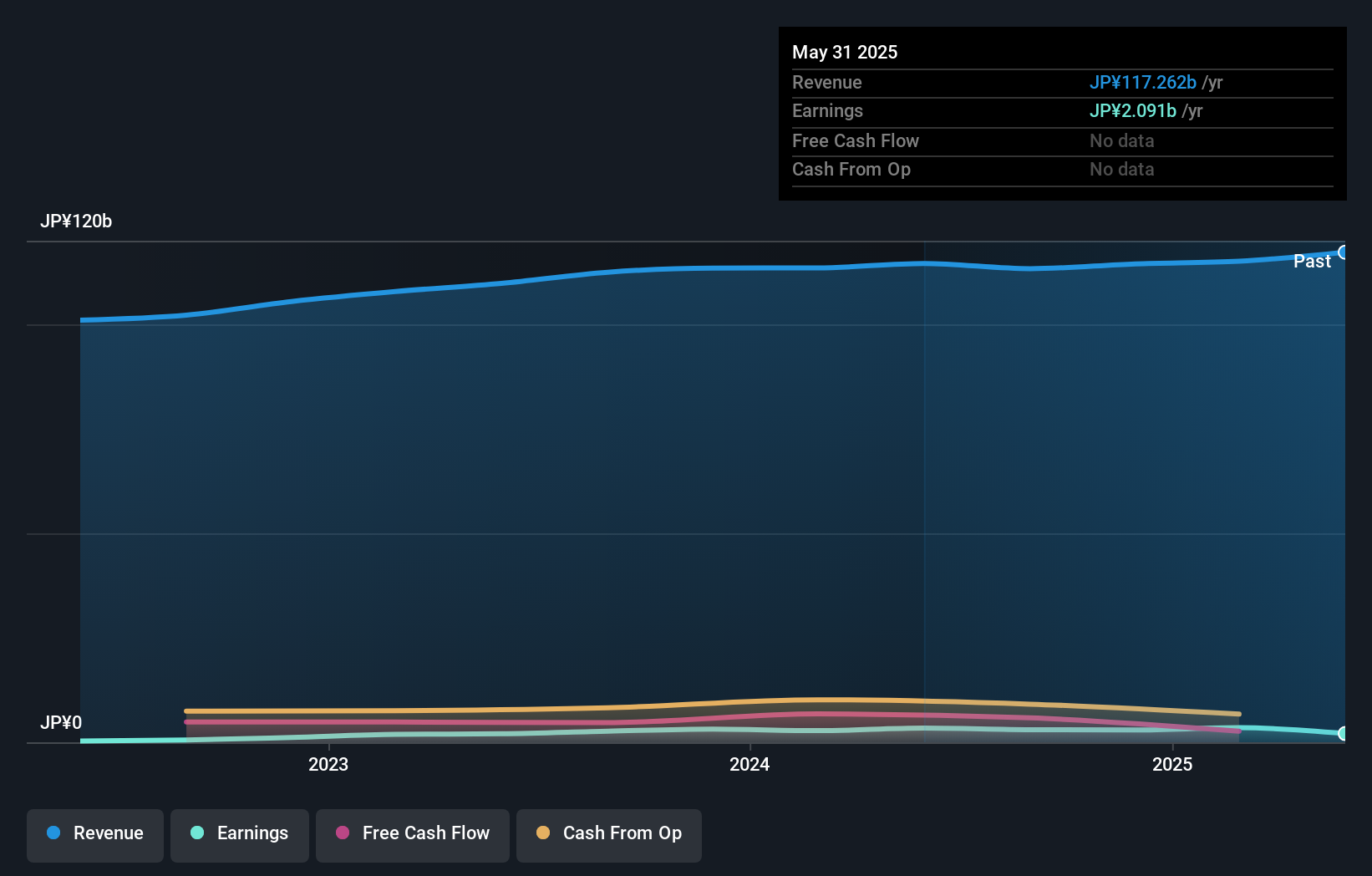

Operations: Kintetsu Department Store generates revenue primarily from its department store operations in Japan. The company has a market cap of ¥82.82 billion and focuses on retail sales, which contribute significantly to its overall revenue. Net profit margin trends provide insight into the company's profitability over time.

Kintetsu Department Store, a smaller player in Japan's retail landscape, is trading at 44.6% below its estimated fair value. Over the past five years, its debt to equity ratio has decreased from 37.8% to 13.1%, indicating improved financial health. The company’s earnings surged by 66.4% last year, outpacing the Multiline Retail industry’s growth of 11.5%. With a net debt to equity ratio of just 6.7%, Kintetsu appears financially robust and well-positioned for future opportunities in the sector.

Yamanashi Chuo BankLtd (TSE:8360)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Yamanashi Chuo Bank, Ltd., along with its subsidiaries, offers a range of banking services to both individual and corporate clients in Japan and has a market cap of ¥50.71 billion.

Operations: Yamanashi Chuo Bank, Ltd. generates its revenue primarily from banking services provided to individual and corporate clients in Japan. The company has a market cap of ¥50.71 billion.

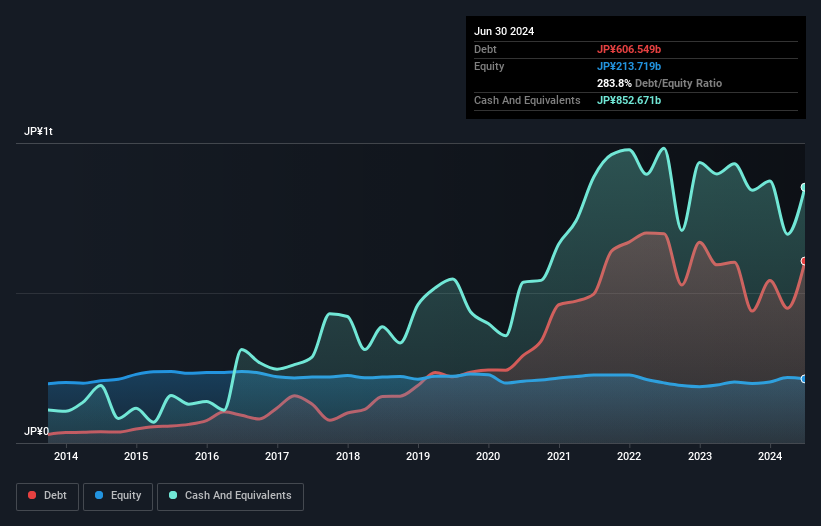

Yamanashi Chuo Bank, with total assets of ¥4.58B and equity of ¥213.7B, operates primarily on low-risk customer deposits (85% of liabilities). Total deposits stand at ¥3.72B, while loans amount to ¥2.52B with a 1% bad loan ratio and 42% allowance for bad loans. Despite high-quality earnings and trading at 40% below estimated fair value, its earnings growth (17%) lagged behind the industry (19%). Earnings have grown annually by 9.7% over five years.

Summing It All Up

- Take a closer look at our Japanese Undiscovered Gems With Strong Fundamentals list of 751 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8360

Yamanashi Chuo BankLtd

Provides various banking services to individual and corporate customers in Japan.

Solid track record with adequate balance sheet.