Mr Max Holdings (TSE:8203) Profit Rebound Challenges Bearish Narrative on Growth Durability

Reviewed by Simply Wall St

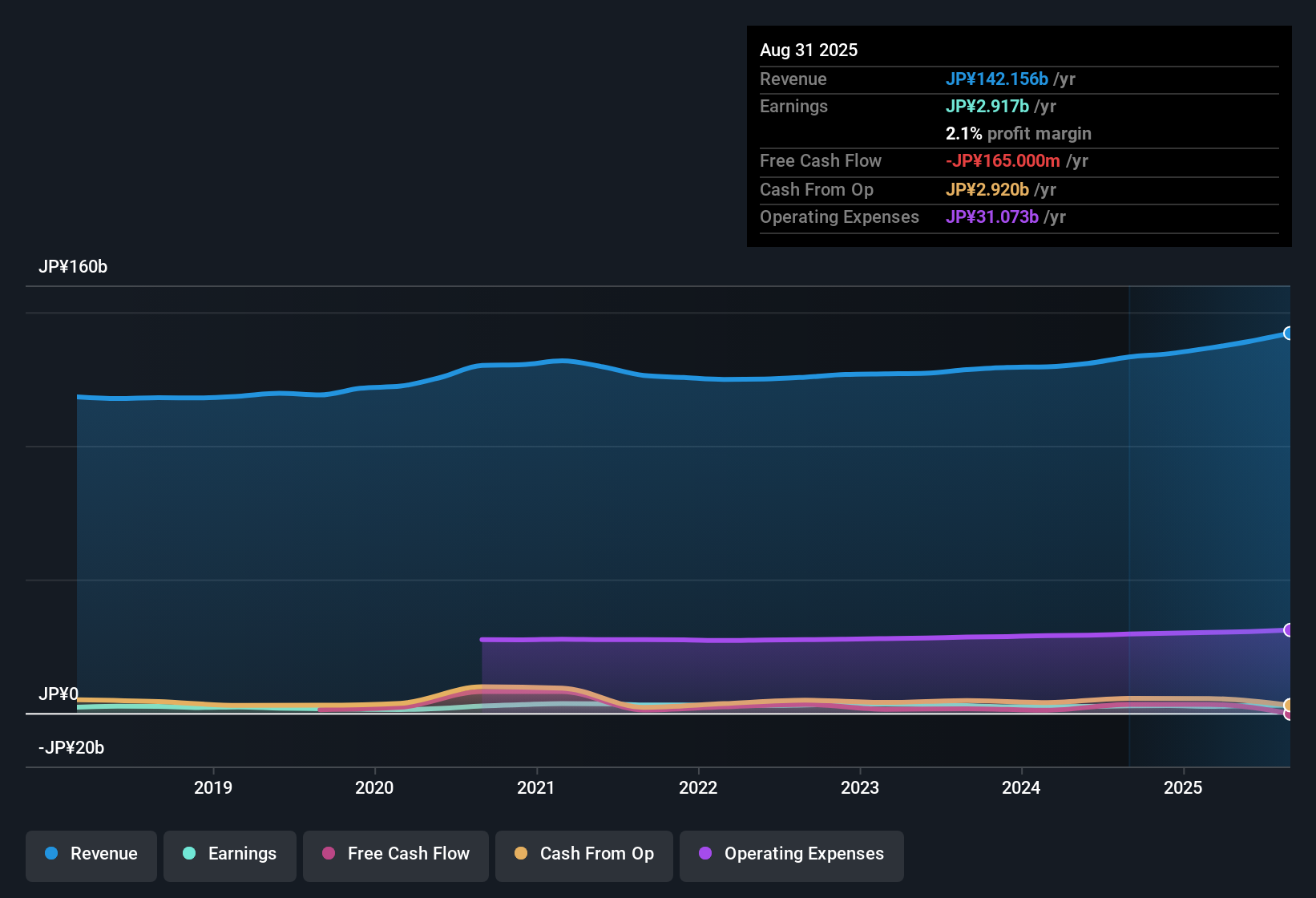

Mr Max Holdings (TSE:8203) posted a 7.9% rise in profits for the past year, a notable reversal from its 5-year average annual decline of 4%. Net profit margins inched up to 2.1%, just above last year’s 2%, and the quality of reported earnings remains high. With shares trading at a price-to-earnings ratio of 9.1x, well below both peer and industry averages, investors will be weighing these attractively priced results against a number of flagged risks, including ongoing financial and dividend sustainability concerns.

See our full analysis for Mr Max Holdings.The next section dives into how these headline numbers measure up against the key narratives investors are following, where the results reinforce expectations, and where they put popular stories to the test.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Gains Defy Flat Sector

- Net profit margins for Mr Max Holdings reached 2.1%, edging above last year’s 2% and signaling a small but meaningful uptick in profitability despite sector-wide cost pressures.

- What’s surprising is that, even with only modest improvement in margins, the prevailing market narrative sees the quality of these earnings as high.

- This suggests efficiency gains are more persistent than some expected and could support future profit stability.

- However, skeptics may note that such slim margin expansion leaves little room for error if broader retail trends soften.

Quality Earnings Outshine Growth Worries

- The EDGAR filing highlights “high quality” reported earnings alongside a clear reversal of a five-year average annual profit decline of 4%.

- Prevailing analysis underscores how this shift counters market fears about growth durability.

- The ability to shift from negative profit trends to positive territory increases confidence that underlying business fundamentals have improved, not just short-term accounting.

- At the same time, the data offers an implicit challenge to those who argue any rebound may be unsustainable. Without evidence of aggressive cost cuts or one-offs, the durability of the reversal boosts the case for continued improvement.

Valuation Discount Unmatched by Industry

- Shares trade at a price-to-earnings ratio of 9.1x, a steep discount to the Japanese multiline retail industry average of 17.9x and the peer average of 22.7x. The current share price (¥794) is well below the DCF fair value of ¥1,200.89.

- Prevailing perspective is that this valuation gap, combined with visible earnings quality, heavily supports arguments for good value.

- Investors who prioritize undervalued opportunities may see this as a classic example where the market’s caution about risks has overshot underlying fundamentals.

- Yet, the ongoing concerns around financial and dividend sustainability, flagged as real risk indicators, remain a necessary check on optimism, making it important for value-driven buyers not to ignore underlying balance sheet questions.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Mr Max Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Mr Max Holdings reversed a declining profit trend, lingering concerns about balance sheet and dividend sustainability could challenge future stability.

If you prefer companies with stronger financial foundations, use solid balance sheet and fundamentals stocks screener to find businesses with robust balance sheets and lower financial risk.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8203

Good value with proven track record.

Market Insights

Community Narratives