Takashimaya (TSE:8233): Evaluating Valuation as Steady Gains Draw Investor Interest

Reviewed by Simply Wall St

Price-to-Earnings of 12.5x: Is it justified?

Takashimaya Company is currently valued at a price-to-earnings (P/E) ratio of 12.5x, which is lower than both the peer average (17.4x) and the Japan Multiline Retail industry average (17.6x). This below-average multiple suggests that investors may be assigning a discount relative to its sector peers.

The price-to-earnings ratio reflects how much investors are willing to pay today for each unit of the company's earnings. In retail, the P/E ratio is a key benchmark, helping to compare companies’ profitability and expected growth within the sector.

A below-average P/E can signal undervaluation if the company’s fundamentals remain strong, or it may reflect tempered expectations for future earnings growth. In this case, Takashimaya’s multiple implies the market may be underestimating its potential, even as the company’s earnings continue to grow.

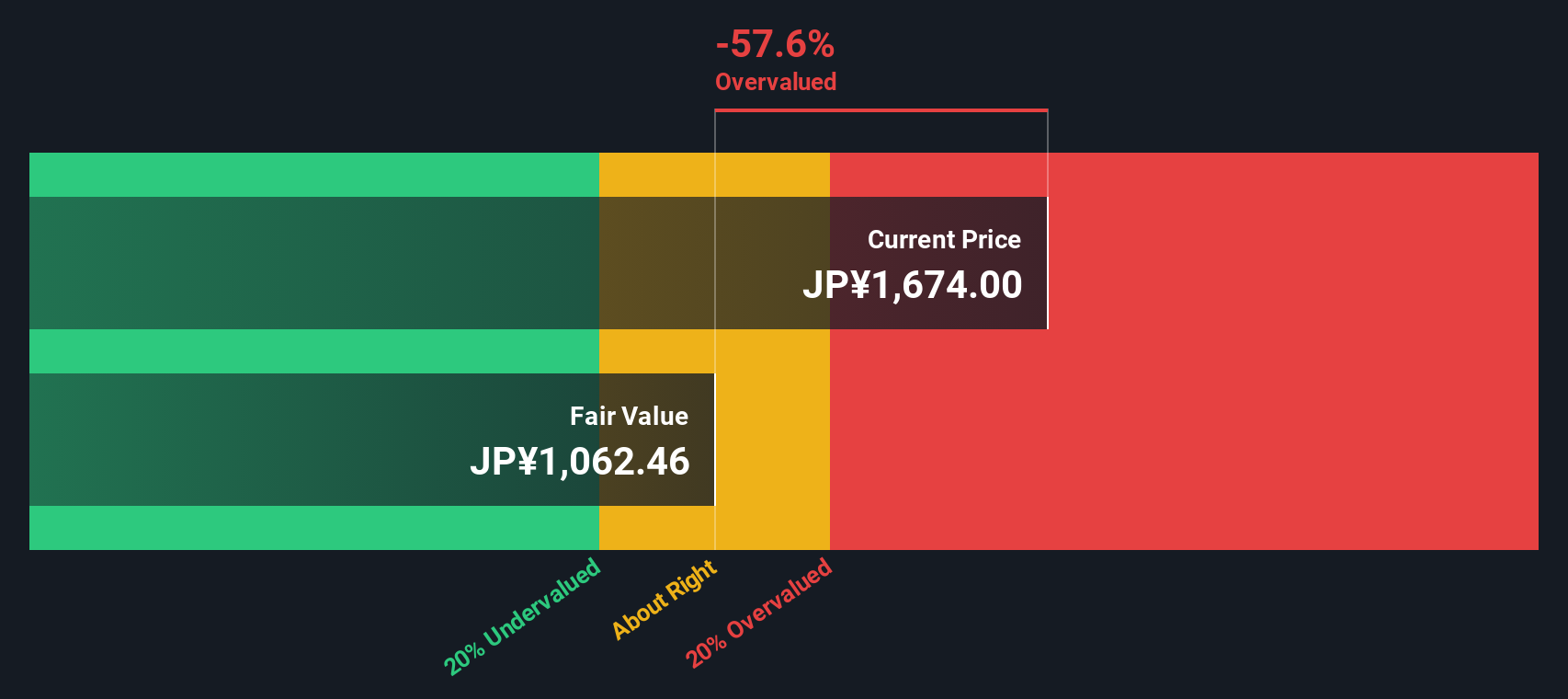

Result: Fair Value of ¥1,255 (OVERVALUED)

See our latest analysis for Takashimaya Company.However, risks remain, such as slowing annual revenue growth. The stock is now trading above analyst targets, which could prompt a reassessment by investors.

Find out about the key risks to this Takashimaya Company narrative.Another View: Discounted Cash Flow Model

Looking at Takashimaya Company from the perspective of our DCF model produces a markedly different valuation, suggesting the stock could be significantly overvalued. When different models provide contrasting results, it raises the question of which one investors should trust.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Takashimaya Company Narrative

If these conclusions do not align with your perspective, or if you would prefer to analyze the data yourself, you can quickly create your own comprehensive view of Takashimaya Company. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Takashimaya Company.

Looking for More Smart Investment Ideas?

Unlock even more opportunities by checking out promising sectors that could transform your portfolio. Miss this and you could pass up market leaders of tomorrow.

- Spot high-growth opportunities by checking out AI penny stocks, which are shaping everything from software to smart retail.

- Capture steady income streams as you browse dividend stocks with yields > 3%, featuring reliable companies with strong yields above 3%.

- Tap into potential market bargains while reviewing undervalued stocks based on cash flows for overlooked stocks based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takashimaya Company might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSE:8233

Takashimaya Company

Engages in the department stores, corporate, and mail order business in Japan.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives