Matsuya (TSE:8237) One-Off ¥1.4B Loss Drives Net Margin Miss, Raises Profit Recovery Questions

Reviewed by Simply Wall St

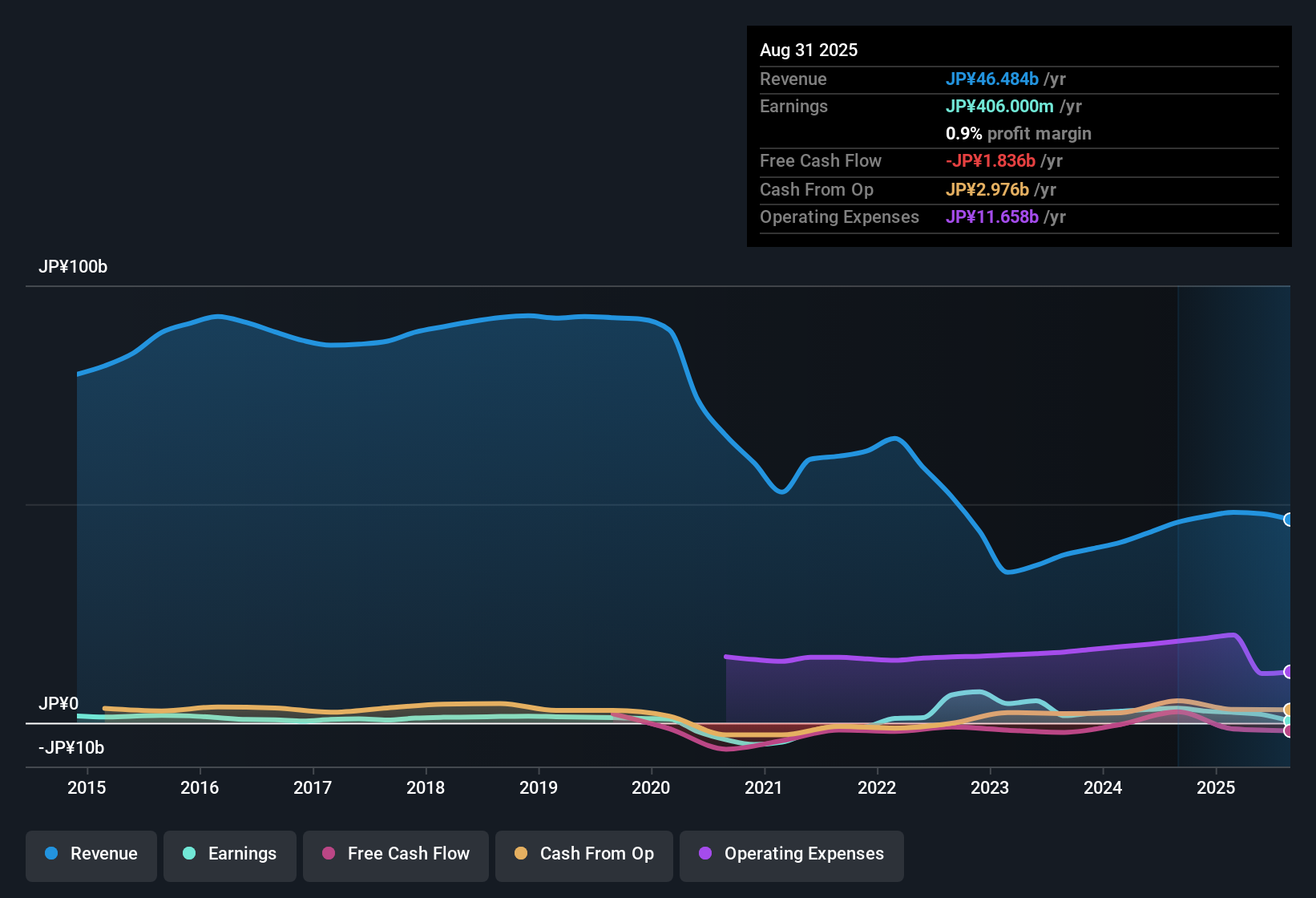

Matsuya (TSE:8237) recorded a net profit margin of 0.9% for the twelve months ending August 31, 2025, a sharp drop from 7.2% the previous year. Profitability was hit by a one-off loss of ¥1.4 billion, despite the company’s average earnings growth of 41.4% per year over the past five years. Meanwhile, Matsuya’s shares currently trade at a Price-to-Sales ratio of 1.8x, well above both the industry and peer averages. This could weigh on investor sentiment as margins compress.

See our full analysis for Matsuya.Next, we will see how this latest performance compares with the key narratives investors are following. Setting the numbers side by side with prevailing expectations can help highlight where they align and where the story might need to be updated.

Curious how numbers become stories that shape markets? Explore Community Narratives

Non-Recurring Loss Hits Profit Recovery

- The most material driver weighing on profitability is a one-off loss of ¥1.4 billion, which sharply curtailed Matsuya’s usual earnings growth momentum and left the latest net profit margin at just 0.9% for the year ending August 31, 2025.

- Prevailing market analysis suggests investors often look past one-off expenses in mature retailers. However, the scale of this loss draws attention to risk:

- The latest margin reversal interrupts five years of average annual earnings growth of 41.4%, challenging any assumption that a post-pandemic recovery would ensure smooth profit acceleration.

- While department stores like Matsuya can see sentiment rebound quickly around tourism or luxury sales, meaningful sustained improvement now depends on avoiding further large, non-operational hits to the bottom line.

Balance Sheet Signals Caution

- Matsuya is not currently assessed to be in a good financial position according to the latest filing. This adds to concerns about short-term resilience and the ability to weather future setbacks.

- In the prevailing market view, critics highlight that weak recent earnings quality, now burdened with a major non-recurring loss, can compound financial pressures:

- Fragile balance sheet metrics leave little room for error if the company faces another unexpected earnings dip or if margin pressure persists.

- Strategic flexibility may also be limited. Further declines could force difficult trade-offs on investment or cost management, affecting competitiveness against digital and luxury retail peers.

Valuation Premium Raises the Bar

- Matsuya’s Price-to-Sales ratio stands at 1.8x, a notable premium over the industry average of 0.7x and peer average of 0.5x. This sets high expectations despite narrow margins and recent setbacks.

- The prevailing market view notes this valuation gap puts pressure on operational performance to deliver:

- If weak margins and lackluster recent profit persist, such a valuation could limit upside and make the stock vulnerable to negative sentiment shifts.

- Investors often reward department stores for signs of earnings recovery or retail traffic growth. At these levels, even minor disappointments may spark an outsized reaction as peers trade on much lower multiples.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Matsuya's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Matsuya’s profitability has faltered due to a major one-off loss, soft margins, and balance sheet weaknesses. This highlights financial stability concerns if setbacks continue.

If you want more confidence in a company’s resilience, you can find those with stronger fundamentals and healthier finances among our solid balance sheet and fundamentals stocks screener.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8237

Mediocre balance sheet with low risk.

Market Insights

Community Narratives