- Japan

- /

- Retail Distributors

- /

- TSE:7552

Undiscovered Gems Promising Stocks To Explore In January 2025

Reviewed by Simply Wall St

As global markets continue to navigate the shifting landscape of trade policies and technological advancements, major indices like the S&P 500 have reached record highs, buoyed by optimism around softer tariffs and AI-driven growth. While large-cap stocks have generally outperformed their smaller counterparts, small-cap companies remain a fertile ground for discovering potential opportunities that may not yet be on investors' radar. In this context, identifying promising stocks involves looking at factors such as innovation potential, market positioning, and resilience in changing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Yantai Ishikawa Sealing Technology | NA | 0.96% | -9.28% | ★★★★★★ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 18.55% | 49.85% | 71.73% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Maezawa Kasei Industries | 0.81% | 2.30% | 18.80% | ★★★★★★ |

| Shandong Boyuan Pharmaceutical & Chemical | NA | 28.20% | 32.92% | ★★★★★★ |

| Center International GroupLtd | 27.06% | 1.89% | -39.77% | ★★★★★★ |

| Master Trust | 33.35% | 28.01% | 41.50% | ★★★★★☆ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 2.80% | 17.08% | -4.11% | ★★★★★☆ |

| Zhejiang E-P Equipment | 15.30% | 21.69% | 32.47% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Reysas Tasimacilik ve Lojistik Ticaret (IBSE:RYSAS)

Simply Wall St Value Rating: ★★★★★★

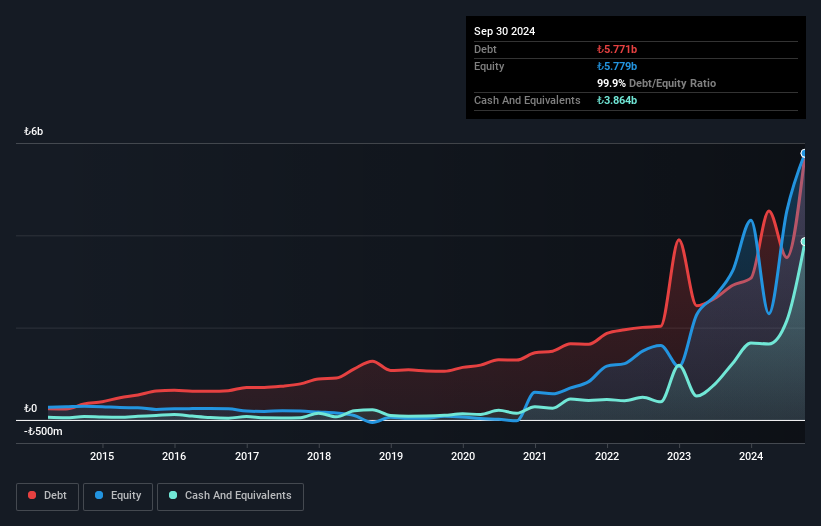

Overview: Reysas Tasimacilik ve Lojistik Ticaret A.S. is a Turkish company engaged in logistics and transportation services, with a market capitalization of TRY43.40 billion.

Operations: RYSAS generates revenue primarily from transportation storage logistics services, which account for TRY4.77 billion, followed by real estate rental activities at TRY3.29 billion. Vehicle inspection service activities contribute TRY1.10 billion, while tobacco product-related activities add TRY968.82 million to the revenue stream.

Reysas Tasimacilik ve Lojistik Ticaret, a notable player in logistics, has shown impressive earnings growth of 215% over the past year, outpacing the industry average of 3.6%. The company's net debt to equity ratio stands at a satisfactory 33%, down from a staggering 1352% five years ago. Despite its volatile share price recently, Reysas reported significant sales of TRY 3.15 billion for Q3 2024 compared to TRY 1.78 billion last year and net income soaring to TRY 1.62 billion from TRY 149 million previously. However, free cash flow remains negative despite these strong financial results.

Luyang Energy-Saving Materials (SZSE:002088)

Simply Wall St Value Rating: ★★★★★★

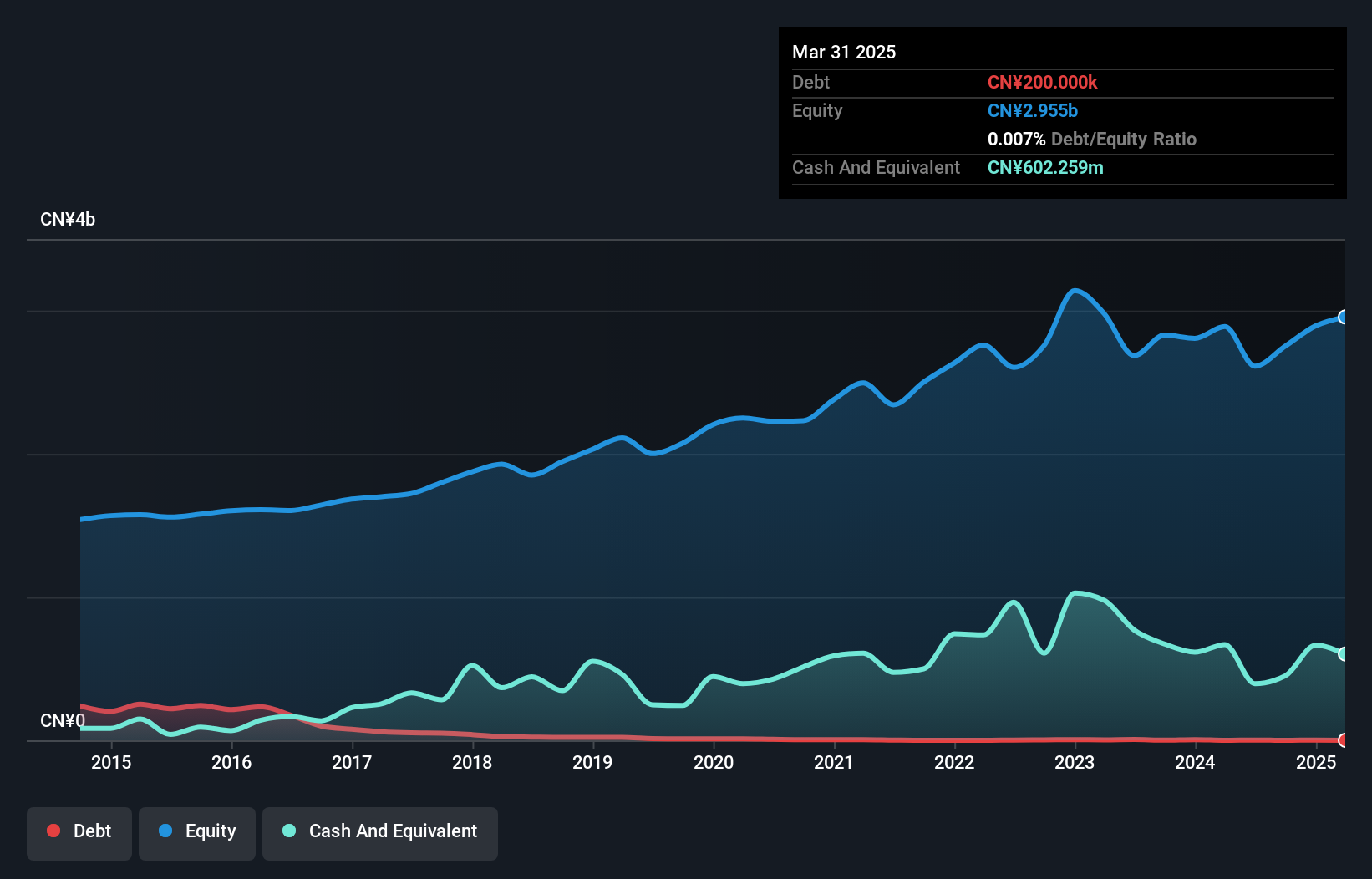

Overview: Luyang Energy-Saving Materials Co., Ltd. is engaged in the research, development, production, and sale of energy-saving products such as ceramic fiber, alumina fiber, soluble fiber, basalt fiber, and insulating firebrick both in China and internationally with a market capitalization of CN¥6.13 billion.

Operations: Luyang generates revenue through the sale of energy-saving materials, including ceramic fibers and insulating firebricks, both domestically and internationally. The company has a market capitalization of CN¥6.13 billion.

Luyang Energy-Saving Materials, a nimble player in its field, showcases a P/E ratio of 13.5x, notably below the CN market's 35.1x. Despite recent earnings showing a slight dip with net income at CNY 341 million from CNY 364 million last year, the company remains debt-free and boasts high-quality past earnings. The recent nine-month sales stood at CNY 2.54 billion compared to CNY 2.56 billion previously, reflecting stable performance amidst industry headwinds where earnings growth lagged behind the sector average by -2.5%. Upcoming shareholder discussions could further refine its business focus and strategic direction.

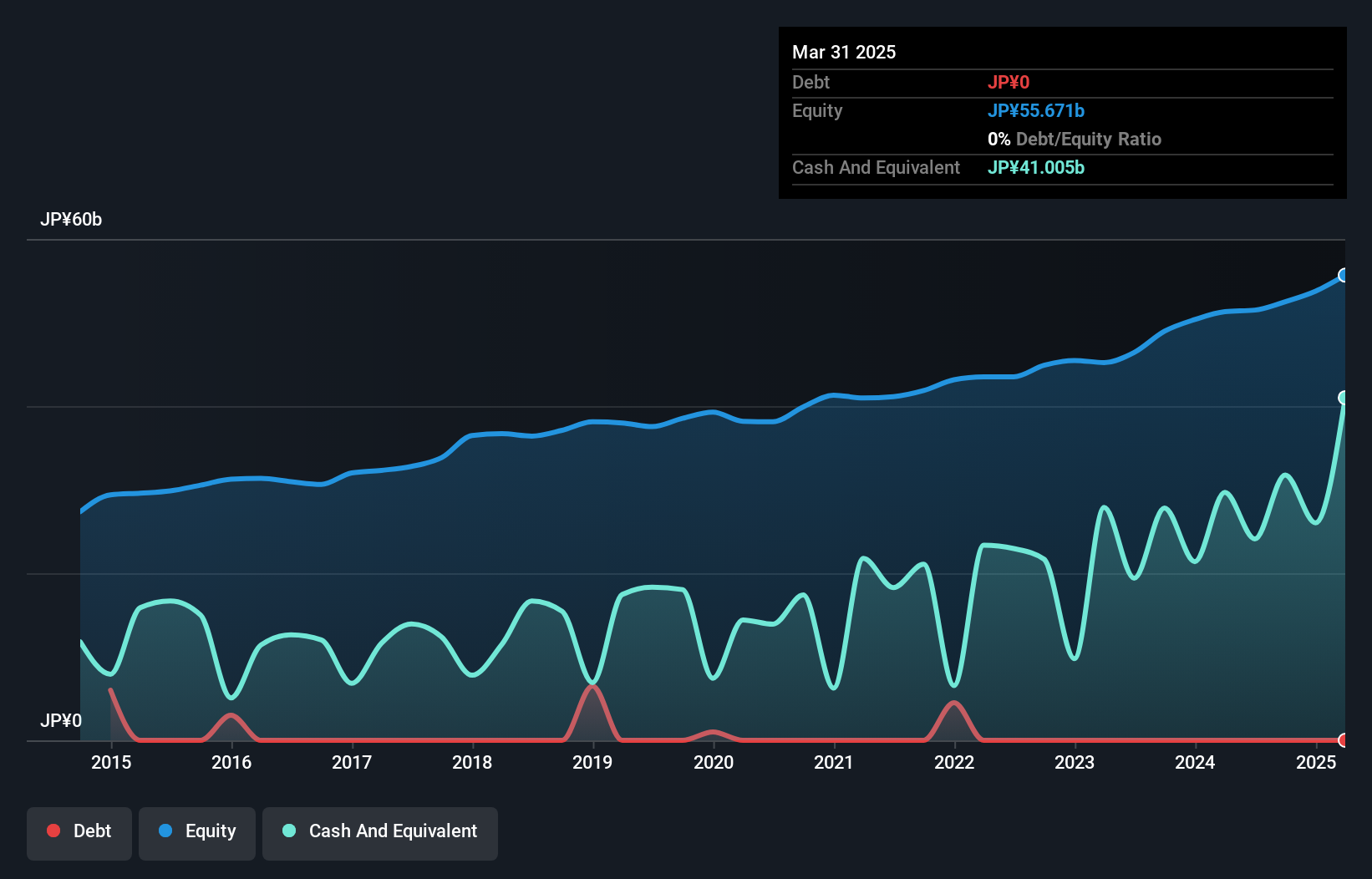

Happinet (TSE:7552)

Simply Wall St Value Rating: ★★★★★★

Overview: Happinet Corporation operates as an entertainment trading company in Japan with a market capitalization of approximately ¥96.99 billion.

Operations: Happinet generates revenue through its four primary segments: Amusement, Toy Business, Video Games Business, and Visual and Music Business. The Toy Business is the largest contributor with ¥159.32 billion in revenue, followed by the Video Games segment at ¥91.32 billion.

Happinet, a small player in the retail distribution sector, is catching attention with its robust financial health and impressive growth. Over the past year, earnings surged by 25.8%, outpacing industry averages of -2.2%. The company stands debt-free, eliminating concerns around interest payments and bolstering its stability. Trading at 80.5% below estimated fair value suggests potential undervaluation in the market's eyes. With free cash flow consistently positive, Happinet’s financial strategies seem effective in maintaining operational efficiency despite challenging market conditions. This combination of high-quality earnings and strategic positioning makes it an intriguing prospect for those seeking under-the-radar opportunities.

- Navigate through the intricacies of Happinet with our comprehensive health report here.

Evaluate Happinet's historical performance by accessing our past performance report.

Taking Advantage

- Explore the 4668 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Happinet might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7552

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives